Why Singapore is Increasing Its Gold Reserves

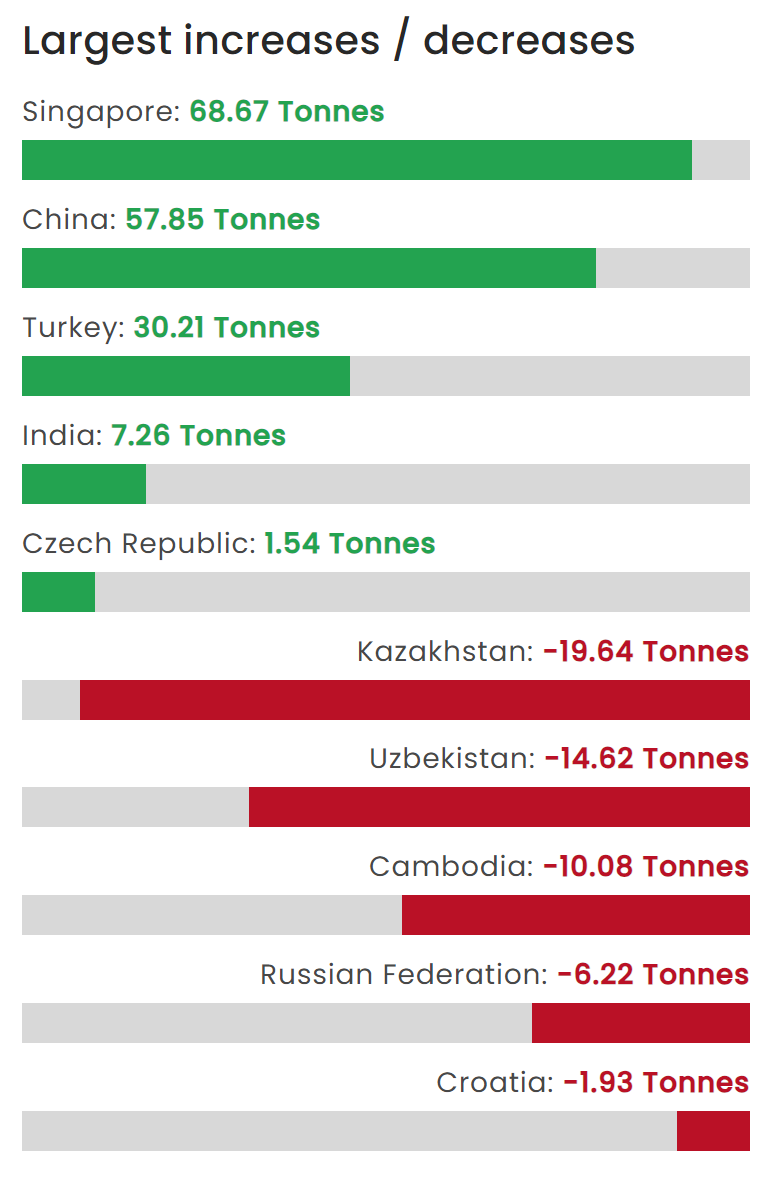

Singapore's recent surge in gold reserves has caught the attention of global financial markets. Emerging as the top single gold buyer in the first quarter of 2023, the country witnessed a remarkable increase, acquiring an additional 69 metric tons of gold—an impressive 45% rise compared to its holdings at the end of 2022. This strategic move has propelled Singapore's gold reserves to reach a milestone of 222 metric tons at the end of Q1 2023, the highest ever recorded since the nation's independence.

Positioned in Southeast Asia, Singapore now stands as the region's second-largest holder of gold reserves, trailing only behind Thailand's 244.2 metric tons. On a global scale, Singapore's gold reserves rank 24th, surpassing larger nations such as Brazil, Sweden, Australia, Denmark, and South Africa. This significant escalation in gold holdings has sparked curiosity and led to questions about the motives and implications of Singapore's decision to bolster its gold reserves.

This article delves into the factors driving Singapore's proactive approach toward gold accumulation. We explore the historical context, reasons behind the increased reserves, Singapore's unique approach, and the potential benefits and implications of this strategic move.

Historical Perspective on Singapore's Gold Reserves

Singapore first bought gold in 1968, three years after its independence. Then a developing country still struggling with running a young nation, the Singapore government purchased an astounding 100 metric tons of gold from South Africa.

This amount of gold was incredible because, even at the time of writing, bigger countries like Australia, Indonesia, Denmark, Finland, and Canada had less than 100 tons of gold in their official gold reserves.

Singapore’s first gold purchase was a clandestine operation, as there was a U.S. embargo on South Africa in the 1960s. Nevertheless, Singapore’s first finance minister Dr Goh Keng Swee and Ngiam Tong Dow, a senior civil servant, completed the under-the-radar gold purchase.

Singapore's gold reserves reached 127.42 metric tons by 2002 and remained relatively stable at that level until 2021. That year, the Monetary Authority of Singapore (MAS), the country's central bank, added 26.35 metric tons of gold by June 2021. This significant acquisition raised Singapore's total gold reserves to approximately 153.76 metric tons.

The 2023 1st quarter gold purchase then brought the country's gold reserves to 222 metric tons. In the latest data from MAS, Singapore increased its gold reserves again by nearly 4 metric tons again in May 2023.

Reasons for Increasing Singapore’s Gold Reserves

When the 2021 gold purchase was reported in the news, a MAS spokesman said, “The change in gold holdings is a result of the continuous and ongoing efforts by MAS to ensure that the official foreign reserves (OFR) portfolio remains well-diversified and resilient through economic and market conditions.”

According to Singapore's Ministry of Finance:

“OFR is accumulated when MAS purchases U.S. dollars in exchange for Singapore dollars, in order to moderate the appreciation of the Singapore dollar exchange rate. It is hence a consequence of MAS’ monetary policy, which since the early 1980s has been focused on keeping the exchange rate within its target policy band.”

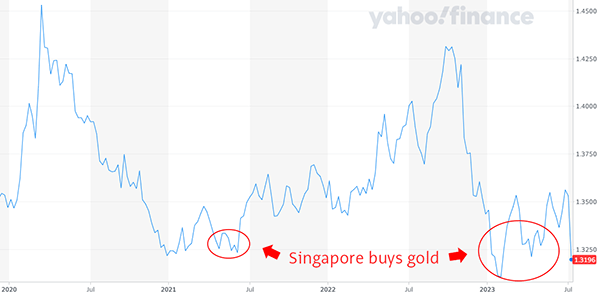

When we look at the USD to SGD exchange rate chart for the last 5 years, the 2021 and 2023 gold purchase periods coincided with lows in the USD-SGD exchange rates, or when the Singapore dollar was depreciating around the $1.32 USD to SGD rate.

Given that gold is typically denominated in U.S. dollars, it is possible that the MAS bought gold using a small fraction of the USD purchased from depreciating the SGD to within the central bank’s desired band.

Historically, prior to 2021, the Monetary Authority of Singapore (MAS) did not engage in gold purchases when the USD-SGD exchange rate fell to approximately $1.32 or lower. However, since May 2021, the central bank of Singapore made the decision to acquire gold instead of maintaining an equivalent amount in U.S. dollars, deviating from its previous approach.

While Singapore's gold reserves constitute a mere 2% of its total reserves, the gold purchase made in the first quarter of 2023 witnessed a substantial 45% surge in the country's gold holdings. It is certainly a move to improve the Singapore dollar’s solidity against the potential depreciation of major foreign currencies or the next financial crisis.

Given that Singapore’s 2021 gold purchase was the first increase in gold reserves figures dating back to 2000, gold is clearly now in the mindshare of Singapore’s central bankers.

Shift in How Other Central Banks View Gold

After the 2008 Great Recession, there seems to be a shift in central banks’ attitudes toward gold.

The Dutch central bank (DNB) stated:

“A bar of gold always retains its value, crisis or no crisis. This creates a sense of security. A central bank's gold stock is therefore regarded as a symbol of solidity… Shares, bonds and other securities are not without risk, and prices can go down. But a bar of gold retains its value, even in times of crisis. That is why central banks, including DNB, have traditionally held considerable amounts of gold. Gold is the perfect piggy bank – it's the anchor of trust for the financial system. If the system collapses, the gold stock can serve as a basis to build it up again. Gold bolsters confidence in the stability of the central bank's balance sheet and creates a sense of security.”

The Bank of Italy shared the following view on gold:

“Gold is an excellent hedge against adversity… Incorporating gold into a financial portfolio is a way of hedging against high-risk scenarios, however unlikely… Another good reason for holding a large position in gold is as protection against high inflation since gold tends to keep its value over time. Moreover, unlike foreign currencies, gold cannot depreciate or be devalued as a result of a loss of confidence. So, when a foreign exchange crisis erupts, central banks can use gold in the same way as their official foreign exchange reserves, to shore up confidence in the national currency… A large stock of gold gives a central bank plenty of room for manoeuvre to preserve confidence in the national financial system.”

In 2021, Adam Glapinski, Governor of the National Bank of Poland (NBP), said:

“Why does the central bank own gold? Because gold will retain its value even when someone cuts off the power to the global financial system. Of course, we do not assume that this will happen. But as the saying goes - forewarned is always insured. And the central bank is required to be prepared for even the most unfavorable circumstances. That is why we see a special place for gold in our foreign exchange management process."

According to a Central Banking Publications annual survey conducted among 83 central banks responsible for overseeing a total of $7tn in foreign exchange assets, it was revealed that over two-thirds of the participants anticipated their counterparts to increase their gold holdings in 2023.

These reserve managers cited high inflation and geopolitical risk as their top concerns. Given that gold tends to do well in both scenarios, hedging such risks is likely the reason for the 152 percent year on year increase in central bank gold buying in 2022.

It was a record-breaking year for central bank gold buying, with 1,136 metric tons purchased.

When viewed on a longer horizon, this massive amount of gold bought by central banks is a continuation of a trend since 2010, when central banks transitioned from net sellers to net buyers of gold.

The research of precious metals analyst Jan Nieuwenhuijs tracing the activity of European central banks in the gold market also suggests that European central banks could be preparing for a Gold Standard, albeit, one that is different from the Classical Gold Standard.

The World is Awaking to Gold’s Value and Reliability

At the beginning of the Russian-Ukrainian war in 2022, western governments froze $300 billion in Russian foreign currency reserves.

More than 13 months later, the West is still debating on whether they should dip into Russia’s frozen reserves to help Ukraine.

“If you ask yourself which is the politically easier course – seizing our adversaries’ assets that we have already frozen or appropriating taxpayer dollars to support economic reconstruction in Ukraine – overwhelmingly, the easier course is relying on the Russian assets,” Larry Summers, a U.S. Treasury Secretary under President Bill Clinton reportedly told a conference in February.

While proponents for confiscation are often based on notions of justice and fairness, the act is likely to run afoul of legal frameworks that exist to enforce stability in the global financial system.

While freezing Russia’s assets has triggered global central banks’ fears of the safety of their own dollar reserves, an unlawful seizure is likely to exacerbate dollar distrust internationally.

Russia’s military campaign has opened the eyes of the world to dollar counterparty risks.

“Countries have recognized that the gold that Russia holds, because it’s outside of anybody else’s control, is useful in situations where you might not be able to access any other reserves,” said John Reade, chief market strategist at the World Gold Council.

Mainstream doubts about gold’s role in modern finance are gradually turning from that of an optional asset to one that is critical to crisis survival.

Gold, the Ultimate Crisis Insurance

Gold has long been regarded as a traditional safe-haven asset and is often considered the ultimate crisis insurance.

As mankind’s premier choice of money for over 5,000 years, gold had the characteristics of money – durable, fungible, divisible, portable, and a store of value. It was the market’s choice, not the government’s because gold represented fairness as a medium of exchange for goods and services.

The freedom to print money globally as a result of the severing of the US dollar’s link to gold in 1971 has relegated gold to an old-fashioned “barbarous” second-rate asset in the subsequent decades. Far be it from the truth, gold’s importance as the ultimate crisis insurance, inflation hedge, and monetary asset is once again coming to the forefront as the world grapples with high inflation and wearisome government quantitative easing programs.

While the early years of wonton government money printing led to decades of wealth creation with leverage, the time to protect wealth has come, given that payback for the money printing years is evidenced in continuous international currency debasement by central banks worldwide, resulting in rising inflation.

Central banks, like the Monetary Authority of Singapore, are turning their sights on gold as they seek to protect their country’s reserves. Likewise, it would be wise for private investors to follow central banks’ cue to own gold to protect their wealth.

Having precious metals such as gold, silver, or platinum as a Plan B could be one of the best decisions for one’s financial health.