The Gold to Silver Ratio Rule, Buy Low, Sell High

|

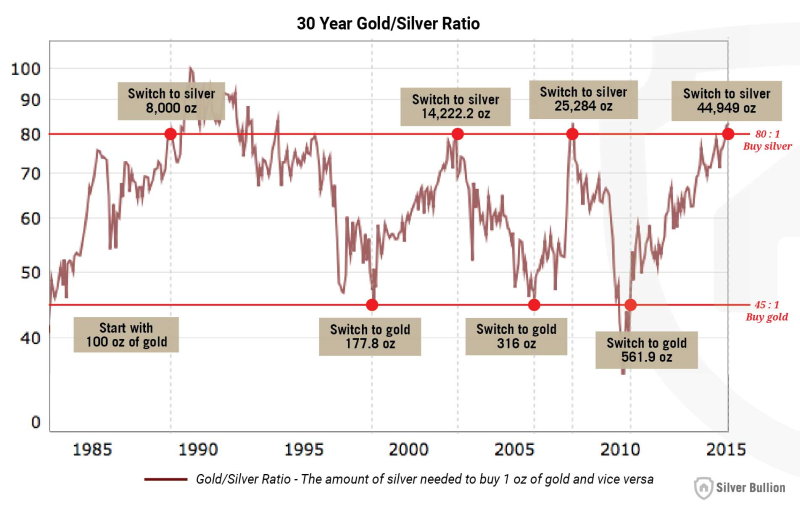

Throughout most of our history, silver and gold were interchangeable at a ratio of 15 to 1. The value of a gold ounce would be equivalent to 15 silver ounces. This ratio roughly mirrored the natural occurrence of silver to gold as mined from the earth. It was only in the 20th century with the widespread introduction of fiat currencies and the abandoning of silver as backing for currency, that this ratio skyrocketed and started to fluctuate dramatically. Throughout the 20th century the gold to silver ratio averaged 47 and spiked to an all-time high of over 100 in 1991. For the last 30 years the ratio has consistently ping-ponged within a wide range, characterized by rough lows of 40 to 45 and rough highs of 80 to 85. A simple strategy of converting silver ounces to gold when the ratio was 45 and swapping those silver ounces for gold at 80 would have resulted in 100 ounces of gold to become 562 ounces in 30 years. Yes, 665,000 USD worth of gold rather than 122,000 USD. The 45 and 80 gold to silver ratio (GSR) rule would have required just 7 transactions in the last 30 years, so it is neither difficult nor expensive to implement. There is no need to time trades to a given day or try to guess tops or bottoms... simply buy gold when it is cheap relative to silver (around 45), wait, and a few years later buy silver when it is cheap relative to gold (around 80). Example:

At the time of writing the gold to silver ratio is over 82 and silver is nearing a 21 year low in terms of gold (see chart). So regardless whether precious metals will fall or raise in the near term the likely hood that silver will outperform gold is historically very high over the next few years. An increasing number of customer already switched from gold into silver or prioritized silver purchases over gold, as they wait for the ratio to fall and eventually switch back to gold. A similar argument to be made for platinum, which used to be valued at twice the price of gold but is currently selling at prices 25% below gold. There are no get rich quick schemes, but sometimes wealth just seems to lie on the street, waiting to be picked up by a patient buyer. This may well be one of those times. As this strategy is becoming more popular Bloomberg has interviewed us on this very subject, see Why Poor Man's Gold May Be About to Get More Investor Love. By Gregor Gregersen |