Renting an Insured Safe Deposit Box for Gold and Silver in Singapore

If you are a gold and silver investor who purchased bullion bars and coins, safely storing your precious metals is no doubt a top priority. While home safes are an option, storing physical gold and silver at home can be risky, depending on your country of residence. In jurisdictions with high crime rates and gun ownership, your home security is only as good as the safety of you and your family from being held at gunpoint. Otherwise, you may be coerced to disarm your home security and open your home safe.

An alternative way to mitigate the risk of an armed robbery is to store your precious metals in a safe deposit box offered by a bank or private vault. However, storing your bullion in a safe deposit box does not completely mitigate jurisdictional crime risks, as there have been instances of safe deposit burglary in the past, such as the Hatton Garden safe deposit burglary.

Securing your gold and silver is best achieved when you mitigate jurisdictional and third-party storage risks. In this article, we explain why Singapore is one of the best places for bullion storage and how you can rent an insured safe deposit box for precious metals in Singapore.

Safe Deposit Box Explained

A safe deposit box (SDB), or safety deposit box, is a secure container usually made from metal or fiberglass that is used for safekeeping valuables, collectibles, and important documents.

SDBs are often rented from an operator such as a bank, credit union, private vault, or a private safe deposit box company. Box access is limited to the renter and authorized representatives. The safe deposit box operator cannot access renters’ safe boxes.

Many SDBs use a dual-key access mechanism with an operator and client key. The safe box is opened only when both keys are inserted into the locks, preventing any unauthorized access by the operator.

This operator-renter relationship, where the operator cannot access the renter’s box, is often why safe deposit boxes are not considered reportable for tax purposes in many countries. For example, SDBs are not reportable on FBAR as they are not considered financial accounts in the United States.

Why Most Safe Deposit Boxes Are Uninsured

In most cases, safe deposit box services do not provide insurance coverage for box contents for several reasons.

Firstly, the perceived complexity of potentially insuring many items, ranging from physical documents to digital files on flash drives, gemstones, precious metals, and collectibles.

Moreover, value assessment is possible only if the item is correctly authenticated to be genuine, especially for precious metals, timepieces, and gemstones. There is no one-size-fits-all authentication method for different types of assets, making authentication potentially complex and costly.

Even if insurance coverage could be arranged, insurance premiums could vary significantly, given the range of valuables stored in the SDB. Most customers may not want to pay the insurance premium in addition to the safe deposit box rental fee, causing a lack of economies of scale to offer insurance coverage. This is why the operator’s terms and conditions often state that it is the customer’s responsibility to obtain insurance individually if needed.

Where to Rent a Safe Deposit Box in Singapore

Singapore is one of the best countries in the world to rent safety deposit boxes to store precious metals.

The Global Peace Index 2023 ranks Singapore as the safest country in Asia and the 6th safest country in the world. The city-state has a strong rule of law, as attested by the World Justice Project’s Rule of Law Index 23, ranking 17th out of 142 countries. Singapore scored well in areas such as order and security, regulatory enforcement, absence of corruption, and civil justice.

In addition, possession of firearms and ammunition is also illegal in Singapore, carrying a five to ten-year jail term with at least six strokes of the cane for anyone guilty of such an offense. The country also imposes the death penalty on any person found guilty of using or attempting to use arms criminally.

Singapore’s safety and strong rule of law are important for safe deposit hirers, as these qualities provide the foundations for ensuring the safety of assets and valuables held in the country.

Safe deposit boxes in Singapore can be rented from banks or private safe deposit box services.

However, many banks have gradually ceased their safe deposit box services over the years. As large spaces are needed to house safe deposit boxes, the SDB business became less profitable as commercial real estate rentals increased, especially at prime locations. Moreover, bank safe deposit boxes are often offered without insurance coverage.

Private operators have entered the safe deposit box market as banks exit it. The largest and most reliable SDB providers include The Reserve, Certis CISCO, SECOM, and The Safe House.

However, apart from The Safe House, most private SDB providers offer uninsured conventional safe boxes that may not be well-suited to store large quantities of bullion bars and coins.

Why The Safe House’s Safe Deposit Boxes Are Well-Suited For Gold and Silver Bullion

Precious metals like gold, silver, and platinum are some of the densest metals on earth. They pack a lot of weight in a small space. A one-kilogram gold bar is smaller than an Apple iPhone but is four to five times heavier.

Although offered with many safe deposit box sizes, conventional safe deposit boxes are often designed to store lightweight items, including documents, flash drives, jewelry, and collectibles. They may appear spacious, but you will have difficulty moving the box if you fill every nook and cranny with dense precious metals.

If your SDB is positioned above shoulder level, pulling a 30-kilogram safe box out and carrying it down safely will be challenging for most people!

For this reason, Certis CISCO safe deposit boxes have weight limits: 4 kilograms for extra small, small, and medium safe boxes and 8 kilograms for large and extra large safe boxes.

The Safe House’s Insured Safe Deposit Boxes

Safe deposit boxes from The Safe House are purpose-built for storing gold, silver, and platinum bullion.

We offer two types of SDBs:

- A class II safe deposit box suitable for storing gold, platinum, and rhodium. Each SDB can store up to 15.6 kilograms (or 500 troy ounces) and has a USD 200,000 liability protection included in the rental fee.

The Safe House SDB for gold and platinum

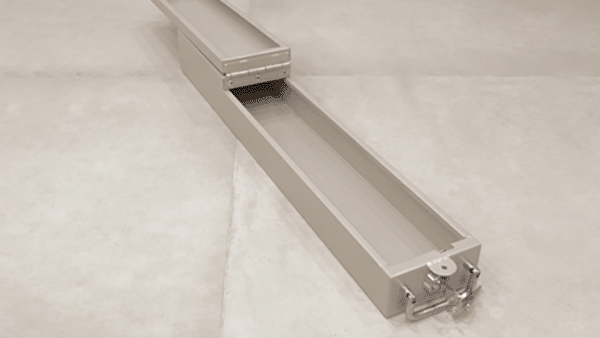

- A class I safe deposit box suitable for storing silver. Each SDB can store up to 202 kilograms (or 6,500 troy ounces) and has a USD 50,000 liability protection included in the rental fee.

The Safe House SDB for silver

The insurance coverage for both types of boxes can be increased optionally according to your needs.

The Safe House’s safe deposit box service is unique for the following reasons:

- Unlike automated safe deposit box services, our secure safe deposit boxes are stored in vaults guarded by armed auxiliary police. All visitors' identities must be verified before being granted access to the safe deposit box facility.

- Our vault storage area, which holds all safe deposit boxes, is protected by physical security measures such as lasers, seismic detectors, motion sensors, and high-definition CCTV cameras.

- Each SDB is locked by a client key issued solely to the renter.

- In addition, each SDB is sealed by a uniquely numbered tamper-evident metal seal. Once sealed, these metal seals cannot be removed without being destroyed. Moreover, each metal seal is uniquely numbered, and the serial number is recorded in the customer’s deposit and withdrawal statements, ensuring your sole access to your safe box. This is a superior way to secure safe deposit boxes than a dual locking mechanism, as it quells doubts regarding the operator having a copy of the client key.

Safe boxes secured with uniquely-numbered tamper-evident single-use metal seals

- When customers visit, two of our vault operators bring safe deposit boxes to a private viewing room without customers needing to carry their boxes. Even for a class I safe deposit box filled to its maximum capacity of 202 kilograms, we can safely move it with our heavy-duty stacker equipment.

- Only precious metals declared are covered by liability protection. The bullion will be sealed in uniquely numbered tamper-evident bags, and the bag serial numbers will be recorded in deposit or withdrawal statement documents for transparency. Customers accessing their boxes on the next visit can verify the bag serial numbers on the statements against bags held in their boxes to ensure their bullion is in order.

- Clients who cannot physically attend the Safe House vault can use our safe box remote opening option for the first deposit. They can purchase the bullion from our parent company, Silver Bullion, and our vault operators will assist in depositing it into the new safe box. The entire process, from the deposit to the closing and sealing of the SDB, is performed under CCTV surveillance. Once completed, a video of the deposit and the box keys will be sent to the client via postal mail. SDBs that are fulfilled with the remote opening option have full liability protection automatically.

- Given that we have more than a decade's experience testing precious metals, we can authenticate the bullion you have selected to have insurance coverage to ensure that they are genuine.

Rent From One of the Best Safe Deposit Box Service Providers in Singapore Today

The Safe House precious metal vault is located within The Reserve, the headquarters of our parent company, Silver Bullion, in eastern Singapore. As Silver Bullion fully owns the Reserve building, we are able and have designed a seamless and secure safe-deposit-box visiting experience from the moment you enter The Reserve vault storage area to your safe box access.

Located only 7 minutes from the Singapore Changi Airport, The Reserve offers foreign clients convenience in visiting The Safe House to manage their SDBs during their Singapore visit.

You can rent The Safe House’s safe deposit boxes with absolute peace of mind, knowing that your valuable belongings are secured with layers of security protection from onsite security personnel and auxiliary police and state-of-the-art vault security systems.

In addition, unlike most uninsured safe deposit boxes, The Safe House offers SDBs with insurance coverage, ensuring that you are well-protected even in the unlikely event of loss.

Our SDBs are purpose-built for storing large amounts of precious metals with insurance, offering bullion investors the best way to secure their assets.

Contact us today for more information about our secure safe deposit boxes.

This article was originally published at: https://www.thesafehouse.sg/articles/renting-an-insured-safe-deposit-box-for-gold-and-silver-in-singapore