Understanding Exter's Pyramid and Gold's Pivotal Role in Global Finance

In global finance, few concepts have captured money flow quite like Exter's Pyramid. Created by the economist John Exter, this pyramid serves as a visual masterpiece, illustrating the hierarchy and vulnerability of different asset classes in times of financial distress, and emphasizing gold's timeless significance in a world brimming with digital and ephemeral assets.

What is the Exter's Pyramid?

Exter’s Pyramid, a brainchild of economist John Exter, is a visual representation that categorizes assets based on their liquidity and risk. For more than a decade, the inverted pyramid has been a reliable guide for investors, particularly during financial turbulence. Ranking the assets in the inverted pyramid from the most liquid at the bottom to the least liquid at the top provides a roadmap to navigate the complex investment classes found in today's financial system.

The Pyramid becomes more than just a tool during economic downturns. It transforms into a crucial aid for financial professionals, facilitating a better understanding of their investments’ stability and assisting in the reallocation of assets to safer, more liquid options. Thus, the pyramid has become an essential part of the financial landscape, guiding investors through the ever-changing tides of the global markets.

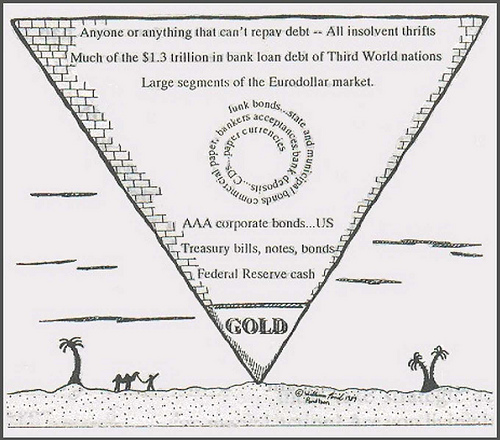

John Exter's original pyramid of assets

The Man Behind the Pyramid: John Exter

John Exter, the architect of the pyramid, was a man of many hats. A former member of the Federal Reserve, Exter’s career as a central banker spanned an array of roles, including serving as an advisor to the U.S. Secretary of the Treasury.

Highly sought after for his knowledge of the establishment of central banks, Exter was an adviser to the Secretary of Finance of the Philippines, and then to the Minister of Finance of Ceylon (now Sri Lanka) when the newly independent nation decided to replace the Currency Board System. Shortly after, he became the Central Bank of Ceylon's founding governor between 1950 and 1953.

John Exter

Then, Exter briefly joined the World Bank for a year before returning to serve in the US Federal Reserve System as Vice President of International Operations of the Federal Reserve Bank of New York, being in charge of gold and silver operations, until 1959.

Between 1960 and 1972, Exter was the Senior Vice President of First National City Bank, which later became Citibank, handling foreign central banks and governments.

Exter was a vocal critic of U.S. fiscal policy in the 1960s when the U.S. government was printing more dollars than country's the gold reserves could back. However, his warnings were mostly ignored. He was a vocal critic of unrestrained money printing, believing staunchly that lasting economic prosperity could not be attained by printing more dollars.

Foreseeing the avalanche of dollars flooding the world, Exter began buying gold coins in the 1960s, even to the point of having a 100% gold position in 1968. During that time, Americans were prohibited from owning gold with the exception of rare gold coins. Exter bought Gold Sovereigns, which were declared to be rare, at $35 an ounce.

In 1970, John Exter, alongside prominent economists including Henry Hazlitt, Jacques Rueff, and Robert Triffin, established the Committee for Monetary Research and Education (CMRE). Their collective concern centered on the potential downfall of the prevailing monetary system at the time, the Bretton Woods System. They were proven right in 1971 when President Nixon closed the gold window, severing the link between the dollar and gold and commencing the era of floating fiat currencies.

The 1971 Nixon Shock sent gold prices skyrocketing, making Exter a huge fortune for his gold coin hoard.

Exter’s contributions to economics were revolutionary, and he was called a "central banker for all times" by W A Wijewardena, a former deputy governor of the Central Bank of Sri Lanka. Exter's 'Report on the Establishment of a Central Bank for Ceylon', commonly referred to as the Exter Report, continues to be relied upon by modern central bankers and academics with regard to the rationale and operations of a central bank.

Motivation For Creating Exter's Pyramid

Born in 1910, John Exter witnessed the United States stock market crash of 1929 in his adulthood and lived through the Great Depression of the 1930s. His experience from this difficult economic period motivated him to study and understand the causes of the Great Depression.

Exter’s Pyramid was born out of a time of great economic uncertainty. Following World War II, Exter foresaw a deflationary depression in the US. He believed the Federal Reserve’s monetary tools would be inadequate to prevent it, leading him to create the Pyramid. His creation was a response to the credit-driven expansion he observed, providing a structured framework to manage financial risk, liquidity, and creditworthiness.

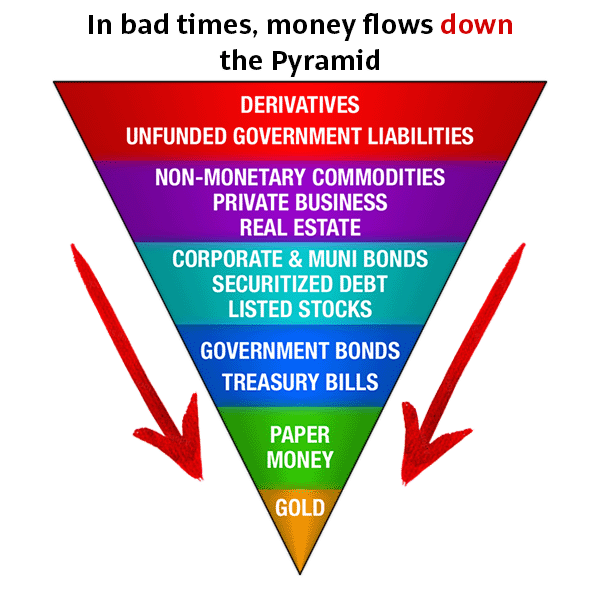

Understanding the Exter's Pyramid: Asset Classes and Their Positions

Exter’s Pyramid is layered with asset classes that are arranged according to their risk and liquidity, situating the safest and most liquid at the inverted pyramid's apex (at the bottom), while the riskiest and least liquid resides at the top.

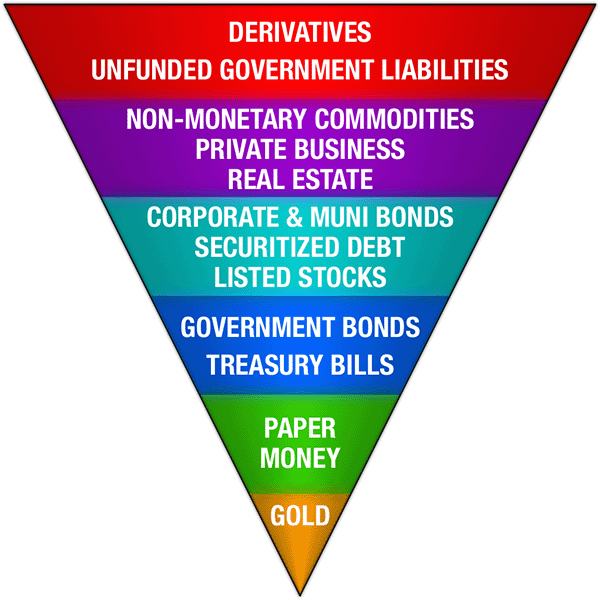

Given that international banking and the global financial system have evolved significantly since Exter's original pyramid was created, the Pyramid has been updated to reflect the asset classes of our current time.

Regardless, gold is still positioned at the inverted pyramid's apex due to its absence of counterparty risk and high liquidity. The riskiest and most illiquid assets, which John Exter referred to as "Anyone or anything that can't repay debt", are now derivatives and unfunded government liabilities occupying the highest position.

Modern revision of Exter's Pyramid

Gold: The Apex of Safety

Gold holds a unique position at the apex of Exter's Pyramid. Thanks to its historical role as money and also the go-to safe haven during economic and financial crises, it is deemed the safest asset. Gold’s timeless nature as a store of value, particularly in times of economic uncertainty or market volatility, cements its position as the most trusted asset in the financial system.

Cash: Paper Money and Currency

Just above gold on the pyramid, we find paper money or currencies layer - one of the more liquid and widely recognized forms of financial assets. They are government-issued fiat currencies and paper money, which are the most commonly used mediums for daily transactions and commerce, often deposited in bank savings accounts.

Unlike the assets lower in the pyramid, such as precious metals, fiat currencies and paper money are not backed by physical commodities; instead, their value is derived from the trust and credit of the issuing government. This layer is more susceptible to risks like inflation and currency devaluation, especially in economic crises, highlighting its less stable nature compared to precious metals.

Government Bonds and Treasury Bills

Government bonds are considered the next safest asset after fiat currencies. These financial instruments are essentially promises by the government to pay back borrowed funds with interest at a later date. This layer in the pyramid includes all government-issued debt securities, including treasury bills (short-term), notes (medium-term), and bonds (long-term).

While the interest rates of government bonds are not as attractive as those of other riskier assets, investors often flock to these securities as a safe haven, especially during periods of economic uncertainty or market volatility, due to their backing by the government's credit. This perceived safety stems from the assumption that the risk of a government defaulting on its debt is relatively low, especially in the case of stable, economically strong countries.

For example, the U.S. Treasury market is one of the world's largest and most liquid financial markets, with trillions of dollars in outstanding debt. This immense size is a reflection of the global confidence in the U.S. economy and the dollar's status as the world's primary reserve currency. Due to their perceived safety and liquidity, many countries hold U.S. Treasuries as part of their foreign exchange reserves. These bonds are seen as a secure investment because they are backed by the full faith and credit of the U.S. government

Additionally, the U.S. Treasury market's depth and liquidity mean that large amounts of these securities can be bought or sold quickly without significantly impacting their price, making them an attractive option for central banks and governments looking to manage their reserves efficiently and effectively.

Corporate & Municipal Debt, Securitized Debt, and Listed Stocks

Corporate debt includes bonds issued by companies, which can range from highly-rated, stable entities to high-yield, riskier ones.

Municipal debt, on the other hand, comprises bonds issued by local or state governments, often for infrastructure projects or other public services. These debt instruments carry risks related to the financial health and creditworthiness of the issuing entity.

Securitized debt, such as mortgage-backed securities (MBS) and asset-backed securities (ABS), adds another layer of complexity. These are pools of loans that have been packaged and sold as financial products, with their value and risk profile dependent on the performance of the underlying assets.

Listed stocks, representing ownership shares in publicly traded companies, are also part of this layer. Stocks are subject to market volatility and can be influenced by a myriad of factors, including corporate performance, economic conditions, and investor sentiment.

Non-monetary Commodities, Real Estate, and Private Businesses

Non-monetary commodities include physical goods like oil, agricultural products, and industrial metals considered essential for various industries and are meant to be consumed or used in production. Their values are often driven by supply and demand dynamics in the global market and are largely unaffected by government backing or corporate performance.

Real estate, encompassing residential, commercial, and industrial properties, forms another significant part of this layer in the pyramid. The value of real estate is influenced by factors such as location, economic conditions, and interest rates. It's often considered a stable investment, though it lacks the liquidity of financial securities and can be subject to market and regulatory risks.

Private businesses involve direct investment in privately held companies, ranging from small local businesses to large enterprises. Unlike publicly traded companies, these businesses are not subject to the same level of regulatory scrutiny and market volatility. However, they carry their own set of risks, including limited liquidity, reliance on the success of the business, and less transparency in operations and financial health. Investments in private businesses are typically characterized by a longer-term perspective and a higher threshold for risk and due diligence. They offer potential for significant returns, particularly if the business grows or the real estate market appreciates, but they also require a deeper understanding of the specific market and a higher tolerance for potential loss.

The Base: Derivatives and Unfunded Government Liabilities

At the base of Exter’s Pyramid, we find the riskiest assets: derivatives are financial contracts whose value is derived from the performance of an underlying asset, index, or interest rate. This category includes options, futures, forwards, and swaps. These instruments are often used for hedging risks or for speculative purposes. The complexity and leverage associated with derivatives can lead to substantial gains and significant losses, as their value can be extremely sensitive to changes in market conditions. The notional value of the derivatives market is immensely large, estimated at over $1 quadrillion, dwarfing the size of the physical markets they are based on, which can lead to systemic risks, as seen during the 2008 financial crisis.

Unfunded government liabilities, on the other hand, represent future payment obligations that do not have corresponding assets set aside to cover them. This includes pension obligations, social security, and other government-promised benefits. The concern with these liabilities is that they represent a significant and growing burden on government finances, potentially leading to fiscal instability if not managed properly. Unlike funded debt, which is backed by specific revenue streams or assets, unfunded liabilities are more nebulous and depend on the government's ability to meet these obligations through future taxation or other means.

This layer of the pyramid is often the most opaque and is the most sensitive to political and economic uncertainties.

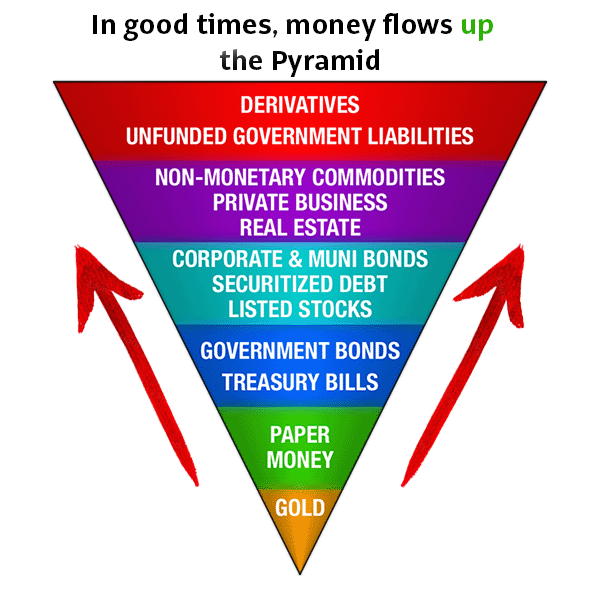

Money Movements in Good and Bad Times

Beyond the different asset class layers defined, the Exter's pyramid is a visual representation of the flow of money during both prosperous and challenging economic times. It shows how investors shift their preferences among various asset classes based on the prevailing economic conditions.

During Good Times, Money Flows Up the Exter's Pyramid

In times of economic prosperity, money tends to move up the pyramid towards riskier, higher-yielding assets like stocks, derivatives, and high-yield bonds. Investors, buoyed by optimism and a willingness to take on more risk, seek higher returns, leading to an influx of capital into these more speculative markets.

During Bad Times, Money Flows Down the Exter's Pyramid

Conversely, in times of economic downturn or uncertainty, the flow reverses, with money cascading down towards the base of the pyramid. This reversal can also be interpreted as the assets at the top of the inverted pyramid getting sold first when panic liquidation happens. Here, investors seek safety in more stable, lower-yielding assets like gold, cash, and government bonds, prioritizing capital preservation over high returns. This flight to quality or safety reflects a risk-off sentiment, where the primary concern shifts to protecting wealth rather than growing it.

The ‘flight to quality’ is a typical reaction to financial upheaval. As market conditions fluctuate, investors tend to reallocate their investments accordingly from riskier assets to those that are more secure and stable.

Historical market crises, such as when the stock market crashed, have shown a clear trend of investors reallocating their investments from stocks and derivatives to assets such as gold reserves and government bonds.

Lessons from Past Crises: Examples of Exter's Pyramid in Action

Past lessons frequently serve as the best guideposts for the future. During the 2008 financial crisis, which happened over a decade ago, there was a sharp decline in high-risk assets, and investors transitioned towards safer options such as cash and gold. This illustrated the ‘flight to quality’ phenomenon in response to the recognition of excessive risk within the financial system.

Historical crises such as the Dotcom bubble and the Great Depression have also shown capital flight, as illustrated by the Exter’s Pyramid.

Implementing Exter's Pyramid in Investment Strategies

Beyond its theoretical implications, Exter’s Pyramid has practical utility in shaping investment strategies. By emphasizing the significance of liquidity and providing a structured approach to asset allocation, the Pyramid assists in the development of a diverse and well-rounded strategic asset allocation.

Diversification is a key strategy in managing risk and achieving a balanced portfolio. By spreading investments across various types of assets or securities, investors can better mitigate the impact of market volatility.

The Pyramid is useful in improving portfolio diversification by offering a structured approach to allocating assets based on varying levels of risk and liquidity. This involves prioritizing highly liquid and low-risk assets like gold, cash, and government bonds at the foundation and gradually incorporating higher-risk assets such as stocks and real estate as one ascends.

Physical Precious Metals: One of the Safest Assets For Wealth Preservation

As illustrated by the Exter's Pyramid, physical gold and silver are among the safest assets to have in your investment portfolio. Gold, in particular with our modern global financial system, is still the bedrock of the monetary system. Physical silver and gold, stored securely in a safe jurisdiction, will allow your wealth to weather financial crises and currency failures.

Today, it is an observable global trend that the response of central banks to a financial crisis is almost always to print money. This practice is called different names - quantitative easing, debt monetization, or Modern Monetary Theory. Regardless, they involve debasing the purchasing power of each currency unit, causing you to buy less and less with currencies. This is also why the prices of goods are services are mostly going in one direction - up.

Before considering riskier investments, educating oneself about safer assets like physical gold and silver is important. They are easy to understand and can be added to your wealth portfolio quickly - you just need to buy a gold bar or silver bar from your local bullion dealer and store it safely.

Conclusion

Exter’s Pyramid provides a valuable framework for understanding the hierarchy of assets based on risk and liquidity. From its creation by John Exter to its application in today’s evolving financial landscape, the Pyramid continues to guide investors in managing risk and making informed investment decisions. It is also a reminder that gold (and silver) are one of the safest asset classes that you can add to your investment portfolio.