What is the Gold Spot Price and How is it Set?

The gold spot price refers to the current market price for one troy ounce of gold for immediate delivery or settlement.

For those new to the precious metal industry, a troy ounce weighs 31.1 grams and is 2.75 grams heavier than the more common avoirdupois (imperial) ounce. Mentions of ‘ounce’ or ‘oz’ within the precious metal market usually refer to the troy ounce.

If you are wondering how the gold price is set, we explain this and more about the gold price in this article.

What is the Gold Bid Price and the Gold Ask Price?

The spot price of gold comprises a gold bid price and a gold ask price that vary slightly.

As an investor planning to buy gold bullion, your physical gold purchase price is based on the dealer’s ‘ask’ price, which is higher than the ‘bid’ price. Conversely, when you want to sell your gold bullion, the dealer’s sell-back price is based on the ‘bid’ price.

However, the actual physical gold price displayed on a bullion dealer’s website would oftentimes include an added premium. We will discuss this matter further in this article.

Bid and ask prices are a common market mechanism also inherent in other asset markets such as stocks and non-precious metal commodities. The difference between the gold bid price and the gold ask price is called the bid-ask spread.

How is the Gold Spot Price Set?

Fluctuations in the gold spot price result from supply and demand mechanics in the gold market. Gold is the largest precious metal market internationally, with many buyers and sellers, all looking to profit from arbitrage opportunities or investment strategies.

The setting of the gold spot price happens as a result of the interplay of trading activity between the gold over-the-counter (OTC) market and the gold futures market. Arbitrage traders around the world monitor divergences between the gold spot and futures prices, motivated by profit opportunities by the price differential. This trading activity results in spot price discovery while keeping both prices aligned.

Needless to say, traders' decisions to buy or sell gold are influenced by geopolitical events and the performance of financial markets as well.

Major Gold Trading Markets That Impact Gold Prices

Arbitrage traders globally trade around the clock during active market trading hours across different time zones. The biggest gold markets in the world are the London OTC market, the COMEX in the United States, and the Shanghai Gold Exchange (SGE) & the Shanghai Futures Market (SHFE) in China. Gold price movements are greatly influenced by the trading activities of different gold investment products in these OTC markets and futures markets.

The London OTC Market

An over-the-counter (OTC) market refers to the direct or principal-to-principal dealing between traders outside of regulated exchanges. OTC trading is executed using phone calls or proprietary trading software.

The London OTC market, operated by the London Bullion Market Association (LBMA), has historically been the largest gold trading center, comprising 70% of global trading volumes, according to World Gold Council estimates. Due to its pre-eminence, it attracts global participants such as major bullion banks, large gold funds, and institutional investors.

The market trades exclusively in LBMA Good Delivery bars, 400 oz gold bars (and 1,000 oz silver bars), usually for settlement in London (loco London).

While physical gold bars change hands in the OTC market, most synthetic gold contracts are settled in cash without any movement in gold bullion.

As trades are settled, the bullion banks' trading desks update the spot price on a bulletin board. Other third-party price feed services then obtain the price data, producing a feed that can be accessed by other market participants, usually via a paid subscription.

COMEX (US futures market)

The futures market, or exchange, is the go-to place for precious metal refineries, mints, hedge funds, and bullion dealers to manage the risk of fluctuating gold prices when buying or selling gold.

These entities buy gold futures contracts meant for future delivery to hedge against the ebb and flow of the markets.

As mentioned before, arbitrage traders usually use the current (or nearest) gold futures prices to assess potential divergences from the OTC market’s gold price for arbitrage opportunities.

Traders in the COMEX

The US COMEX market, operated by CME Group, is by far the largest and most influential futures of all futures markets for gold in driving price discovery today. Similar to the London OTC market, the majority of gold contracts are settled in cash, with a small number resulting in physical delivery of bullion bars through its Exchange for Physical (EFP) market.

According to the World Gold Council, the COMEX trading volume has steadily increased during Asian market hours as well.

Shanghai Gold Exchange (SGE) & the Shanghai Futures Market (SHFE)

Despite being founded in 2002, later than the London market and COMEX, the Shanghai Gold Exchange (SGE) has become the largest physical spot exchange in the world, accounting for the highest volume of physical bullion deliveries.

Created with the goal of becoming the central hub for all Chinese gold trading activities, nearly all imported, recycled, and domestically mined gold is traded through the SGE. The Chinese gold exchange increased its global footprint as a price-setter with the launch of the Shanghai Gold Benchmark price in 2016.

According to the CME Group, Chinese gold prices are influenced by the COMEX futures market, the London bullion market, and local supply and demand factors. Chinese gold prices tend to have a premium to attract gold into the country.

Secondary Gold Trading Markets

Other secondary gold markets offering a range of spot trading facilities are present in Japan, Hong Kong, Singapore, India, and Dubai. However, they do not have the liquidity of the aforementioned major gold trading markets. Regardless, they continue to serve as important gold trading hubs for their respective regions.

How is the Gold Spot Price Different From the LBMA Gold Price?

The London Bullion Market Association (LBMA) is the international trade association for the gold and silver bullion market. Despite being headquartered in London, the LBMA has a global client base that includes gold-holding central banks, refiners, fabricators, and private sector investors.

The LBMA publishes the LBMA Gold Price, which serves as a central benchmark for the physical gold market. Unlike the spot price of gold, which is constantly changing, the LBMA Gold Price is set twice daily (at 10:30 and 15:00 London UK time) via an electronic auction hosted and operated by the ICE Benchmark Administration (IBA).

Auction participants are limited to a select list of accredited LBMA members, who are typically banks, trading firms, and precious metal wholesalers. Initial prices quoted during the auction are based on the current gold spot price before the auction’s price discovery process results in the two fixed gold prices daily.

Beyond being a trusted reference price for the gold industry, the LBMA Gold Price is also used by market participants to confirm larger gold transactions (e.g., central bank gold purchases) where constant price fluctuations, like that of the gold spot price, could result in significant trading losses should there be negotiation delays.

Why is the Physical Gold Price Different From the Gold Spot Price?

Retail investors buying physical gold and silver bars and coins may notice that the gold and silver spot prices differ from the actual price they pay for bullion. Why is this so?

As mentioned previously, the OTC and futures trading activity contributes to the spot price discovery. Both these markets are mainly paper gold markets where most trades are settled in cash instead of physical bullion. As the term suggests, paper trades do not result in actual movements of physical silver and gold in exchanges’ vaults. Rather, there are changes in the ownership of the precious metals.

Therefore, before a physical gold coin or bar can be placed in consumers’ hands, the gold must be delivered from exchanges, transported to a refinery or mint, processed into specific bullion products, and shipped to bullion dealers. Costs are accumulated throughout this supply chain and included in the physical bar or coin price, resulting in a markup above the spot price.

This markup is also frequently referred to as the ‘premium,’ and it can be expressed as a currency value or a percentage over the spot price.

Given the above costs, it is uncommon for gold and silver bullion to be sold at the spot price.

An Example of the Price Premium When Buying Gold and Silver

Here is an example showing how the price premium is expressed and displayed on Silver Bullion’s website.

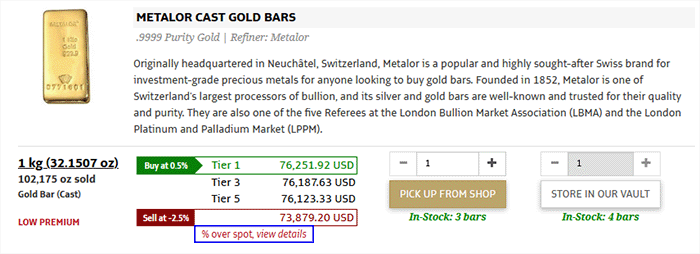

On the ‘Buy Gold Bars’ page, we have an example of the price of a 1-kilogram gold bar below.

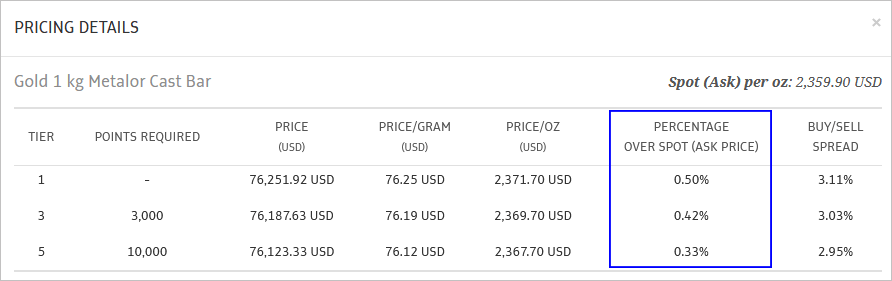

Clicking on the ‘% over spot, view details’ link displays the following table with further information on the gold bar.

The ‘Percentage over spot (ask price)’ column shows the gold bar’s price premium expressed as a percentage. In this case, it means that the gold bar is priced at USD 76,251.92, which is 0.5% over the spot price of gold.

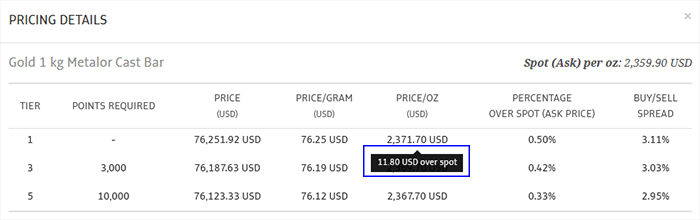

If you move your mouse over the price under the ‘Price/oz’ column, a tooltip appears under the 2,371.70 USD price, showing the price premium is 11.80 USD per troy ounce over the spot price of gold.

You can easily calculate the total price premium for the gold bar by multiplying 11.80 USD by 32.151 troy ounces, which is 379.38 USD.

This example of viewing the pre-calculated premiums on our website also applies to platinum and silver bars and coin prices on our website.

Why Are Spot Prices Different Between Precious Metal Dealers?

It is also common for precious metal dealers to display the spot price of gold on their websites. However, you may notice that the spot price is not the same across multiple precious metal dealers. Why is this so?

We mentioned earlier that precious metal dealers pay and obtain gold spot prices via feeds produced by data vendors. As with all market data, the lack of a uniform price is usually a result of different data sources, refresh frequencies, and server delays.

Regardless, given the continuous buying and selling of gold on global exchanges, spot gold prices from different data sources would not differ significantly, even with varying refresh rates and delays taken into account.

Why Do Bullion Dealers’ Prices Differ For the Same Product?

As bullion markets mature, it is increasingly common for bullion dealers to publish their buy and sell prices transparently on their websites. This allows consumers to compare prices across different precious metal dealers easily using their mobile devices or computers at home.

One of the common questions consumers new to the bullion industry ask is the difference in prices between bullion dealers for the same product.

There are many factors that could contribute to the price difference, ranging from varying supplier costs, spot price feed sources, and the dealers’ pricing strategies.

From our years of experience in the bullion industry, we advise customers to assess a precious metal dealer not just on pricing but also on its trustworthiness and business track record.

As it is increasingly common for precious metal orders to be submitted online, your choice of bullion dealer must ensure that your order’s details are captured accurately, that the bullion received is genuine, and that you are well-served throughout the transaction process.

Finding the Latest Spot Prices of Gold, Silver & Platinum

You can refer to Silver Bullion's price chart page for gold, silver, and platinum to find the latest spot prices (both bid and ask prices), which are updated every 2 to 3 minutes. In addition, our price charts below the page allow you to see the short and long-term price trends.