Latest

Displaying 211 to 220 of 840

-

10 Aug 2023

Bill Holter - China's Golden Rule (Opinion)

SBTV spoke to Bill Holter about China's golden rule, currency wars, going nuclear, and gold. Things are running hotter, getting hotter, and gold looks to both unite and ignite the global financial system. What else did Bill have to say...watch this interview for more.

(Read more) -

05 Aug 2023

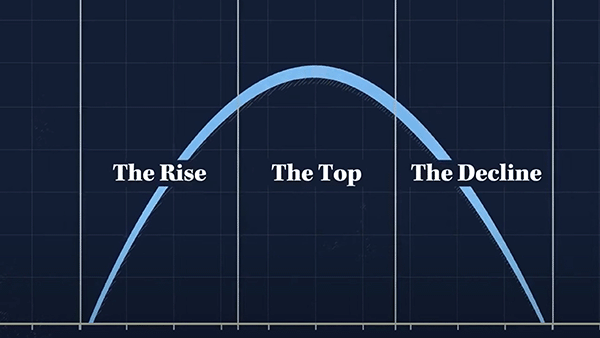

A Comparative Analysis of the Rise of the Dutch, English, US, and Chinese Empires According to Ray Dalio

Ray Dalio, a renowned hedge fund manager, has written extensively about the "Big Cycle" in his book 'Principles for Dealing with the Changing World Order'. Dalio posits that these cycles have an average duration of roughly 250 years, divided into three main phases: the rise, the top, and the decline. Additionally, the transition periods between these cycles can span 10 to 20 years, during which the old world order gives way to the new.

(Read more) -

03 Aug 2023

Egon von Greyerz - Europe is Suffering (Opinion)

SBTV recently had a compelling conversation with Egon von Greyerz, where he discussed the pressing issues concerning the euro, the economy, inflation in Europe and the ongoing struggles it is facing. He emphasized that the situation has not reached the level of "misery" just yet.

(Read more) -

27 Jul 2023

Dr. Marc Faber - Move away from the US dollar (Opinion)

SBTV spoke with Dr. Marc Faber from gloomboomdoom.com. Dr. Faber holds no punches as he talks about the inflation lie, getting away from the US dollar and how the West is going past the point of no return. It's all about Faber fundamentals!

(Read more) -

24 Jul 2023

Ep 3: Building the World's Highest Capacity Precious Metals Vault

In Episode 3, Gregor Gregersen retraces the events after Silver Bullion had successfully completed the moving of its vault, The Safe House. Together with Wesley Liew and Jessica Baczkowski, design architects for The Reserve, they explain how this new vaulting facility was designed.

(Read more) -

20 Jul 2023

Rick Rule - Gold Backing Currencies Again is a Longshot (Opinion)

SBTV spoke with Rick Rule, president and CEO of Rule Investment Media, about the future of precious metals, the U.S. dollar dominance and why he thinks a return to gold-backed currencies is a longshot.

(Read more) -

15 Jul 2023

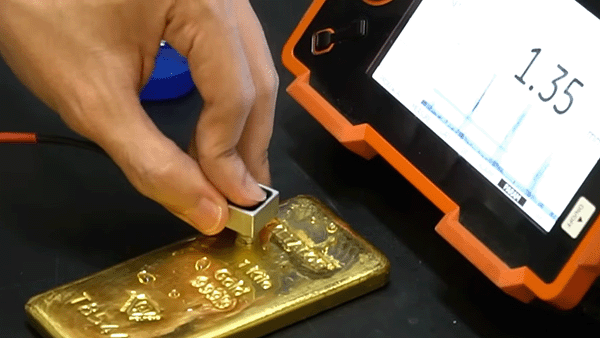

How Ultrasound Testing is Used to Authenticate Precious Metals

Gold and silver have been cherished for centuries, captivating humankind with their allure and enduring value. As these precious metals continue to hold a significant place in the global economy, the need for accurate and non-destructive testing methods has become paramount.

(Read more) -

14 Jul 2023

Why Singapore is Increasing Its Gold Reserves

This article delves into the factors driving Singapore's proactive approach toward gold accumulation. We explore the historical context, reasons behind the increased reserves, Singapore's unique approach, and the potential benefits and implications of this strategic move.

(Read more) -

13 Jul 2023

Tavi Costa - Central Banks Will Be Forced to Buy Gold (Opinion)

SBTV spoke with Tavi Costa, partner and portfolio manager at Crescat Capital, about the inverted yield curve and the prospect of more bank failures ahead. Tavi believes we are in the early stages of a new gold cycle. He sees silver as the better buy.

(Read more) -

06 Jul 2023

Stephen Leeb - BRICS Wants a Currency Basket Backed by Gold (Opinion)

SBTV spoke with Stephen Leeb, founder of Leeb Capital Management, about why gold is the enduring monetary metal of all ages and how the BRICS nations are supporting a new monetary system backed by gold.

(Read more)