The Repeating Pattern of Screwing Over Dollar Holders

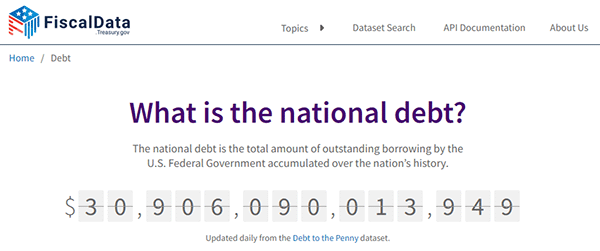

The US national debt stands at over $30.9 trillion USD today. It is the largest debt America has owed since its founding in 1776, and it continues to rise each year. As aptly described by The Department of the Treasury’s Fiscal Data website, “the national debt is similar to a person using a credit card for purchases and not paying off the full balance each month.”

Well, from this perspective, the US has a special credit card with seemingly no credit limit that continues to be accepted by merchants globally.

The national debt does not include the $162 trillion in unfunded liabilities from federal entitlement programs such as Medicare, Medicaid, and Social Security. The federal government has set aside $0 to cover these obligations.

In addition, the debts carried by state and local governments, as well as debts carried by individuals, such as credit card debt or mortgages, are not included in the national debt.

When debt reaches the realm of trillions, it becomes increasingly unfathomable. It takes more than 32,000 years to count to one trillion. Yet, the US has added $8 trillion in debt since 2020.

It is hard to ignore the fact that the US government has lost control of the nation’s debt situation.

With the debt continuing to rise to numbers increasingly unfathomable to the human mind, the elephant-in-the-room question is: How will this all end? While the truth is that none alive knows where this journey into uncharted waters will lead, history has many clues.

The Debt Will Not Be Repaid

It is almost certain that the US debt will not be repaid. There is little to no precedence of the US attempting to pay down its debt substantially since its inception. While there were periods where the debt shrank, it has moved mostly in one direction since - up.

It is also interesting that the US Treasury’s Fiscal Data website acknowledges the growing national debt, the country’s increasing inability to pay down its debt (debt to GDP), and the higher costs of maintaining the national debt given the recent interest rate rise.

Yet, there is no mention of how this debt can be paid down. The stark reality is that no one really has a clue as to how the repayment route is feasible.

There is, however, mention of a debt default scenario: “Since the United States has never defaulted on its obligations, the scope of the negative repercussions related to a default is unknown but would likely have catastrophic repercussions in the United States and in markets across the globe.”

If a default is understood as a failure to fulfill an obligation, the federal government has definitely defaulted before.

When the US Defaults on Obligations

Two sure-fire instances of default at the federal level happened in the twentieth century. The first was in 1933 when the United States intentionally defaulted on its debt, an action that was supported by both Congress and the Supreme Court. Back then, US bondholders had the option to be repaid in gold coins instead of paper currency. However, the Roosevelt administration wanted to depreciate the paper currency and thought the gold clauses contained in various bonds were an obstacle.

In the summer of 1933, Congress passed the “Joint Resolution to Assure Uniform Value to the Coins and Currencies of the United States” which retroactively rewrote contracts and voided the gold clauses in them. Bondholders were forced to accept the depreciated currency.

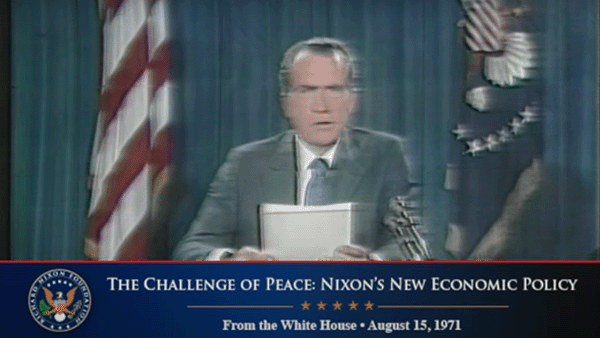

The second instance of a US default was the infamous closing of the gold window by President Nixon in 1971. In The Case For Gold, Ron Paul equated the severing of the dollar’s link to gold as “declaring international bankruptcy.” The US had reneged on an international agreement – the Bretton Woods Agreement, and stopped countries from obtaining gold in exchange for dollars.

The number of US defaults would be much higher if one considers the 78 times Congress has acted to raise the debt limit since 1960. If an existing debt limit had held with deficits continuing to increase, a US debt default would most certainly have occurred.

Dollar Holders Are Left With Consequences

In the abovementioned cases of US debt default, one aspect is certain – dollar holders were left to fend for themselves and face the impending consequences.

Following the 1933 default, the government price of gold was increased from $20.67 to $35 per ounce in 1934, effectively depreciating the dollar by 69% for all holders of US bonds and currency. If you held US bonds then, you could only be paid in depreciated dollars.

The $35 per ounce price was held under the Bretton Woods System until the 1971 default, an event also known as the Nixon Shock – aptly named to describe the world’s reaction to US action. Under the Bretton Woods System, currencies were pegged to the dollar and the dollar was pegged to the price of gold.

Countries could convert their trade-accumulated dollars into gold and the dollar was thought to be “as good as gold.”

However, rising US balance of payments deficits due to US inflation, funding of the Vietnam War, and President Lyndon Johnson’s Great Society program caused the world to realize that the dollar had clearly become overvalued, and gold was undervalued.

While global central banks refrained from redeeming gold for dollars due to immense US pressure, private citizens rushed to exchange their dollars for gold. This caused gold to leave the US reserves.

In 1968, the US eventually stopped the redemption of privately held dollars for gold at the $35 rate. It was made available only to central banks. Once again, dollar holders were left to their own devices with overvalued notes. Unable to exchange dollars for gold, many sold their dollars for stronger currencies, such as the Swiss franc, the German mark, and the Japanese yen.

This flight into stronger currencies led to dollars pouring into countries, and the central banks were forced to buy these dollars in mounting volume. Defending an exchange rate is a costly affair as reserves are used to buy up the incoming dollars.

The German central bank was the first to throw in the towel in defending the mark. It withdrew from the market, choosing to let the mark float. With the mark devalued, Germany’s neighbors became the next targets for now-homeless dollars flooding in. The central banks of Switzerland, the Netherlands, Belgium, and Austria soon set their currencies afloat, choosing to devalue them as the first response.

However, there is a limit to the number of dollars these foreign countries can accumulate. By May 1971, central banks began to redeem their accumulated dollars for US gold. Rumors spread among central banks that the untenable situation of a confidence-losing dollar would lead to the shutting of the gold window. The Bank of England was also rumored to be ready to redeem dollars for large quantities of gold.

Faced with the stark reality of more gold leaking out of its reserves, the US made the decision to overrule and stop foreign central banks’ right to convert dollars for gold on 15 August 1971. There was no solution to the game of unending US deficits, other than to renege on promises to dollar holders. It was clear the game was indeed over.

The Pattern Of Screwing Over Dollar Holders

It should be clear by now, with the past US defaults, that dollar holders are of the least concern to the ‘managers’ of the currency. Regardless if they were private individuals or central banks who were allies, dollar holders are but creditors holding a promise of payment. In every instance where the US financial dynamics became untenable, the easy solution had been consistently to screw dollar holders through inflation or defaults. These defaults were often shocking because they were sudden – often without any warning.

If one understood such events in history, we would understand why Ray Dalio, founder of the world’s largest hedge fund, believes that “cash is trash” – a guaranteed loser, especially with the world now facing runaway inflation.

The US debt will not be repaid. It will only be inflated away with hyperinflation or defaulted upon. Either way, holders of currencies will experience a lot of pain and a loss of wealth. This is not something new – it has happened before and will happen again. There is nothing new under the sun.

A 1966 essay written by Alan Greenspan, former Chairman of the Federal Reserve, noted that “in the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value.”

Gold and silver are highly liquid assets the world runs to during financial panics throughout history. They are independent of nations’ flags, religion, and political beliefs. Gold and silver are universally accepted safe stores of value that never change their nature – they are sound money.