|

Dear Subscriber

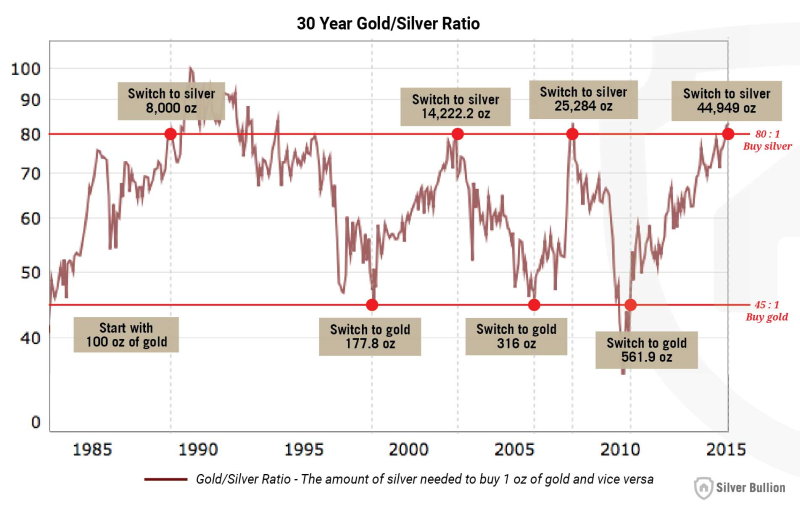

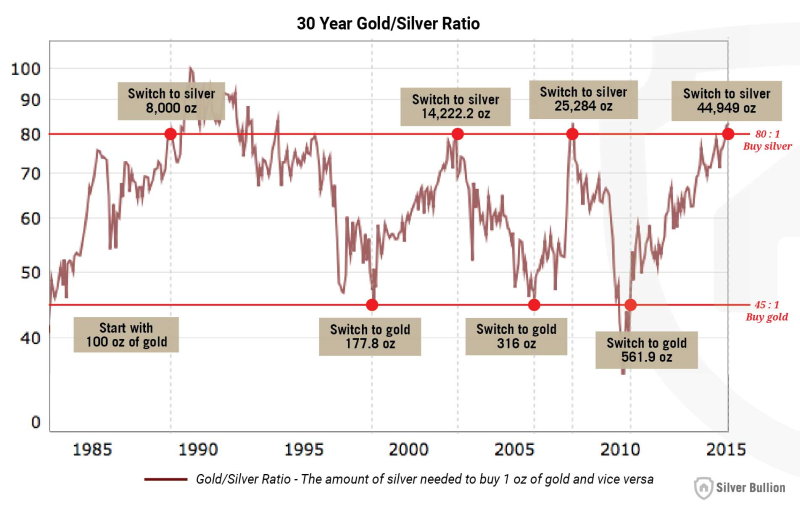

As we write this, an ounce of gold will buy you about 82 ounces of silver, however just 5 years ago the same ounce of gold would only have bought 40 ounces and yet, 3 years prior in 2008, an ounce of gold would have bought you 80 ounces of silver, just as it is today.

The number of ounces of silver it takes to buy an ounce of gold is called the "Gold-Silver Ratio" and this ratio has been swinging back and forth between 45 and 80 consistently over the last 30 years as we illustrate in the chart below. A simple gold/silver switching rule, applied over these years, would have easily increased your gold /or silver ounce holdings five to six fold.

In this newsletter we explore how this would have worked and why the ratio right now makes a strong case to switch your gold into silver until the ratio falls again, allowing you to a gain more gold ounces when switching back into gold. As this strategy is becoming more popular among clients Bloomberg has interviewed us on this very subject, see Why Poor Man's Gold May Be About to Get More Investor Love.

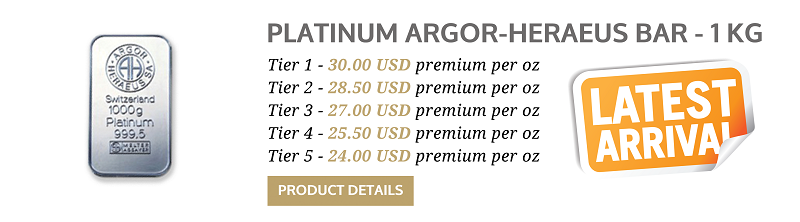

To support the increasing number of customers who wish to make such a switch, until the end of March, we will pay more for gold sold to us, while offering excellent prices on our featured silver and platinum bullion products. We will buy gold maple leaf coins for example, the most popular gold coin in Singapore, at around half a percent above the gold spot price.

In other news:

- The Safe House's insurance coverage was increased to 200 million SGD per incident starting this month

- Next month, we will be introducing a one month secured peer-to-peer loan contract

| The Gold to Silver Ratio Rule, Buy Low, Sell High |

|

Throughout most of our history, silver and gold were interchangeable at a ratio of 15 to 1. One gold coin would be equivalent to 15 silver coins of the same mass. This ratio roughly mirrored the natural occurrence of gold and silver as mined from the earth.

It was only in the 20th century with the widespread introduction of fiat currencies and the abandoning of silver as a currency backing, that this ratio skyrocketed and started to fluctuate dramatically. Throughout the 20th century the gold to silver ratio averaged 47 and spiked at an all-time high of over 100 in 1991.

For the last 30 years the ratio has consistently ping-ponged within a wide range, characterized by rough lows of 40 to 45 and rough highs of 80 to 85. A simple strategy of buying gold for silver at the 45 ratio and swapping silver for gold at 80 would have resulted in a 100 ounces of gold to become 562 ounces in 30 years, resulting in a 665,000 USD worth of gold rather than 122,000 USD in 2016.

The 45 and 80 gold to silver ratio (GSR) rule would have required just 7 transactions over 30 years, so it is neither difficult nor expensive to implement. There is no need to time trades to a given day or try to guess tops or bottoms... simply buy gold when it is cheap relative to silver (around 45), wait, and a few years later buy silver when it is cheap relative to gold (around 80).

- Start with 100 oz of gold.

- In late 1989 when the ratio is at 80, convert the 100 oz of gold to 8,000 oz of silver.

- In mid 1998 when the ratio is at 45, convert 8,000 oz of silver to 177.8 oz of gold.

- In late 2003 when the ratio is at 80, convert 177.8 oz of gold to 14,222 oz of silver.

- In mid 2006 when the ratio is at 45, convert 14,222 oz of silver to 316 z of gold.

- In late 2008 when the ratio is at 80, convert 316 oz of gold to 25,284 oz of silver.

- In mid 2011 when the ratio is at 45, convert 25,284 oz of silver to 561.9 oz of gold.

- In early 2016 when the ratio is around 80, convert 561.9 oz of gold to 44,949 oz of silver.

Read the full article...

|

|