The Electrification Supercycle

The demand for metals—such as lithium, cobalt and nickel—means that there is only one way to feed an electrifying world: higher prices.

Lithium prices have soared since 2015 and in early 2017, the industry recognized that there will soon be shortages of cobalt. We believe that class I nickel, which has yet to move substantially and is priced at 32% of its 2007 high, will become one of the biggest benefactors of the Electrification Supercycle.

Lithium

Since its 2015 breakout

Since its 2017 breakout

Own the kind of metal being hoarded by battery, electronics and car manufacturers, and get direct, long term exposure to the coming supply squeeze pushed by the electrification supercycle.

We create a market on these physical metals and ensure buy/sell volume liquidity by working with LME brokers and refineries, while also allowing customers to borrow against their holdings via the Peer to Peer Lending platform.

Participate in the EV revolution

Our electric vehicle (EV) metal parcels are packaged in 250 kg (551 lb) industrial drums or 2 ton (4,409 lb) bulk bags. These parcels contain battery-grade metals used in battery manufacturing.

The drums and bulk bags fulfill the industry standard requirements for security, size, rates, logistics, accessibility, material handling, delivery points, and permitting to ensure liquidity.

EV parcels are uniquely identified physical property, audited by our financial auditor and Bureau Veritas, fully insured against loss, guaranteed to be genuine, and stored in an LME-approved warehouse in Singapore to allow for seamless liquidity solutions.

EV parcels can be bought and sold online 24/7 based on LME cash pricing, with additional competitive mark-up. They can serve as collateral to easily obtain low interest peer to peer loans. EV parcels can be delivered on demand.

Electric vehicle metals offered

Other electric vehicle metals

Lithium

Reacts with humidity and can be explosive when exposed to air or water. It is also corrosive and produces poisonous fumes. We do not offer lithium purchasing options nor storage solutions.

Copper

Copper’s low price and bulkiness make it expensive, as a percentage of its value, to store. We currently do not see enough demand to offer a copper storage option.

Graphite

Forms the anode of almost every battery, but can be easily produced synthetically. It is unlikely to appreciate substantially as demand increases. We do not offer graphite storage.

Bulk Metals

Manganese, aluminum and silicon are also used in these batteries but supply is plentiful and no shortages are expected.

The shift to electric vehicles is accelerating

The electric vehicle revolution is undeniable. The International Energy Agency expects the number of electric vehicles on the road to increase from 2 million in 2016 to 70 million by 2025.

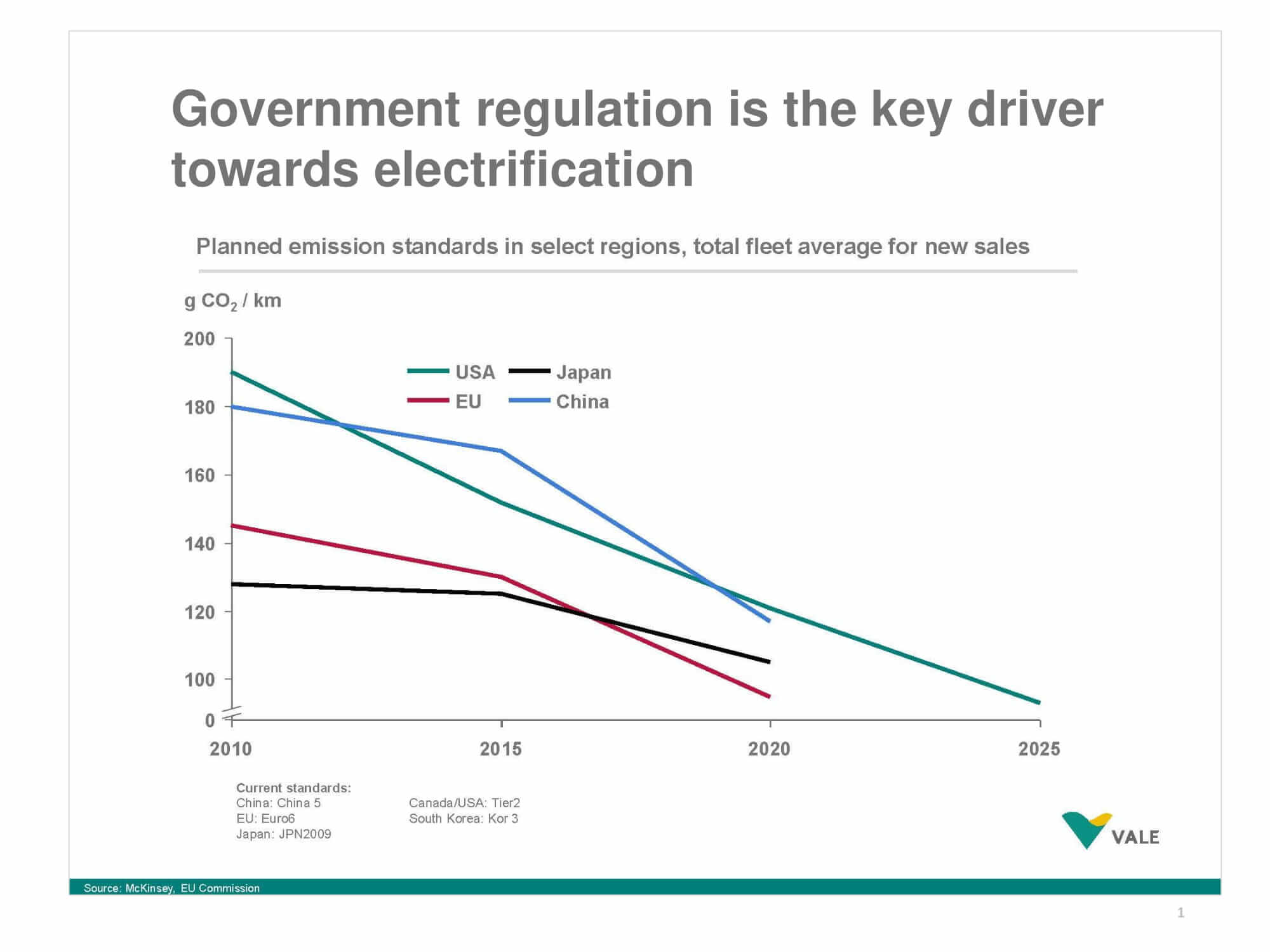

This number will increase substantially, as stringent combustion engine restrictions are being implemented by governments. China will require that 12 percent of all vehicles sold in the country must be electric by 2020. The French and British governments plan to end the sale of new petrol and diesel vehicles by 2040. The Indian government has set a target for every vehicle sold in the country to be powered by electricity by 2030.

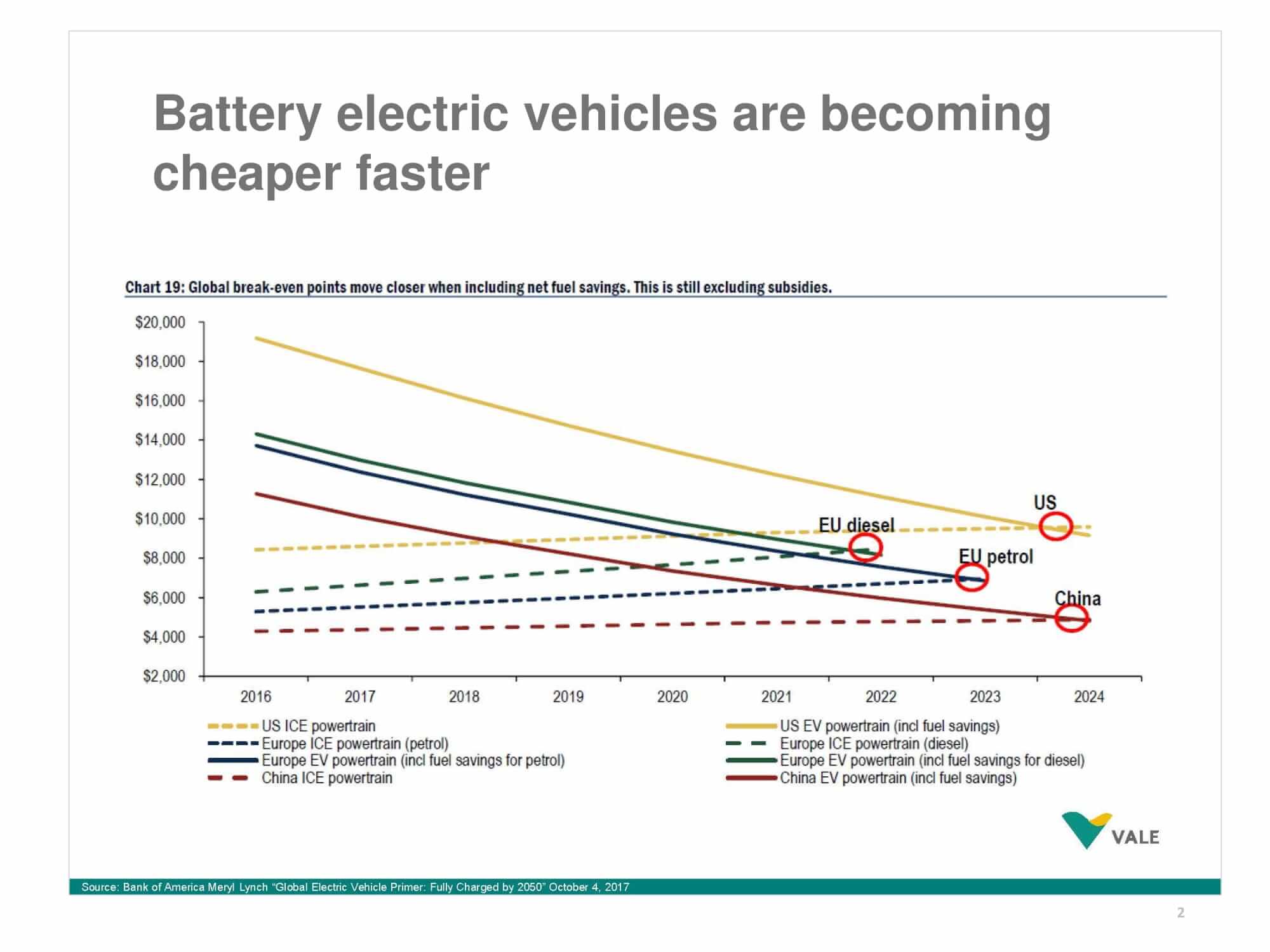

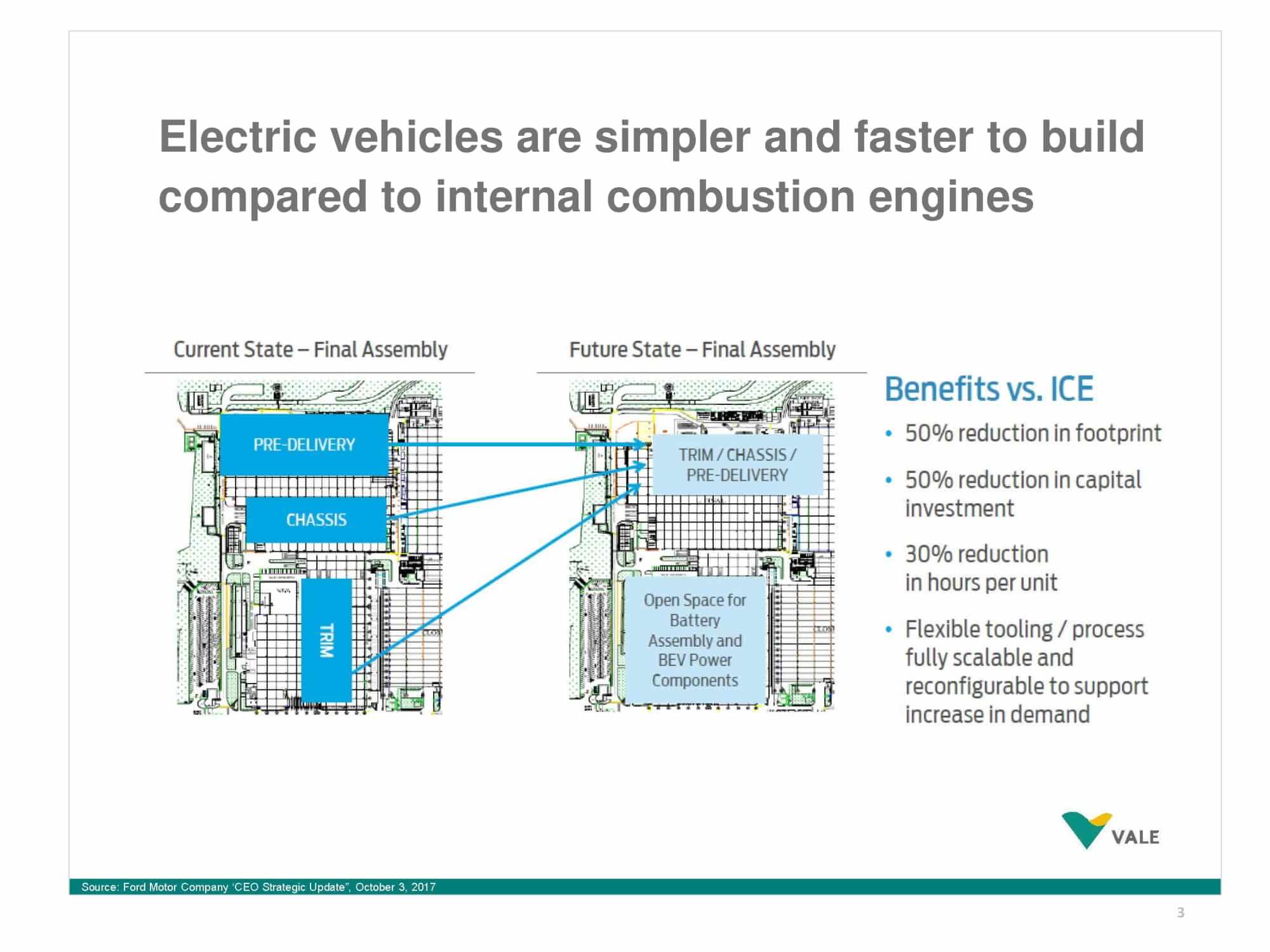

This shift is propelled by battery costs which have fallen tremendously from around USD 1,000 per kilowatt hour (kWh) in 2010 to around USD 150 per kWh in 2018, making EV cars much more powerful and inexpensive. Falling battery prices mean that the production of electric vehicles is becoming cheaper than that of traditional vehicles, as EVs require only half the production floor and capital expenditures compared to equivalent internal combustion engine (ICE) cars.

(Click to enlarge)

The demand for EV batteries is hitting an inflection point, causing more capital to be invested into gigantic factories, which lowers costs through economies of scale, and applied research that increases power efficiencies. These investments in turn will further reduce unit prices of each car, thereby creating even greater demand in an upward spiral that will see a massive shift towards electric vehicles.

For example, Tesla was initially set to double world lithium ion battery production with its pioneering Gigafactory, but is now planning to build four additional such factories. Chinese battery production initiatives are likely to dwarf these investments as a race towards electrification is becoming unstoppable.

Mainstream car manufacturers are now focusing heavily on EVs, with hundreds of new EV models under development, ensuring a tremendous battery demand growth. Volvo, for example, has announced that it will cease the production of pure combustion engine cars by 2019, and Volkswagen has signed a 25 billion USD deal to procure battery supplies and will convert 16 factories to produce electric vehicles.

An increase in electric vehicle production, plus initiatives by governments, is expected to increase the demand for nickel & cobalt

Collin Kettel, CEO of Palisade Global Investments Ltd, discusses the increasing importance of nickel & cobalt

Evolving battery chemistries determine future metal demand

Lithium ion batteries have three key components:

The cathode determines performance and cost.

The cathode determines performance and cost.

Batteries have to compromise between energy, capacity, costs, life cycle, safety, operating allowances and other factors. The cathode chemistry determines how good a battery is and what metals are needed. The following are the various formulations:

Nickel manganese cobalt (NMC). Nickel provides the performance, cobalt keeps the battery safe and manganese allows for high current discharge without heating up excessively. The more nickel is used, the more powerful and inexpensive the battery becomes but it must be more carefully fine-tuned to maintain safety. This chemistry has high energy density and a long life span.

There are three reference NMC generations:

-

NMC111 containing 33% Nickel and 33% Cobalt is the simplest

-

NMC622 contains 60% Nickel and 20% Cobalt, greatly improving the power/cost ratio

-

NMC811 contains 80% Nickel and 10% Cobalt, the highest theoretical performance vs. cost

Lithium nickel cobalt aluminum (NCA). A power/costs improvement over NMC 111 because it increased the percentage of nickel while reducing expensive cobalt. Tesla uses this extensively but will likely switch to the 3rd generation NMC811 chemistry once mature. NCA has relatively lower energy density but a long-life span.

Lithium cobalt oxide (LCO). Used extensively in the portable electronics industry, e.g. in iPhones, this chemistry has good performance but, due to its very high cobalt usage (around 55%), is expensive. LCO has a high energy density but a short life span.

Lithium iron phosphate (LFP). Intrinsically safer than other chemistries but not nearly as powerful as NMC811. This was the early preferred choice in China, but the trend is now to switch to NMC which meet the minimum energy density levels required to qualify for Chinese government subsidies.

Lithium manganese oxide (LMO). It was used in early EVs, such as the Nissan Leaf, because of its high reliability. LMO's downside is low cell durability and mediocre power compared to competing technologies.

"Lithium ion batteries should be called nickel graphite" Elon Musk, Tesla Founder / CEO

The industry is moving toward NMC811

NMC811 is widely expected to become the preferred cathode chemistry for EV as it will have the best power to cost ratio. NMC811 is expected to drive battery prices well below USD 100 per kWh and enormous NMC production capacity is currently being setup.

Battery production realities are such that class I nickel and cobalt will remain the primary EV cathode metals for the next few decades. Promising improvements are the advent of solid state batteries and potentially graphene coatings. Solid state batteries could replace the liquid lithium electrolyte with a solid electrolyte which could make them safer, more compact and faster charging.

Solid state batteries will change the electrolyte, thereby possibly changing the “lithium-ion” designation and with batteries potentially not requiring lithium at all. However, the NMC811 cathode chemistry and the role of nickel and cobalt will essentially remain the same.