Lend Money Safely With Our Fully Secured Loans

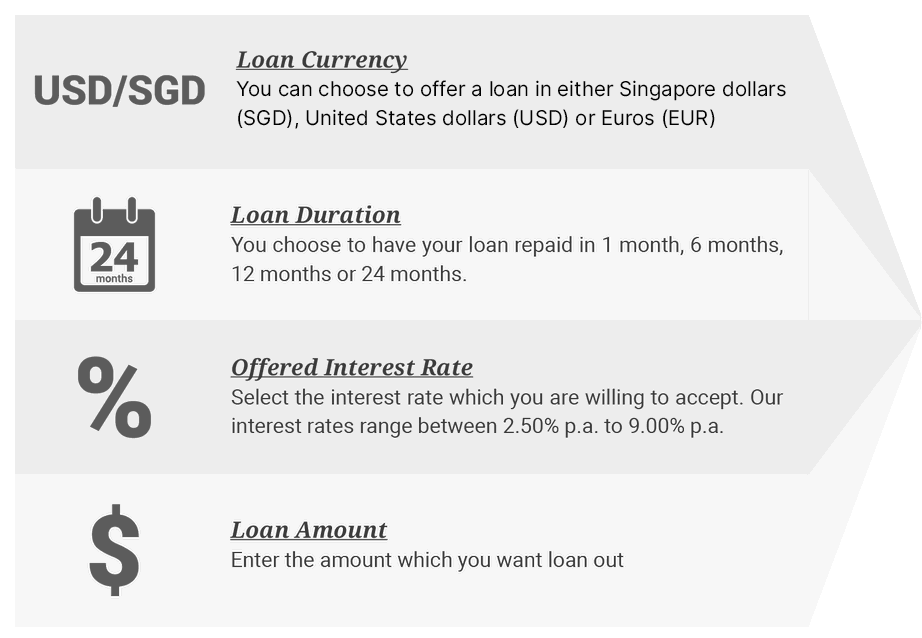

Safely earn interest by lending USD, Euro or SGD on our Secured P2P Loan platform to our storage clients who pledge their S.T.A.R. Storage Parcels (precious metals, nickel, and luxury watches) as collateral. Interest rates are determined between clients themselves in a bid/ask market.

Lending starts from a minimum of 5,000 USD, 5,000 SGD or 5,000 EUR, and in multiples of 500, with loans arranged directly between individual lenders and borrowers with no third-party intermediaries involved. Silver Bullion facilitates the entire process as the platform operator and custodian, handling all documentation and fund transfers securely. To maintain privacy while ensuring transparency, all parties are identified solely by their unique S.T.A.R. ID throughout the transaction.

Our secured lending has proven to be highly reliable and safe. Since 2015, we have processed 29,230 secured loans were processed and thanks to our high collateral requirements and Reserve Fund system there has been no loan default or repayment delays to lenders.

An active S.T.A.R. storage client with funds in the dedicated P2P Client bank account can:

Use their USD, Euro or SGD to earn interest, secured by collateral

Specify acceptable loan amount, interest rate, currency, and duration

Enjoy simple procedures and seamless roll-overs

| 22 Feb 2026 Contracts |

Borrowers are Requesting |

|

|---|---|---|

| EUR 1 month | ||

| SGD 1 month | 5.00% p.a. | |

| USD 1 month | ||

| EUR 6 months | ||

| SGD 6 months | 6.50% p.a. | |

| USD 6 months | 6.50% p.a. | |

| EUR 1 year | 8.25% p.a. | |

| SGD 1 year | 6.00% p.a. | |

| USD 1 year | 7.00% p.a. | |

| EUR 2 years | 7.50% p.a. | |

| SGD 2 years | 6.00% p.a. | |

| USD 2 years | 9.00% p.a. | |

| 22 Feb contract bidding closes in 15 hours 58 minutes. | ||

Who are you lending money to?

As a lender, you would no doubt be concerned about our borrowers' profiles as they directly impact loan repayment. Our borrowers are clients who have physical precious metals, nickel, and luxury watches, stored under our S.T.A.R. Storage program.

Our typical storage client is someone who is holding silver and gold bullion long-term to protect wealth from systemic crises. They had also satisfied our Know Your Customer (KYC) requirements before being accepted as a S.T.A.R. Storage client and allowed to borrow money on the secured loan platform.

Borrowers on our secured loan platform seek personal loans for various reasons and there are no restrictions on how they use the funds. They could be borrowing money to buy more precious metals, invest in other assets, repay a home equity loan, or consolidate debt.

How lender funds are protected

Silver Bullion’s mission is to provide the safest place possible for your wealth, in normal times or during systemic crises. This mission extends to allowing customers to lend funds through the P2P platform. Your funds in a secured loan are protected in the following ways:

Borrower Default Risks: Unlike unsecured loans, which have a high risk of borrower default, all our loans are fully backed by physical assets (precious metals, nickel, and luxury watches) stored in our vaults. In addition, our secured loans have transparent loan collateral requirements.. Each loan contract specifies the S.T.A.R. parcels that the borrower has pledged as collateral to guarantee the loan. The parcels are conservatively valued (e.g. valued at spot) throughout the loan duration and, should the collateral value fall to 110% of the principal, the collateral is liquidated. Furthermore, loans start with high collateral ratios (160% to 200% depending on parcels and duration), making liquidation unlikely.

Borrower Repayment Delays: Should a borrower have insufficient funds to settle a loan, the Reserve Fund will lend the required amount of funds to the borrower with the aim of ensuring that the original loan is settled on time, allowing our lenders to always receive their returning funds on time.

Collateral Loss: All collateral is stored in our highly secure state-of-the-art vaults in Singapore, one of the safest countries in the world. In addition, the collateral is fully covered by insurance, further safeguarding lenders' funds.

Systemic Crises: Lenders' funds are not subject to risks stemming from financial crises such as financial institutions' insolvency because the secured loan is between individuals (peer-to-peer) and fully backed by physical property in Silver Bullion’s vault.

Together, these safeguards produce a secure and reliable lending market, giving lenders peace of mind to provide liquidity safely for attractive interest returns. This allows loans to be matched quickly on our secured loan platform, given the amount of liquid funds available.

Earn recurring interests without downtime

Loan settlements occur on the 1st, 8th, 15th and 22nd of the month. This fixed loan maturity dates allows for loaned funds to be rolled over from one loan to another without downtime. The next loan settlement is on 22 Feb 2026.

About a week before the loan settlement date, you can utilize the funds from your maturing loan towards a new loan, commencing immediately after your original loan expires. This allows you to continue earning interest on your lending funds without downtime ! This new roll-over can be with the same borrower or new ones depending on bid/ask market conditions and preferences. Necessary fund transfers are handled by Silver Bullion.

See the Loan Schedule for more details.

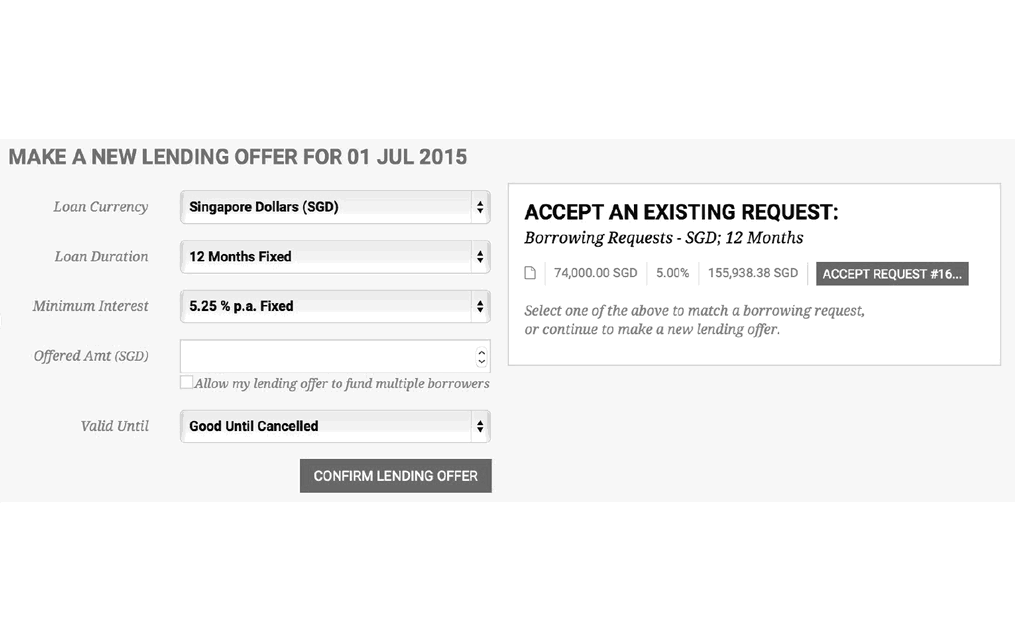

Increasing the chances of matching a loan

Your funds in a lending offer can be lent across multiple loans if you allow partial filling for your offer. Allowing partial filling means permitting borrowers to borrow only a partial amount of your funds, which avails your offer to more borrowers, thereby increasing the chances of you obtaining a loan quickly.

The opposite is true when you disable partial filling for your lending offer. Borrowers would only be able to take up the full sum of your offer, which would avail your offer to a smaller group of potential borrowers.

There is no difference in fees on whether a single contract or multiple contracts are made and the loan contracts are automated, resulting in little to no extra work.

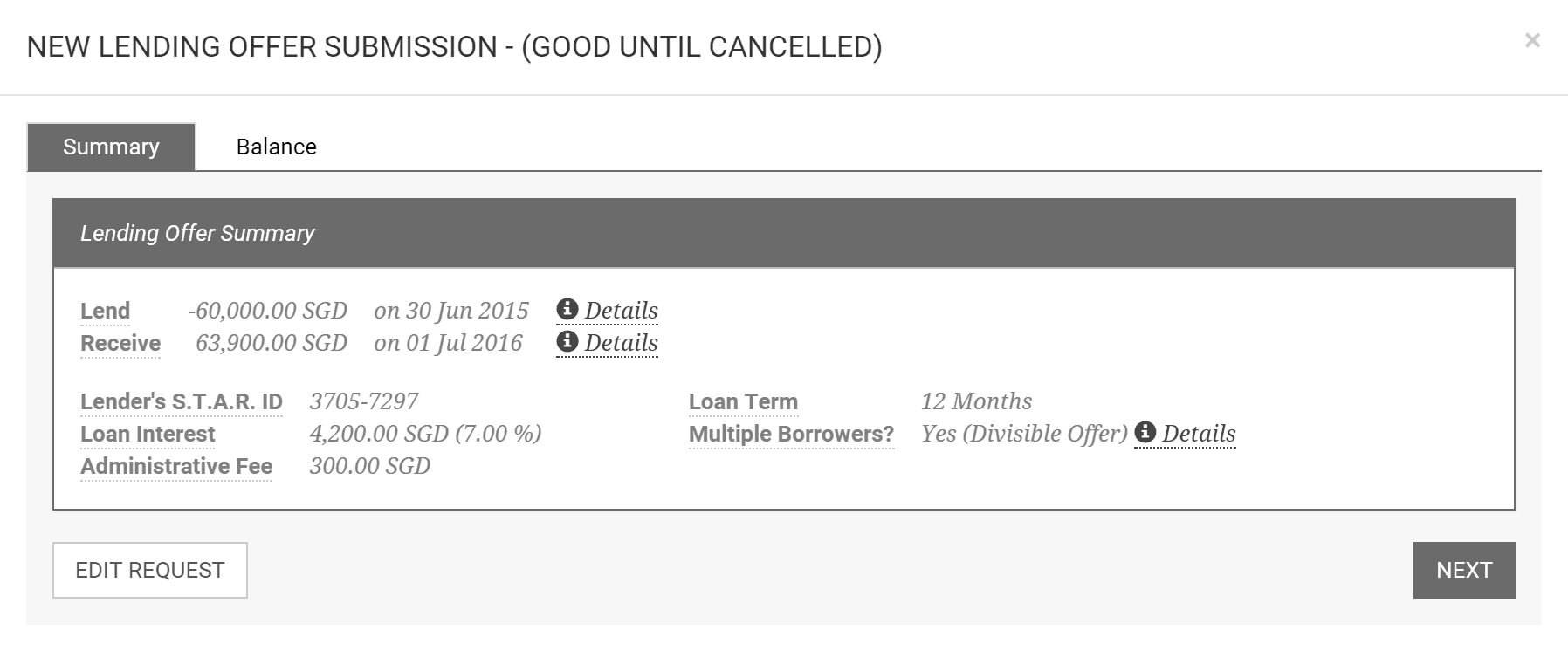

You pay a fee only when a loan is matched

There are no charges when you list a lending offer on our secured loan platform. You only need to pay a small processing charge when a personal loan is successfully matched with a borrower.

Our only fee is charged at 0.5% per annum of the loan amount ( 1% for 1-month loans), prorated by the loan duration. This fee is paid at the end of the loan (except for 2 year loans where annual interest and administrative charge are paid annually) and deducted from interest payments. For example, if you clinched a 5% interest loan with a 6, 12, or 24-month duration as the lender, you will receive a net interest of 4.5% after the processing fee is paid.

Assuming a 10,000 USD loan, the fees would be as follows:

| Duration | Loan principal | Processing Fee | Fee |

|---|---|---|---|

| 1 Month | 10,000 USD | 1% | 8.33 USD |

| 6 Months | 10,000 USD | 0.5% | 25.00 USD |

| 12 Months | 10,000 USD | 0.5% | 50.00 USD |

| 24 Months | 10,000 USD | 0.5% | 100.00 USD |

The processing fee is per annum-based; hence a 1-month loan is prorated to only 1/12th of 1%.

Lenders must wait for contract end for principal return

While borrowers have the option to terminate a loan early by repaying the loan in full, lenders have to wait until loan maturity to receive their funds back or until the borrower decides to repay early.

Shorter term loans therefore offer more flexibility for lenders, but longer term loans are easier to manage and tend to pay a higher interest.

Popular Reasons To Lend

Safe Lending Returns

Earn interest and re-lend funds to obtain lending returns in a safe manner.

Lend to net out eventual Storage Fees

If you also vault bullion with us, you can use the earned interest to pay storage fees.

Protect Your Funds

Diversify away from thinly capitalized financial systems and counterparty risks and protect your lent funds with insured physical collateral.

How to Lend

Loan Contracts

Once your loan request is filled and a legally binding contract between the lender and borrower is created, Silver Bullion will act as a custodian to enforce the contract by collecting and disbursing funds between the parties and locking collateral.