WPIC: Platinum Demand to Benefit From Artificial Intelligence’s Rise

A March 2024 ‘60 Seconds in Platinum’ article from the World Platinum Investment Council (WPIC) reported that platinum demand is expected to increase in the coming years due to the growth of artificial intelligence (AI) applications.

The article, produced by leading precious metals consultancy Metals Focus, cited Bloomberg Intelligence’s 2023 Generative AI Growth Report, which shows that the generative artificial intelligence market is set to grow from a US $40 billion size to around US $1.3 trillion within the next ten years.

The proliferation of AI applications is expected to generate “strong global demand” for technologies supporting the AI market, namely, semiconductors – small electronic devices needed for AI’s voluminous data to be processed, transferred, and stored.

According to Gartner’s forecast in its 2Q23 update for ‘AI Semiconductors, Worldwide, 2021 – 2027,’ semiconductors revenue from the AI market could rise from around US $44 billion in 2022 to US $120 billion in 2027.

How Platinum is Used in Semiconductors

Platinum, a rare and precious metal known for its stability, corrosion resistance, and excellent conductivity, is a well-suited candidate for integrated circuit fabrication in the semiconductor industry for electronic devices.

The performance of the myriad of miniature transistors and capacitors embedded into an integrated circuit is enhanced by the deposition of thin platinum films onto semiconductor wafers. Platinum’s stability and excellent conductivity allow for efficient electron flow through these films within semiconductor devices.

These platinum films are created using a technology known as sputtering, where platinum particles are ejected and deposited onto a surface, creating a thin (only a few atomic or molecular layers thick) platinum layer.

How Platinum Will Benefit Artificial Intelligence Applications

According to the WPIC article, platinum thin films are also applied to sensors for a wide variety of uses. In the artificial intelligence field, AI models can be combined with sensors such as photocells, motion sensors, thermal cameras, ultrasonic sensors, and inductive sensors, reducing the quantities of data needed to train them.

Sensors manufactured with thin films are also widely used in the wearables market. Devices such as fitness and health trackers and smartwatches employ sensors for the continuous and non-invasive monitoring of health vitals such as blood pressure, heart rate, and glucose levels.

The AI market is using wearables and camera sensors to develop so-called “happy technology,” which attempts to determine an individual's mental state. They aim to allow AI to surmise feelings from a person’s expression, tone of voice, body temperature, pulse rate, and more. The information can be fed to AI systems that can assess people’s behavior, prompting a suitable response.

For example, camera sensors in cars can detect drivers’ attention levels based on their facial expressions and behaviors, sending timely warnings that may avert accidents. Sensors in wearables can also generate data on professional athletes’ state of mind to train them to better handle pressure during competitions.

Would it not be good if an air conditioner is able to adjust a room’s temperature and humidity automatically based on the occupants’ comfort levels when it detects their behaviors or body temperature?

Platinum thin film sensors are also key components for temperature mangement in electric vehicle batteries. Providing precise temperature measurement information to an EV’s central AI computer can improve the vehicle’s battery life by finetuning performance during a journey, allowing an electric motor to perform close to its limits.

Four Core Segments of Platinum Demand

Beyond artificial intelligence, the four core segments of platinum demand are automotive, industrial, jewelry, and investment.

Platinum Use in Automotive

With increasingly strict vehicle emissions regulations in most countries around the world, platinum’s central role in reducing vehicle emissions is increasingly important. Automotive demand for platinum is the largest demand segment, accounting for 30-44% of total platinum demand in the last five years.

Today, catalytic converters or autocatalysts are mandatory for road-legal automobiles. Platinum Group Metals (PGMs) are used as a coating in autocatalyst filter traps to burn off fine exhaust particulates, which are known causes of lung and cardiovascular disease.

Although platinum is mainly used in diesel vehicles’ catalytic converters and palladium is used principally in gasoline vehicles, the World Platinum Investment Council reports that this usage is shifting. They observed that platinum is increasingly substituting palladium in autocatalysts due to sustained palladium deficits and high palladium prices. WPIC also expects autocatalyst demand for platinum to grow “well into the decade, despite the ongoing electrification of transport.”

In addition, platinum is also widely used in the manufacturing of spark plugs, where platinum's durability and high melting point give platinum spark plugs an edge over conventional copper plugs. Spark plugs with platinum electrodes are found to last five times longer than the copper versions.

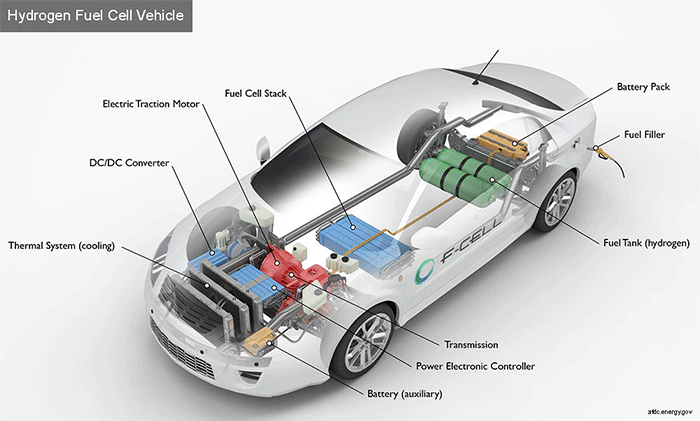

Platinum’s superior catalytic and conductive properties also make it an important component in fuel cell electric vehicle (FCEV) production. Unlike battery electric vehicles (BEVs), FCEVs require no charging and will run indefinitely when supplied with hydrogen. FCEVs also have quick refueling times while having the range of gasoline or diesel cars.

Platinum Use in Industrial Applications

Platinum catalysts are used to make nitric acid for fertilizers in the agrochemicals sector and to achieve a greater yield of high-octane fuel per barrel of oil in the petrochemical industry. WPIC estimates that the global nitric acid market is currently around US$22.3 billion and is forecast to reach US$27.5 billion by 2025.

Platinum is vital to the glass-making industry due to its high melting point, stability, and resistance to corrosion. It can withstand high temperatures without distortion or causing contamination. Platinum is also used to produce glass fiber and LED screens.

In the medical industry, platinum’s biocompatibility, inertness within the body, durability, electrical conductivity, and radiopacity make it an excellent component for a range of medical devices. They include pacemakers, catheters, stents, and implantable defibrillators. The discovery that platinum compounds can kill off cancer cells has also led to the introduction of platinum-based anti-cancer drugs and chemotherapy.

The hydrogen economy is a new end-use demand driver for platinum. As the world increasingly emphasizes decarbonization, platinum-based proton exchange membrane (PEM) technologies are expected to impact energy transition significantly.

PEM fuel cells have advantages over batteries in that they do not require recharging and will run indefinitely when supplied with hydrogen. In addition, they have characteristics of a battery – no moving parts, silent operation, and an electrochemical reaction to generate power.

Green hydrogen is increasingly seen as a suitable replacement for fossil fuels. It can be used in a myriad of applications, including as a sustainable aviation fuel, heating, powering FCEVs, and fertilizer and steel production.

Evidently, platinum's industrial demand growth is strong in entrenched traditional markets and forward-looking markets where technological innovations provide solutions to the future.

Platinum Use in Jewelry

Global annual platinum demand in jewelry has been between 23-30% over the last five years.

Platinum continues to be the choice for engagement rings for couples in the United States. Platinum jewelry is known for its durability, and its neutral color complements all skin types, making it an easy choice for brides and grooms.

The demand for platinum jewelry remains robust in markets like China and Japan, despite strong competition from gold jewelry.

While platinum’s denseness can be more difficult to work with than gold, its rigidity is preferred by jewelry makers for the ease of setting gemstones.

Platinum in Investment

Like gold and silver, physical platinum can be purchased in the form of bullion bars and coins for investment. Renowned international mints, like the Perth Mint and the Royal Canadian Mint, produce platinum bullion coins annually, including the popular Australian Kangaroo platinum coins and the Canadian Maple Leaf platinum coins.

Precious metal refineries like Heraeus, Valcambi, and Argor-Heraeus are also known for producing 99.95% pure platinum bars up to a weight of 1 kilogram. As platinum coins are often minted to a weight of one troy ounce only, larger platinum bars allow investors to buy platinum at a lower price premium.

Today, the investment landscape for platinum is diverse. Platinum Exchange Traded Funds (ETFs), together with gold and silver ETFs, are firmly established in markets. American and Australian investors can include platinum bullion products in their retirement savings plans. The People’s Bank of China has also reintroduced the platinum Chinese Panda coin to investors.

Precious metal firms are also introducing digital platinum investment platforms that offer fractional ownership of platinum. An example is Silver Bullion’s Platinum Grams product, which is fully allocated and can be purchased in increments of 0.01 grams of platinum with a small spread.

The Case for Platinum Investment

Between 2000 and 2008, platinum was more expensive than gold. This is not the case today.

The gold-platinum ratio is at an all-time high of 2.4 at the time of writing, signaling that platinum is significantly undervalued compared to gold.

Most of the world’s platinum comes from South African mines. Extracting platinum is no easy feat as it is rarely found in concentrated deposits. More often, platinum is mined as a byproduct of mining base metals such as nickel, copper, and chrome.

Unlike gold and silver, platinum is not known as a monetary metal, having not been used as currency for most of history. However, this is not necessarily a disadvantage. As mentioned above, platinum is widely used in industrial applications using new technologies for high future growth. With most platinum supplies used and not hoarded, unlike gold, the platinum market has already been experiencing annual deficits for the past few years. With platinum supplies unable to meet demand, we could see high platinum prices in the future to rebalance this supply-demand equation.

Without question, platinum as a precious metal, like gold and silver, ought to be on investors’ radars, and even more so in the current precious metal bull market.