Protect your Wealth from Escheatings, Nationalizations and Confiscations

|

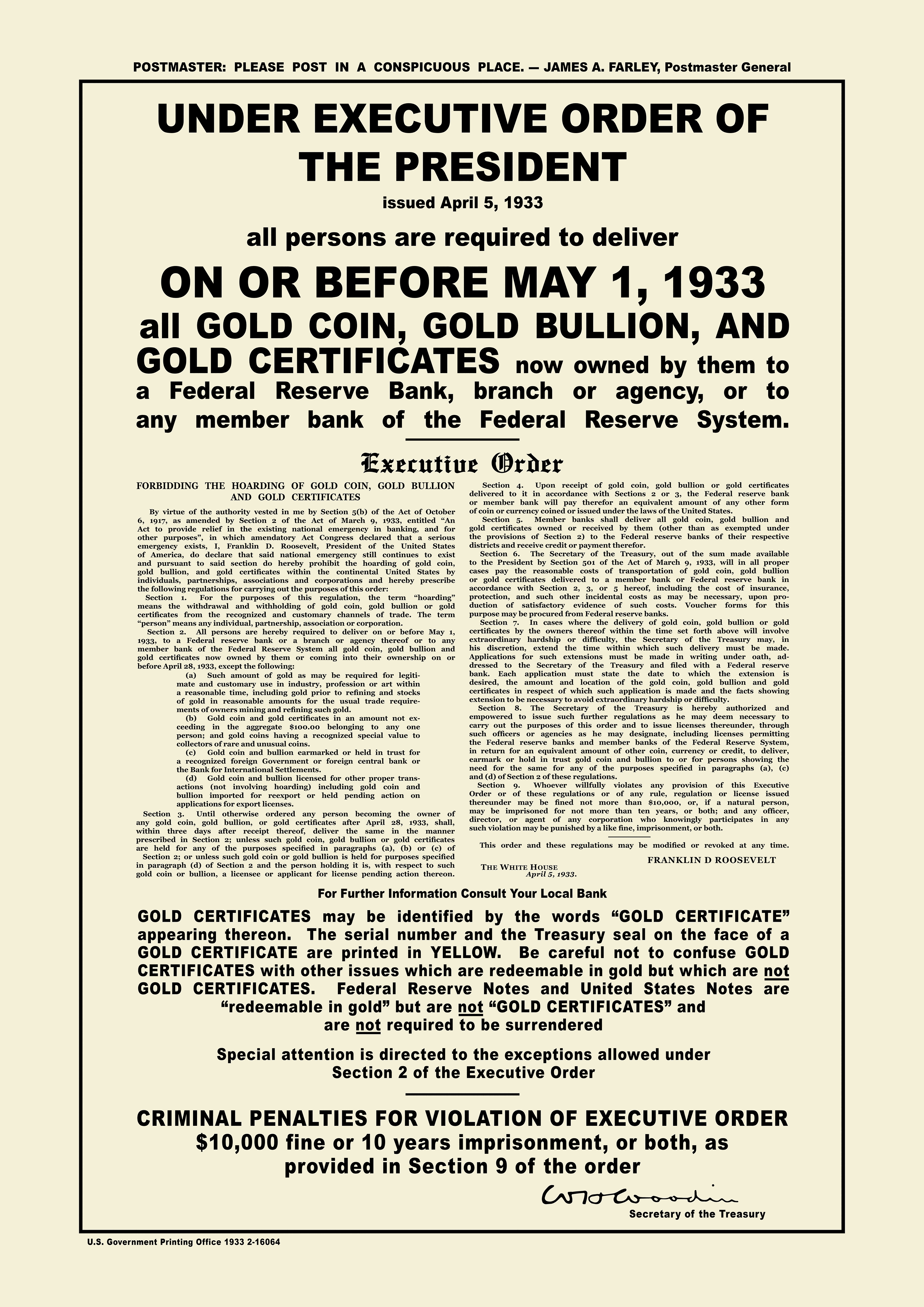

It has happened before. On April 5th 1933 US President Franklin Roosevelt issued Executive Order 6102 requiring all privately owned gold to be delivered to the government within 25 days. Gold owners would receive 20.67 USD for each troy ounce of gold. By May 1st anybody caught in possession of gold would be committing a felony and could face a ten year prison sentence. Thus, under US jurisdiction, gold had become a liability which could cause the owner to be fined twice the value of the gold held and possibly result in prison sentences. Because at the time the USD was still redeemable for physical gold the government's ability to print money in excess of governmental gold reserves was severely constrained. So the rationale for the law was that if gold could not be legally owned by the public, then it could not be legally redeemed. If it could not be legally redeemed, then it could not constrain the Federal Reserve's ability to print money. Despite its huge implications, and likely unconstitutionality, this order became law without approval or debate by the US Senate and occurred so suddenly that it was near impossible to move gold out of the United States without being subject to nationalization (before May 1st) or confiscation (after May 1st). The law applied to nearly all gold within US jurisdictional control, even those owned by non-citizens. Mr. Josefowitz, a Swiss-Lithuanian businessman, had 10,000 ounces of gold confiscated from his safe deposit boxes in New York and faced fines of nearly twice the value of the gold. It was not until 1971 that gold ownership became legal again when the USD officially abandoned any pretence of being backed by gold. |

Executive Order 6102, in 1933 banning gold ownership allowed for currency debasement and easier money printing |

|

Could it happen again? In 1933 the US nationalized and then devalued gold to allow for un-restrained money printing and debt creation. Ironically debasements through excessive money printing and unsustainable debts are often the very reason why trust in a currency is eventually lost causing it to be discarded and resulting in hyperinflation as had occurred in 1922 Germany. In such a hypothetical scenario gold and silver could be nationalized to create a new gold/silver backed currency to replace the old fiat USD and create acceptance for the new currency. Such an event would also be a way to de-facto default on the massive US debt as the old fiat USD and accumulated USD debts would essentially become worthless. Note that the US has defaulted in the past, see the Continental currency default of 1779 for example. In 1933 moving or holding your gold with a foreign custodian or bank would likely have placed your gold outside of US jurisdiction where its ownership would have been legal until the US ban is lifted. Today, US jurisdictional reach has become almost universal. Financial institutions globally are effectively under US jurisdiction as they are terrified to be fined, sometimes billions of dollars, if they violate US policy or some obscure regulation. These fears have led to the meteoric rise of compliance departments which seem intent to make formerly routine banking transactions into lengthy bureaucratic ordeals that delay and complicate many financial services. The vast majority of financial institutions outside the US have even chosen to deny and terminate services to US customers altogether in a quest to reduce the potential for US fines. Consequently, this ‘denial of service’ locks US citizen even tighter into US jurisdictional control at a time when their country is on a clear path to fiscal insolvency and the risk of systemic crises is rising sharply. US jurisdictional exposure is not limited to US citizens either. Any interaction with a financial institution or company with substantial US exposure causes the assets in question to become de-facto subject to US jurisdiction, regardless of your citizenship, residency or knowledge. I learned the global extend of US jurisdictional power first-hand. It began when I opened a trading account with an online brokerage house in Hong Kong to buy Canadian equities. Note that I was a German citizen residing in Singapore, not a US person, and I had no relationship, status or business in the US. However on December 6th 2014, I received a bizarre email from my broker stating that my account holdings will be “escheated to the state of Connecticut” unless I log into my account very soon to demonstrate that my account is still active. It seemed ridiculous that my HK account holdings could be taken by to the state of Connecticut. I was about to delete the message, believing it to be malware, when I noticed that my account number ending was correct and the sender was indeed my broker. |

|

“Connecticut escheating”. An example of nasty US jurisdictional exposure. It turned out that because the parent company of my Hong Kong broker was incorporated in the US state of Connecticut, my equities could indeed be "escheated" as “abandoned property” because I had not logged into my online account recently. Account balances are not supposed to dissolve into thin air just because you don't check on them regularly. The basic fiduciary relationship between client and financial institution had been perverted by US regulations that could arbitrarily escheat almost anybody’s life savings. It did not matter that I was not subject, personally, to US jurisdiction, nor did it matter that my account was opened in Hong Kong. Just because my broker had US exposure my accounts became subject to US and Connecticut escheatment laws. So much depends on your counterparty's jurisdictional exposure The incident is a great example why your counterparty’s jurisdictional exposure is so important and why you should have some assets stored outside of US jurisdictional control by avoiding US exposed entities or intermediaries. To put it bluntly, ask yourself what would happen if the US nationalizes gold and you have gold stored abroad (e.g. in Switzerland, Singapore or Hong Kong) with a US exposed vault? I have often, and insistently, posed this question to the management of some of the largest global vault companies. The answers varied from “it is up to the lawyers” to a very honest “it will go straight back to the US”. Leaving your gold’s fate to the lawyers is not an appealing option when you realize that the Force Majeure clause of most storage contracts already holds the vault company immune against the consequences and potential customer lawsuits for implementing "any governmental action by any government". This ‘anything by anybody’ clause means you will have little legal recourse against the vault operator if they send your bullion back to the US to be nationalized. Furthermore, would such a hypothetical nationalization be restricted to US citizens or could it affect everybody regardless of nationality or residency status as it so clearly did to Mr. Josefowitz‘s gold ? It might be argued that if a German citizen’s Hong Kong account can be escheated by the state of Connecticut because a US intermediary is involved then bullion holdings are probably just as escheatable or nationalizable if a US based, or a US exposed, dealer or vault is involved as intermediary. So regardless of your nationality, it is prudent and completely legal to diversify some of you jurisdictional exposure by ensuring your bullion is held by a counterparty that is not materially exposed to the highly indebted jurisdictions which could re-impose nationalization procedures in a currency crisis. Eliminating such jurisdictional exposure and ensuring your and our bullion is safe was a primary reason why we moved our gold and silver out of globally exposed vaults and into our own, fully controlled and operated local facility. It was the only way to reliably remove foreign jurisdictional exposure for our clients and ourselves. When it comes to jurisdictional vault risk: local is good. Global is bad. If you like this article help us share it. By Gregor Gregersen |