Silver's Undervaluation: A Precious Metal in High Demand That Is Growing Scarcer

At the Asia Pacific Precious Metals Conference (APPMC) last week, I was intrigued by unofficial chatter about upcoming silver scarcities due to rapidly growing photovoltaic demand.

After discussing this with trade journalists and industry insiders and conducting my own research, I realized that the upcoming photovoltaic silver demand might well be, short of a USD currency crisis, the major catalyst to push silver into triple-digit valuations.

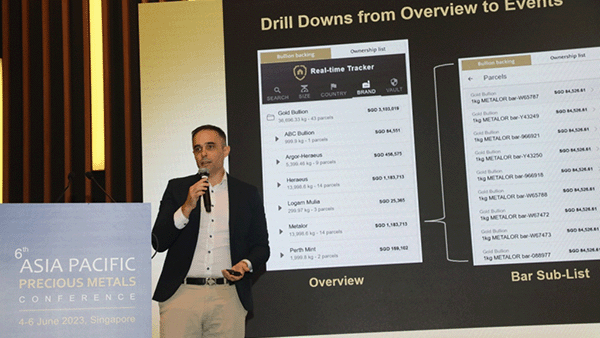

Gregor Gregersen speaking at the 2023 Asia Pacific Precious Metals Conference

Current Silver Supply and Demand

According to the Silver Institute’s 2023 World Silver Survey, silver supply was 1,005 million troy ounces (Moz) of which 81.8% were newly mined while most of the rest were recycled. Demand was 1,242 million troy ounces, which caused a 237 million troy ounce physical shortage. The shortage was mostly covered by silver withdrawals from existing exchange traded product (ETP) inventories.

Silver mine production is lower today than it was a decade ago due to a lack of investments, and production cannot be materially increased over the short term as it can take over 10 years to commence new mining operations. Therefore, increased silver prices will not lead to increased mine production for a long time.

On the industrial demand side, silver is used in minute quantities and is difficult and expensive to replace due to its unique characteristics. Thus, increased silver prices will not lower industrial demand substantially over the short to medium term. In this context, the upcoming photovoltaic growth is particularly exciting to silver owners.

Photovoltaic Production is Surging

Increased efficiencies, falling costs, power generation on-shoring, and environmental policies are greatly increasing solar panel demand. The International Energy Association (IEA) predicts solar investment to exceed the oil production investment in 2023, with over 1 billion USD per day being invested in photovoltaics.

Solar panel production was limited in 2022 by a scarcity of polysilicon, but by 2023 so much supply of polysilicon has come online that there is now an overabundance, causing panel input prices to fall and production to surge. 350 GW of new panel installations, a 50% increase from 2022, now seems achievable in 2023. For practical measurements, 1 GW (gigawatt) is sufficient to power about 100,000 homes. The improvements and benefits in photovoltaics are also why we have also planned for over 250 kW of solar panels for The Reserve, our upcoming 180,000 sqft vaulting facility.

Usage of Silver per Panel Is No Longer Falling but Rising

While solar panel growth over the past decade has been strong, the amount of silver used per panel was reduced by around 80% during this period, reducing the associated silver demand. However, it is increasingly difficult to decrease silver usage further – below 80 mg per cell - and new solar technologies (such as TOPCon / HJT) are now likely to reverse this trend, requiring 30% to 80% more silver.

While requiring more silver (104 to 124 mg per cell), TOPCon solar panels can reuse most existing production lines while being more efficient, degrade less over time, and are better performing in hot climates and low light conditions. These advantages make them substantially more competitive despite the higher silver content.

Copper is a Risky Substitute

Over the past decade, companies that launched solar panels using cheaper copper interconnects, found that the copper paste used to replace silver would loosen over time and oxidize, rapidly shortening panel life. Given that modern solar panels usually come with 25-year warranties, most solar panel producers are hesitant to use copper as it could lead to massive warranty claims in the future.

Implications for Industry and Silver Markets

A cell optimized to use as little silver as possible requires 80 mg of silver, while modern (TOPCon / HJT) cells require 104 to 144 mg. A cell tends to produce an average of around 5 watts of electricity. TOPCon is expected to become the mainstream technology within 3 years.

The industry’s production ramp-up continues to exceed prior expectations and 350 GW in panel installations now seems realistic for 2023. This would translate to at least 70 billion cells manufactured in 2023. Assuming 80 mg per cell, this would result in 180 million ounces of silver needed. If the amount of silver increases to 100 mg per cell, we would require 224 million ounces of silver.

According to the IEA global manufacturing capacity of solar PV, which precedes installations, is projected to reach nearly 1,000 GW by 2024. Such a jump in capacity will set a very fast solar panel production and installation growth for the foreseeable future.

The Looming Physical Silver Shortages

As solar panel production is increasing at astonishing rates and the switch to silver-rich TOPCon or HJT panels continues, we can expect an ongoing surge of physical silver demand from the photovoltaics industry.

This demand cannot be satisfied by financial derivatives, nor can it be the kind of unallocated silver which are often sold without substantial backing for investors. Photovoltaic demand is poised to drain global physical reserves of silver.

Should the 2024 production capacity reach 1,000 GW as predicted by IEA, the required photovoltaic silver demand would likely surpass 500 million troy ounces of silver by mid-decade. It is very unlikely that such demand could be satisfied without drastically higher silver prices or much high physical metal premiums.

Silver is undervalued

In conclusion, the photovoltaic industry's impending impact on silver pricing cannot be overlooked. As the silver shortages loom on the horizon, it is only a matter of time before mainstream media reports on these significant developments. Once the news spreads, we can anticipate substantial price surges in the silver market.

Furthermore, apart from the bullish industrial demand outlook for silver, its current undervaluation compared to gold presents another compelling investment case. With the gold-silver ratio currently at 80, a switch to undervalued silver from gold is a proven approach while we wait for the ratio to return to 50 to go back into gold, which would net 50%+ more gold.

As we navigate the uncertain future, it becomes increasingly clear that the interplay between the photovoltaic industry, silver pricing, and the undervaluation of silver against gold creates an attractive narrative for investors to carefully monitor and capitalize on.

Sincerely

Gregor Gregersen