How China's gold buying spree affects us all

While most of the world is struggling with inflation, China is facing similar yet opposite problems.

Consumer prices in China rose by just 0.7% in March despite the People's Bank of China (PBoC) cutting the reserve requirement ratio for almost all banks by 0.25 percentage points. Despite the removal of strict COVID control measures late last year, the economy has failed to rebound. For ten straight months, wholesale prices paid by businesses to factories and other producers have been dropping compared to a year earlier. Real estate prices are down, too.

According to the Beike Research Institute, China's property market is taking a beating. Prices of existing homes have fallen an average of 14 percent since their peak in August 2021, and rents have fallen 5 percent.

Uncertainty over the economy means many Chinese households heavy in debt are choosing to save as opposed to spend, and companies are cautious of making new investments. Coupled with falling wages, that adds to the squeeze that is holding back spending. Consumption, in many ways, is slowing down.

The Challenges of COVID

Much of the new central bank lending has gone to local governments, who have been repaying high levels of debt incurred even before the huge expenses brought upon by COVID measures. Municipal lockdowns, mass testing, loss of income, and extended periods of mandatory quarantines for large numbers of people have also likely caused lasting harm to consumer confidence that's playing out even now.

Billions have literally been spent on containing COVID over the last three years. The lockdowns greatly affected household incomes, which resulted in less spending, and hence less tax revenue. China avoided deflation in 2012 when it faced weak foreign and domestic demand. But China's central bank has since had to deal with the consequences of the dollar sterilization they imposed in years past to improve the competitiveness of their exports.

Beijing looks to gold

In light of the fading value of the Yuan, it appears gold is a solution.

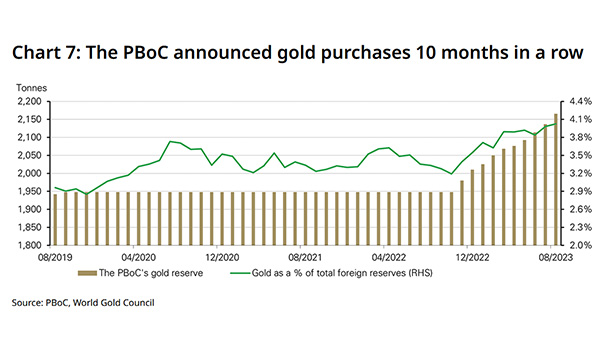

The PBoC has been buying tons of gold from the international market in an effort to support the value of the national currency. China's central bank bought 29 tons of gold in August, following a purchase of 23 tonnes in the previous month.

That brings the country's year-to-date purchases to 155 tons. Gold imports via Hong Kong have also gone up 49.6% on a monthly basis at 45.237 tons.

Given that gold is a store of value that is independent of any currency. As the world faces a new normal of high inflation, it makes sense for China's central bank to increase its gold reserves.

Officially, the PBoC has the seventh largest gold reserves in the world at 2,113.50 tons of gold. This represents about 3.8% of total reserves, but analysts have speculated that the central bank is looking to increase that to at least 5% of total reserves. Some analysts even think China may look to target the nation's total money supply instead, which would mean bringing gold reserves up to 15,320 tons. A significant price for the country, but perhaps a necessary one to pay if it is to assuage concerns over US dollar dominance.

Uncertainty driving record sales in gold

What might be surprising is that Chinese consumers are also getting into the action. China's domestic gold prices have surged well above international spot prices, as the country's middle and upper classes scramble to secure the value of their savings in gold. Unlike fiat, gold holds its value much better through economic uncertainty.

It is also one of the items of value that China's working class can still get readily hold of, as they can't easily buy US dollars or invest in foreign assets. Mass buying of gold bars and jewelry has caused the price of gold in China to rise to a 13-year high.

On September 27th, Bloomberg reported that premiums on the Shanghai Gold Exchange were up 6% compared to the price in London or New York. The so-called Shanghai premium is said to have started in June, a response to the import curbs imposed by the PBoC.

Investors project to reset calculations

As John Reade, chief market strategist at the World Gold Council said: “China is the biggest gold consumer on the planet. It's the biggest gold importer; it's the biggest gold refinery; it's the biggest jewelry market, and one of the biggest investment markets. It has the potential to grow.”

“What happens in China doesn't stay in China.”

With Chinese investors making the same long-term bet on gold as their central bank, the sheer size of China's investment may skew long-term price assumptions that guide the global precious metals market.

The evidence – despite some of the highest rates of inflation since the financial crisis, the price of gold has held relatively steady. Gold generally reacts opposite to fiat, so when interest rates go up, gold becomes less attractive.

That the price of gold hasn't dropped drastically, speaks to the impact of China's gold-buying spree. Perhaps a new “floor” for gold has been established, which could in turn, mean a much higher ceiling. Once yields pull back, the dollar declines, or the U.S. economy stalls significantly, analysts expect gold prices to rise even more significantly.

Carley Garner, co-founder of the brokerage firm DeCarley Trading, says his data predicts that gold is positioned to hit new all-time highs when the U.S. dollar starts to fade. If the Dollar falls below historic levels, gold could even push to new all-time highs, perhaps even US$2,600 an ounce.

If the “floor” has been reached, then now might be as good a time to buy gold as any.