If you are experiencing ever-increasing prices of goods and services, the purchasing power of the currency you are saving is declining. Regardless of how economists may define inflation in the modern world, there is no denying that fiat currency has been created or 'printed' excessively today.

It is common for global central banks to inject massive government-authorized economic stimulus, known by many names, including quantitative easing, to help reboot the economy. There is no denying that rising inflationary pressures result from too much fiat currency chasing after goods and services that are not rising quantity-wise in tandem.

Precious metals, like physical silver and gold, are highly sought-after safe-haven assets that are known to protect wealth during crises and periods of rising inflationary pressures. A safe haven asset tends to maintain or increase in value during economic uncertainty, market volatility, or geopolitical instability. Answering the question, "Why invest in precious metals?" requires learning about the reasons that cause inflation and why precious metals continue to be one of the safest hedge against inflation.

Impact of Fractional Reserve Banking on Money Supply

When you deposit your money with the bank, you may think that your money is safely stashed away in the bank's vault, ready for you to access at any time. However, in reality, this is far from the case due to a common bank practice known as fractional reserve banking.

What is Fractional Reserve Banking?

The world's commercial banking system is based on an interesting premise called fractional reserve banking - a banking system in which only a fraction of bank deposits are backed by actual cash on hand and are available for withdrawal. This is done to theoretically expand the economy by freeing up capital that can be loaned out to other parties.

The fractional reserve banking practice assumes that people are unlikely to cash in all of their deposits at once, and in general, this is true. Under normal circumstances, a bank really only has to hold a fraction of all deposits as cash on hand to cover the demand for withdrawals at any time. It can use the remainder of the deposit to lend out to businesses and consumers to make a profit. The amount required to be held by banks in its reserves, is usually determined by the central banks, and is known as the reserve ratio. It is generally quite low. For example, in the US, this number is far less than 10 percent.

Example of How Fractional Banking Works

How is this inflationary? Let’s consider an example of how this might work. Suppose a bank has a reserve ratio of 10 percent. Someone makes a deposit of $100. The bank keeps $10 in its reserves and loans out the other $90 to an industrial firm, which it then deposits in its account. Out of that $90 deposit, the bank keeps $9 in its reserves and loans out the other $81. This process is repeated until at some point, we will have added almost $1000 to the money supply out of the original $100 deposit.

The Problem with Fractional Reserve Banking

As we can see from this example, fractional reserve banking has allowed the money supply to grow far beyond the underlying base money created by central banks. The multiplier effect of fractional reserve banking means that in effect, private banks are creating more money than the central banks themselves and inflating the money supply many times over. This is especially concerning when we consider the trillions of dollars that the US Federal Reserve has recently created out of thin air.

Printing money and inflation

Central bank money printing, often referred to as quantitative easing (QE), is a monetary policy tool used to inject liquidity into an economy during times of economic distress. By purchasing government bonds and other financial assets, central banks increase the money supply, aiming to stimulate lending, investment, and consumption. While this approach can provide short-term economic stability, it comes with long-term risks.

As the supply of money increases, its value relative to goods and services diminishes, setting the stage for inflationary pressures. The initial impact may not be evident immediately, as inflation depends on various factors, including consumer behavior, production capacity, and supply chain efficiency.

When the economy begins to recover and demand surges, the excess money in circulation can lead to higher prices for goods and services. Businesses facing increased costs for labor and raw materials often pass these expenses on to consumers, further fueling inflation. Additionally, as asset prices rise due to increased liquidity, wealth inequality can widen, with financial assets benefiting more than wages or savings. This creates a ripple effect, where individuals with stagnant incomes face a higher cost of living, exacerbating the impact of inflation on lower and middle-income households.

Central banks manage this lag between monetary policy implementation and its inflationary consequences, and it seems to be a sensible way to maintain stable prices in the economy... theoretically. However, we often experience the opposite: ever-increasing prices of goods and services, a phenomenon usually called inflation.

According to the quantity theory of money, inflation is a function of both the growth in money supply and the velocity of money (i.e. the rate at which money changes hands). It states that an increase in money supply should theoretically lead to an increase in prices because there is more money chasing the same level of goods and services.

In other words, with more money chasing after a relatively stable quantity of goods and services, the purchasing power of each currency unit diminishes, and inflation becomes a stealth tax on savings.

US dollar no longer backed by gold

At one time, the US dollar was backed by the gold standard, which meant that it was possible to redeem a US dollar for an equivalent amount of gold. Those using the currency could have full faith that the dollar would hold its value, and that when it came time to spend it, it would be accepted without question.

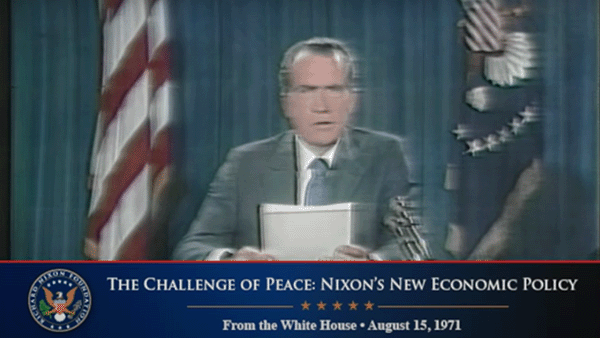

By pegging the dollar to gold, the government could not print money endlessly, as it had to ensure that it held an equivalent amount of gold in its reserves. Government spending was therefore limited to only what it can raise in taxes or borrow against its reserves. However, this is no longer the case as the pegging of the US dollar to the gold standard was abolished in 1971 by then president, Richard Nixon.

President Richard Nixon announced the closing of the gold window in 1971.

President Richard Nixon announced the closing of the gold window in 1971.

Without the backing of the gold standard (or anything else of real value), confidence in the US dollar is solely based on the trust that people have in the stability of that dollar. However, running up a huge debt can only erode the US dollar’s status as the world’s reserve currency, because the international demand for it is based on its perceived financial strength.

The more debt we incur by printing money, the more we jeopardize its status, as it reduces faith in the US dollar as a store of value. The result is that the dollar loses its purchasing power against other currencies, as well as its role as a safe haven during times of uncertainty.

Why Buy Gold?

Gold is scarce

The value of this precious metal is tied to its scarcity. Each year, only a tiny fraction is added to the overall gold supply through mining. Because of its limited supply, we do not see the price of gold fluctuate wildly. It tends to hold its value and is, therefore, widely regarded as an excellent store of value. Gold's scarcity is one of the main reasons why it is suitable to be used as money.

Gold is money

Throughout 5000 years of human history, man has always considered gold to be, not only precious, but also valuable as a form of currency because it can be used to purchase goods. Global recognition that gold is money was not by any decree by a monarchy or government but by the free market understanding gold's intrinsic value.

Gold fulfilled the characteristics of money, being limited in supply, durable, easily divisible, malleable, portable, and fungible. These properties allow the yellow metal to fulfil the functions of money: to be an efficient store of value and unit of account in trading, leading to the free market's natural gravitation to use gold as a medium of exchange.

"Gold is money. Everything else is credit." - JP Morgan

Gold as a hedge against inflation

Gold also acts as a hedge against inflation because its price in US dollars is variable. If the US dollar loses value as a result of inflation, gold becomes more expensive. In this way, the person owning gold is protected, or hedged, against a falling dollar because he is compensated with more dollars for every ounce of gold that he owns.

Gold is a safe haven

During times of geopolitical uncertainty and economic instability, gold has always been viewed as a safe haven. And times have never been more uncertain than now.

The printing of money, amounting to trillions of dollars in government stimulus packages injected into the global economy, is in uncharted territory. Whether this massive injection into the money supply will end well has yet to be seen. But whatever the outcome may be, investing in gold may well prove to be the best form of insurance there is.

Even central bank purchases of gold have increased significantly for more than a decade as central bankers increasingly view gold as an insurance against a reset of the global monetary system or currency collapse. Central banks have been net buyers of gold since 2010.

During times of uncertainty, gold has always been viewed as a safe haven. And times have never been more uncertain than now. The pandemic has created many unknowns in the economy. The printing of money, amounting to trillions of dollars, in the form of stimulus packages, is in uncharted territory. Whether this massive injection into the money supply will end well has yet to be seen. But whatever the outcome may be, investing in gold may well prove to be the best form of insurance there is.

Gold Retains Your Purchasing Power

Imagine you have three different ways to keep your money safe over time: you can buy gold (could be gold bars or gold coins) with it, buy a 1-year US Treasury bond (which is like lending money to the US government in exchange for a small return after one year), or just hold onto US dollars.

Now, think of each of these options as a container for your purchasing power, which is the real value of your money in terms of how much stuff—like bread, milk, or a movie ticket—you can buy with it.

The chart above shows that in 1970, each container started with the same ability to hold your purchasing power. Think of it as if each container could buy you exactly one whole loaf of bread.

Over the years, from 1970 to 2022, something different happens to each container:

The US dollar container has a leak. It's slow but steady. By the year 2022, if you try to buy bread with the dollars from this container, you'd only get a slice. That's because the purchasing power of the US dollar has dropped to 0.13 of what it was in 1970, or 87% less purchasing power.

The 1-year US Treasury bond container is a bit magical—it grows slowly. If you put your purchasing power in this container, by 2022, it would have grown enough to buy you 1.54 loaves of bread.

The gold container is the most impressive. It's like it has a bread-making machine inside. If you had put your purchasing power in gold back in 1970, by 2022, your gold holdings would be able to get you almost seven loaves of bread with it!

So, when you look at all three containers over time, physical gold has done a far better job of being an inflation hedge by not just retaining purchasing power but actually increasing it. The 1-year US Treasury bond does increase your purchasing power, but not nearly as much as gold. And the US dollar, unfortunately, loses a lot of purchasing power over time.

This chart shows us that if you're looking to maintain or increase the value of your money for the future—so you can buy as much or more in the future as you can today—history suggests that physical gold has been much more effective at this than US Treasury bonds or holding onto dollars.

"Gold is a global asset and a hedge against not just the price of goods and services but also the erosion of purchasing power in general." - World Gold Council

Why Buy Silver?

Silver is money

Silver, like gold, has been used as money for thousands of years. In fact, it has a longer monetary history than gold, with silver money being used since as early as 3000 BC in Mesopotamia. Ancient civilizations like the Sumerians, Akkadians, and Babylonians traded with silver shekels, while silver coins like the Greek stater, the Roman denarius, and the Spanish silver dollar dominated global trade in their respective times.

Many currency names today, like the dollar, pound sterling, peso, rupee, rupiah, yuan, and yen, still refer to silver's monetary history. Silver's acceptance as money, like gold's, resulted from its monetary characteristics.

Silver's robust demand

Silver is one of the most important metals throughout history, especially in the modern technological age. Since it is the most conductive metal for electricity and heat, silver is highly sought after in electronics manufacturing. Every smartphone, laptops, and electronic appliances contain minute amounts of silver.

With the rise of green energy, silver's industrial demand has risen remarkably, along with increased demand for solar panels and electric vehicles. Silver's anti-microbial properties have also been leveraged in manufacturing medical equipment like wound dressings, catheters, and silver-based coatings.

According to the Silver Institute, investment demand for silver, in terms of physical silver bullion and jewelry, has consistently recorded over a third of the annual silver supply since 2015.

Silver supply continues to be in deficit

According to the Silver Institute data, the global silver market has been in deficit since 2021, with silver demand outstripping supply due to silver's robust industrial demand. Mine production peaked in 2016 and has declined since.

Unbeknownst to many, primary silver mines are rare and over half of the annual silver supply is mined as a byproduct of base metals such as zinc, lead and copper. The miner's production plans are primarily driven by the base metals market and rising silver prices are unlikely to influence these plans.

Additionally, industrial demand for physical silver results in the precious metal being used in minute amounts in countless electronics and other silver products that are eventually discarded in landfills, further shrinking aboveground inventories. Consumed silver is rarely recovered as it is deemed not economically viable, given the low silver price.

Should demand continue to outstrip supply, a silver squeeze becomes increasingly likely, impacting the silver price in the future.

Silver is currently undervalued

While both physical silver and gold are excellent wealth protection assets, silver is currently undervalued compared to gold. This is evident given the high gold-silver ratio, which measures how many troy ounces of silver are needed to buy one troy ounce of gold and is often used as an indicator of the relative value of the two metals.

The gold-silver ratio's average is typically between 50 to 70 ounces of silver to 1 ounce of gold. A high gold-silver ratio, such as one exceeding 80:1, suggests that silver is undervalued compared to gold. This is because a higher ratio indicates that silver prices have not kept pace with gold prices, potentially presenting a buying opportunity for investors who anticipate a reversion to historical norms.

Silver's undervaluation has undoubtedly caught the attention of silver investors buying silver bars and coins, contributing to the consistent demand for silver.

Silver outperforms gold in bull markets

Analysts have long observed silver's tendency to outperform gold in precious metal bull markets. This is despite it lagging gold early in a bull market. For example, while gold achieved 38 record highs in 2024, climbing 38% since mid-February, silver outpaced gold with a 46% gain over the same timeframe.

One of the main reasons for silver outperforming gold in bull markets is its small market size when compared to the gold market. Estimated to be around $150 billion, the silver market is dwarfed many times over by mutual funds (~$50 trillion), the stock market (~$105 trillion) and the global bond market (~$130 trillion).

Therefore, the price of silver can rise quickly should sudden interest in it bring big money from financial markets flooding the silver market.

Why Invest in Physical Precious Metals

Precious metals like gold, silver and platinum are excellent physical assets to protect against purchasing power erosion due to inflation and currency debasement. In our opinion, the best way to buy gold, silver or platinum is not paper gold or silver financial instruments such as gold mining stocks, silver futures, silver mining stocks, gold exchange-traded funds (ETFs) or other silver investments since they only give exposure to silver and gold prices.

While paper gold investment assets have a role in diversifying an investment portfolio, physical precious metals (i.e. investment-grade silver bullion and gold bullion) are the safest and surest way to give you peace of mind even when the world encounters a financial crisis or economic uncertainty. Unlike paper investments, physical gold and silver are tangible assets with intrinsic value that will never become completely worthless, unlike fiat currencies and paper investments like company stocks, bonds, or other investments.

Gold and silver have a plethora of useful commercial and industrial applications, and unlike industrial metals, they do not corrode and are extremely rare in the Earth's crust, making them many times more pricier than other industrial metals. The usefulness of both metals ensures that they are always in demand regardless of the gold and silver price.

Silver and gold bullion stored outside the global financial system also do not have counterparty risk to the financial market. Your silver and gold coins and bars kept safely in a vault are unaffected even if fiat currencies collapse or there is a market crash in the financial system.

Instead, physical metals like gold and silver have always been an excellent store of value throughout history, even during market fluctuations. Physical precious metals also do not have counterparty risk to the financial market. They are a good portfolio diversifier, given their low or negative correlation to other financial assets. Physical silver and gold bullion are also highly liquid, allowing you to easily sell them if the need arises. The precious metals market has many bullion dealers willing to buy back bullion regardless of where gold and silver prices are.

Physical precious metals are the ultimate safe haven assets, which is why global central banks have been adding to their gold holdings in the past decade. Singapore, where Silver Bullion is headquartered, was one of the largest gold buyers in 2023.

"Gold is the perfect piggy bank – it's the anchor of trust for the financial system. If the system collapses, the gold stock can serve as a basis to build it up again." - Dutch Central Bank (DNB)

Protect Your Wealth With Bullion Bars and Coins

There are many ways to invest in physical precious metals. You can buy silver and gold bullion bars or coins with us and store them in S.T.A.R. Storage in the safe jurisdiction of Singapore. Investment-grade gold, silver and platinum bullion products are exempt from Singapore's Goods and Services Tax (GST).

Bullion coins, like the Canadian Maple Leaf gold coin and the American Eagle silver coin, are produced by government mints and are considered legal tender in the issuing country. This is a common criterion many countries require for sales tax exemption on bullion coins.

Bullion bars are also highly sought-after by investors in the gold and silver market, given their lower premiums compared to coins.

Bullion bars, produced by refiners accredited by the London Bullion Market Association (LBMA), are also highly sought-after by investors, given their lower premiums than coins.

If wealth protection is one of your investment objectives, investment-grade bullion is one of the best asset classes that fulfil your requirements.

Please click on the links below for more information on our precious metal products and services.