What is a Silver IRA?

A silver IRA is a type of Individual Retirement Account (IRA) that allows Americans to save for their retirement in a tax-advantaged manner. Unlike traditional IRAs that are limited to stocks and bonds, a silver IRA offers the unique advantage of including a tangible asset – silver – providing the opportunity to diversify retirement portfolios with gold, silver, or platinum. A silver IRA is a self-directed IRA and adheres to specific IRS regulations regarding the purity and storage of the silver, ensuring a secure and compliant investment approach for your retirement savings.

Benefits of a Silver IRA

#1 Wealth Protection

Gold and silver have played a major role in monetary history. They are the original money and are always cherished throughout history for their unique qualities as a medium of exchange, a store of wealth, and a unit of account.

Given that fiat currencies (paper money) are constantly depreciating, precious metals like gold and silver have withstood the test of time, and they protect wealth in times of crisis, high inflation, and even hyperinflation.

Unlike paper money, the value of gold and silver has never gone to zero. They are one of the most internationally recognizable and trusted safe-haven assets. This is why central banks around the world continue to have (and increase) gold holdings as a reserve asset.

#2 Liquidity

Physical precious metals like gold, silver, and platinum are highly liquid assets. Unlike diamonds, paintings, sculptures, and other collectibles, precious metals have a global transparent spot price that allows them to be bought and sold easily.

The value of your silver bars or coins is transparently published online, and they can be easily sold at a moment's notice to many precious metal dealers, like Silver Bullion. Like gold and platinum, selling physical silver bullion does not require complicated appraisals, apart from a quick test for their authenticity. Investment-grade silver bullion is often produced with a fixed purity and weight, which is why it can be valued easily.

#3 Investment Portfolio Diversification

Incorporating physical silver into a silver IRA presents a strategic approach to diversifying an investment portfolio beyond traditional paper assets such as stocks and bonds. This diversification is crucial because silver, as a tangible asset, often moves counter to the performance of the stock market, providing a buffer during periods of economic downturn or market volatility.

Moreover, unlike stocks and bonds, whose values are tied to the performance of companies or government entities and can be significantly impacted by economic policies and market sentiment, silver maintains intrinsic value due to its physical properties and wide range of industrial applications. In other words, the value of physical silver bullion has never gone to zero.

Having physical silver, gold, or platinum in a precious metals IRA stored securely outside of the financial system can insulate your wealth from a global financial crisis.

#4 Tax Advantages

Precious metal IRAs, like other types of Individual Retirement Accounts, offer significant tax advantages, making them an attractive option for investors looking to include precious metals in their retirement planning. These tax benefits are designed to encourage long-term investments and retirement savings, and they can substantially impact the growth of retirement funds over time.

#5 Potential Growth

With the world washed with money printing by central banks, saving in fiat currencies is a losing proposition, given that annual currency debasement is almost guaranteed. Inflation and higher costs of living are evidence that the purchasing power of money is falling. Physical gold and silver are some of the best safe-haven assets to own when money printing is the only solution central banks have for every economic problem.

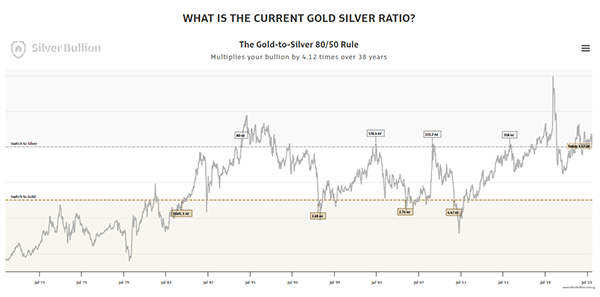

In particular, it is a good opportunity to purchase physical silver bullion, given the high gold-to-silver ratio, indicating that silver is currently undervalued compared to gold. When the gold silver ratio falls to under 40, like it has done several times in the last 30 years, there will be explosive gains in silver prices.

30-year Gold Silver Ratio Chart

Moreover, silver is in growing demand in various industrial applications, including electronics, solar panels, and medical technologies. This industrial demand can drive up the price of silver, potentially leading to capital appreciation.

Types of Silver IRAs

There are 3 types of silver IRAs for your consideration:

- Traditional silver IRAs: This account enables your contributions to accumulate with tax-deferred growth, indicating that taxes on your investment earnings are not due until you withdraw the funds during retirement. In 2023, the maximum allowable contribution is $6,500, increasing to $7,500 for individuals who are 50 years old or older. Should you choose to withdraw funds prior to reaching the age of 59 ½, they will be subject to a 10% penalty tax. Traditional silver IRAs suit individuals who expect their retirement income to be lower than their current income.

- Roth silver IRAs: A Roth IRA suits you if you expect a higher income in retirement. Taxes are paid initially on the contributions, and upon meeting certain conditions, withdrawals made during retirement are exempt from taxes. For 2023, the maximum contribution is set at $6,500, or $7,500 for individuals aged 50 and above.

- Simplified Employee Pension silver IRAs: Best-suited for the self-employed, the SEP silver IRA, which offers tax-deductible contributions, permits you to contribute either up to 25% of your earnings or $66,000 in 2023, depending on which of the two amounts is lesser. Like the traditional silver IRA, your funds will be subject to a 10% penalty tax should you choose to withdraw them prior to reaching the age of 59 ½.

What Silver Bullion Products Are IRA Approved?

You can buy all precious metal products (gold coins, gold bars, silver coins, silver bars, platinum coins, platinum bars) for your precious metals IRA, provided they have the following minimum purities – gold (99.5%)*, silver (99.9%), and platinum (99.95%).

*The only exception to the fineness criteria is the gold American Eagle bullion coins, which are allowed for a gold IRA despite having only 91.6% purity.

IRA-Approved Silver Coins

Here is a list of popular IRA-approved silver coins for your self-directed silver IRA:

- 1 troy ounce Canadian Maple Leaf silver coin

- 1 troy ounce American Eagle silver coin

- 1 troy ounce UK Britannia silver coin

- 1 troy ounce Austrian Philharmonic silver coin

- 1 troy ounce Australian Koala silver coin

- 1 troy ounce Mexican Libertad silver coin

- 1 troy ounce Chinese Panda silver coin

- 1 troy ounce South African Krugerrand silver coin

- Silver Morgan dollar

- Silver Peace dollar

- Sunshine Mint silver rounds

Chinese Silver Panda coins

IRA-Approved Silver Bars

Here is a list of popular IRA-approved silver bars for your self-directed silver IRA:

- Nadir Silver bars

- Royal Canadian Mint silver bars

- Perth Mint silver bars

- Metalor silver bars

- Heraeus silver bars

- Argor-Heraeuse silver bars

- Johnson Matthey silver bars

- Asahi silver bars

- Valcambi silver bars

- Sunshine Mint silver bars

- Golden State Mint silver bars

- Engelhard silver bars