Singapore Now Has the Largest Gold Reserves in Southeast Asia

The World Gold Council’s recently released data showed that Singapore now has the largest gold reserves in Southeast Asia, edging out Thailand for the top spot. The city-state added 6.57 metric tons of gold to its reserves in Q1 2024.

With its latest gold acquisition, Singapore has achieved a historic milestone. It now ranks 22nd globally in terms of gold reserves, marking its highest ranking since gaining independence in 1965. Singapore's gold reserves now stand at 236.60 metric tons.

However, Singapore’s gold purchase in the first quarter of 2024 was significantly less than in the same quarter of 2023, when it was the largest gold buyer globally, with 68.68 metric tons of gold added to Singapore's gold holdings.

The Monetary Authority of Singapore (MAS), Singapore’s central bank, was also the only developed market bank to add to its national gold reserves in Q1 2024.

South East Asia Gold Reserves Ranking (Q1 2024)

World Gold Council (WCG) data also showed that Singapore was the only Southeast Asian nation to buy gold in Q1 2024. Second-placed Thailand’s gold reserves fell to 9.64 metric tons in the same timeframe, while the rest of the Southeast Asian countries’ gold holdings remained unchanged.

However, it should be noted that Thailand’s reduction in gold holdings was not due to a gold sale but a “report adjustment” by the Bank of Thailand to follow the International Monetary Fund (IMF) practice of reporting only gold with a purity of at least 99.95% under International Reserves.

South East Asian Countries Gold Reserves

- Singapore (236.60t)

- Thailand (234.52t)

- Philippines (159.05t)

- Indonesia (78.57t)

- Cambodia (42.49t)

- Malaysia (38.88t)

- Myanmar (7.27t)

- Lao (0.88t)

- Vietnam (data not available)

- Brunei (data not available)

Central Banks Drive First Quarter Gold Rush

The World Gold Council’s Q1 2024 Gold Demand Trends report observed that “Q1 saw no let-up in the pace of central bank gold buying.” Central bank net gold demand totaled 290 metric tons, exceeding the 228 metric tons purchased in the same quarter last year. According to The World Gold Council, this is “the strongest start to any year on record.”

The 290t net increase in global gold reserves in Q1 was the highest in the WCG data series since 2000 and is 69% higher than the five-year quarterly average of 171t.

Central banks registered above 1,000-metric-ton annual gold purchases in 2022 and 2023, marked increases since they became perennial net gold buyers in 2010. The WCG noted that central bank gold buying in 2024 had a strong start, and “voracious buying” continued even with gold prices reaching record levels.

Countries That Bought the Most Gold in Q1 2024

#1 Turkey (30.12 metric tons)

A net seller of gold in 2023, the Central Bank of Turkey became the largest gold buyer in Q1, with 30.12t purchased. The WCG noted that Turkey has now bought gold for ten consecutive months, raising its total gold reserves to 570.30t.

#2 China (27.06 metric tons)

The People’s Bank of China (PBoC) added 27.06t to its official gold reserves in the first quarter of 2024, marking its 17th consecutive monthly increase. With 2,262.45t in total gold reserves, China has the sixth largest gold reserves in the world.

#3 India (18.51 metric tons)

The Reserve Bank of India (RBI) purchased 18.51t in Q1 2024, surpassing its entire 2023 gold purchase of 16.22t. India’s 822.09t in total gold reserves, ranked 9th in the world, is a new all-time high for the world's most populous country.

#4 Kazakhstan (16.39 metric tons)

Kazakhstan was the largest net seller of gold in 2023, with 57.43t sold. The country’s 16.39t purchase in the first quarter of 2024 moved it up a spot above the United Kingdom to have the 17th largest gold reserves in the world.

#5 Singapore (6.57 metric tons)

Singapore bought the most gold among nations in Q1 2023, adding 68.68t to its gold reserves. While the country’s Q1 2024 gold purchase was significantly smaller quarter on quarter, the 6.57t purchased raised its total gold reserves to 236.60t, the highest since its independence. Singapore also now has the largest gold reserves among Southeast Asia countries.

Countries With the Largest Decreases in Gold Reserves in Q1 2024

#1 Uzbekistan (-13.69 metric tons)

Uzbekistan was a net seller of gold in 2023, having reduced its gold reserves by 24.57 metric tons. Gold is a top export for the country, the twelfth-largest gold producer in the world. In the first quarter of 2024, Uzbekistan gold exports surged by 10.5% year-on-year, reaching $2.66 billion.

#2 Thailand (-9.64 metric tons)

Thailand’s official gold reserves fell by 9.64 metric tons. It was the first decrease since 2021. However, this decline was not a result of gold sale but an adjustment to follow the International Monetary Fund definition where only gold with at least 99.95% purity should be recorded.

#3 Jordan (-4.51 metric tons)

The Central Bank of Jordan was the third-largest gold seller in Q1 2024, having sold 4.51t – erasing the net 2.36t purchased in 2023.

#4 Germany (-0.34 metric tons)

Despite reducing 0.34t from its official gold reserves in Q1 2024, Germany remained the country with the second-largest gold reserves in the world.

#5 Suriname (-0.24 metric tons)

Suriname’s first quarter 2024 gold reserves reduction by 0.24t was the first since 2020.

Top 5 Reasons Why Central Banks Are Buying Gold

According to the World Gold Council’s 2023 Central Bank Gold Reserves (CBGR) survey, 24% of central bank respondents intend to increase their gold reserves in the next twelve months. Central bank gold buying data from Q1 2024 has confirmed central banks’ continuing voracious appetite to accumulate gold.

The CBGR survey further polled respondents on the motivations for central banks to hold gold. Here are the top 5 reasons given.

#1 Historical position

Since 2020, citing gold’s ‘historical position’ has been among the respondents’ top two choices. This likely refers to gold’s historical role as money in the international monetary system.

Whether it was the Classical Gold Standard or the Gold Exchange Standard of the Bretton Woods System, a country’s money supply was linked to gold. The ability to convert fiat money into physical gold restricted the amount of fiat currency created. Fiat currency was a claim on the asset of value - gold.

In addition, the international gold market is deep and highly liquid, with trading volumes averaging approximately US$163 billion per day in 2023, edging out trading volumes of US T-Bills and the Euro-Sterling forex markets.

The unanimous recognition of gold’s historical position by central bankers hints at a growing distrust of the Dollar Standard, and a growing yearning for the trustworthiness of gold as a reserve asset.

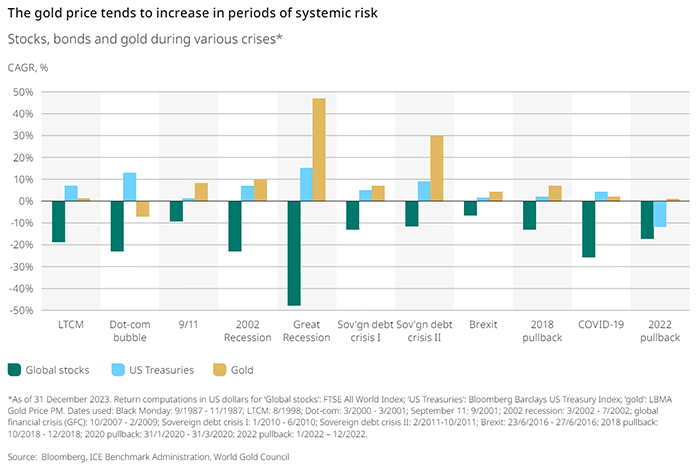

#2 Performance during times of crisis

World Gold Council research also showed that gold prices tend to increase during periods of systemic risks, delivering positive returns and reducing overall portfolio losses.

Furthermore, gold also performs well with equities and other risk assets in the recovery periods following a systemic selloff, making it a well-rounded hedge.

#3 Long-term store of value / inflation hedge

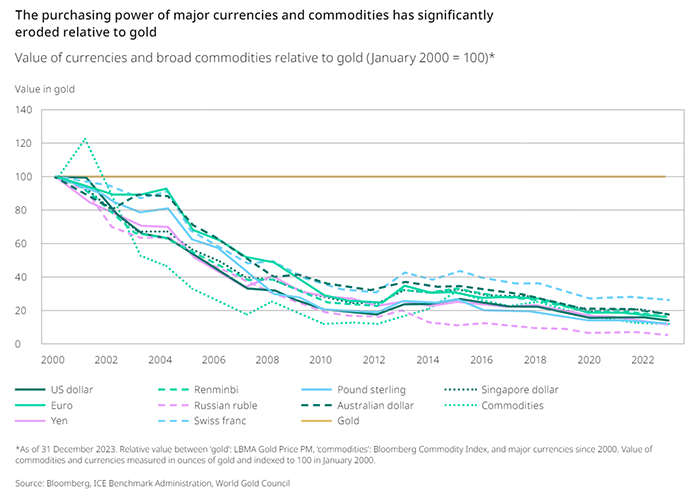

Fiat money printed in unlimited quantities in support of monetary policy ultimately results in inflation, where the purchasing power of each currency unit is debased. The aftermaths of the 2008 Global Financial Crisis and the COVID-19 pandemic were examples of the inflationary effects of central bank quantitative easing measures.

World Gold Council research shows that gold has significantly outperformed all major currencies and commodities as a means of exchange, attesting to gold’s role as an effective long-term store of value.

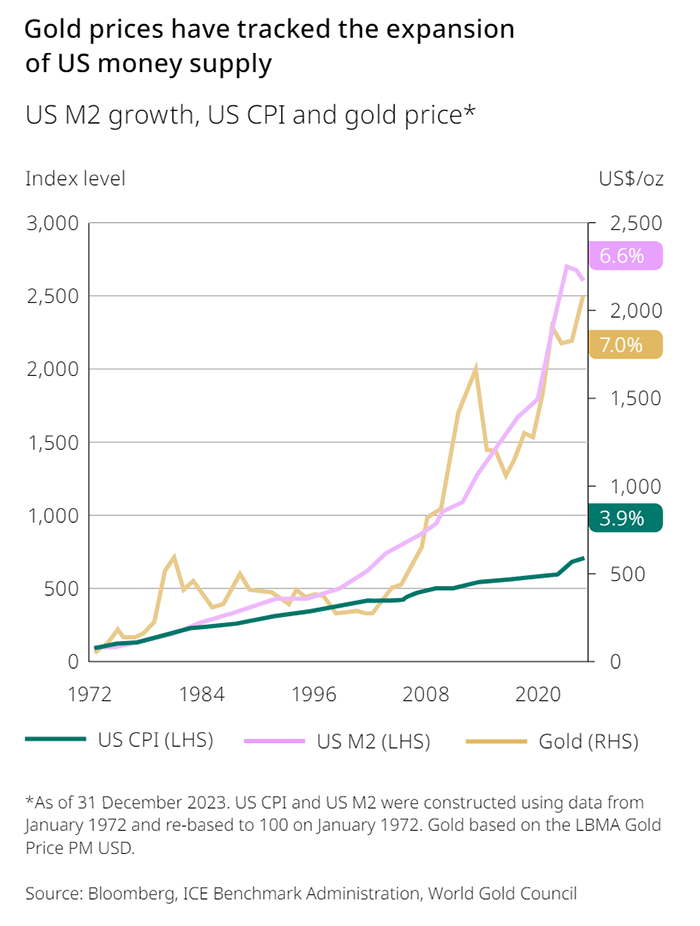

The WCG chart below shows the gold price tracking the US M2 money supply growth since 1972. As more US dollars are circulated, the gold price rises to account for additional dollars in the money supply.

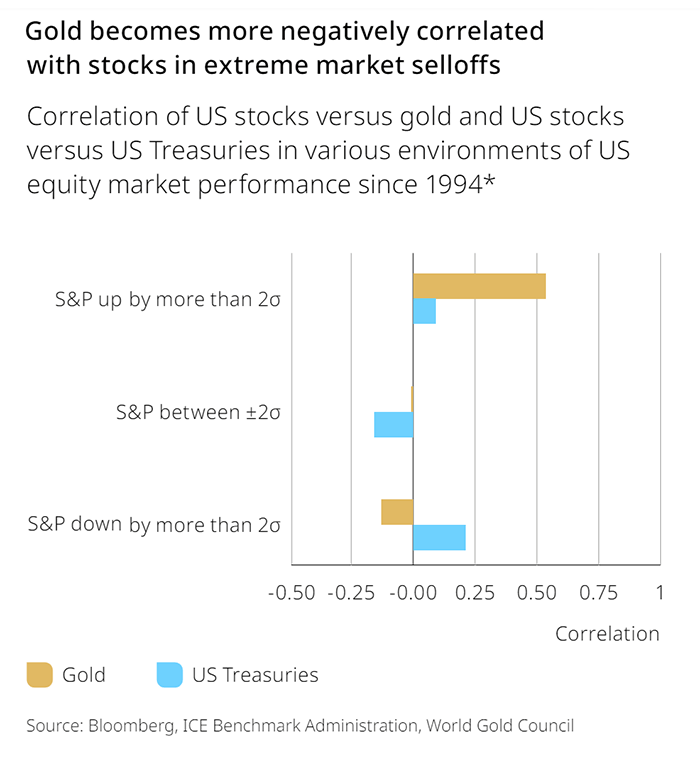

#4 Effective portfolio diversifier

Portfolio diversification is a common investment and asset management strategy to manage risk exposure from different asset classes, helping to minimize overall portfolio losses.

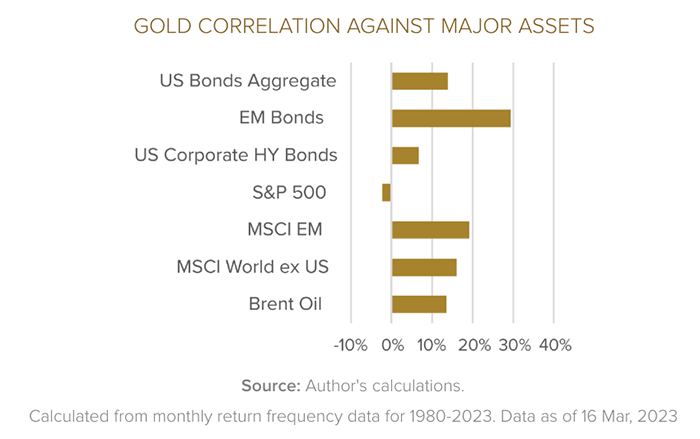

WCG research has shown that gold and US stocks are slightly negatively correlated when the Standard & Poor’s (S&P) 500 weekly returns are between two standard deviations. The negative correlation increases when the S&P 500 weekly returns fall by more than two standard deviations.

The World Bank’s 2024 Gold Investing Handbook for Asset Managers found gold to be a “valuable countercyclical asset in a portfolio” as it “has very little to no correlation with other major asset classes.” Furthermore, World Bank research showed gold’s correlation against other major asset classes averaged below 30 percent and was even negative against the S&P 500 since 1980. Therefore, gold is an excellent portfolio diversifier.

With the United States and its allies freezing over US$300 billion in Russian foreign exchange reserves, central banks are also increasingly aware of the potential for the dollar to be weaponized.

While the US dollar remains useful as the world’s reserve currency, countries with dollar reserves now realize they face potential dollar reserves confiscation risk should they disagree with the United States. The dollar has become less safe.

Gold has always been the bedrock of monetary systems, as illustrated by the Exter’s Pyramid. The yellow metal flies no countries’ flags, nor can it be controlled by the SWIFT banking system. Increasing gold allocation in a country’s reserves has become a proposition worthy of serious consideration.

#5 No default risk

Owning physical gold, such as gold bars or gold coins, is a natural diversifier from paper or digital assets since it does not have credit or counterparty risks and cannot be defaulted upon.

Gold stored outside the financial system is unaffected by a potential economic collapse or banking crisis. Wealth invested in gold bullion can, therefore, survive the worst of economic crises. Unlike fiat money, which is always a promissory note of the issuing country, gold is not a promise to pay but is wealth itself.

It is no wonder we have witnessed the biggest central bank purchases and gold accumulation despite escalating gold prices in recent years as confidence in fiat currencies waned.

Conclusion

Following the 2008 Global Financial Crisis and the resulting Eurozone Crisis, central banks became net buyers of gold in 2010. The trust in fiat currencies was noticeably weakened as the world witnessed the ease at which fiat money could be created to monetize debt.

While central bankers cooperated and embarked on the money printing solution to cure ailing economies, they also realized it was the only solution. Given that true prosperity can never be achieved by printing money, central banks have begun buying gold voraciously, silently nodding to gold’s historical position as money and the ultimate neutral asset.

As the loss of trust in the Dollar Standard increases, potentially leading to its end, a new recognition of gold’s value is increasingly becoming mainstream.

The rising Singapore gold reserves show the city state's determination to quietly allocate more to gold, the world's most trusted neutral asset. This is part of a trend where central banks are increasingly favoring adding gold to their crucial reserve assets worldwide.