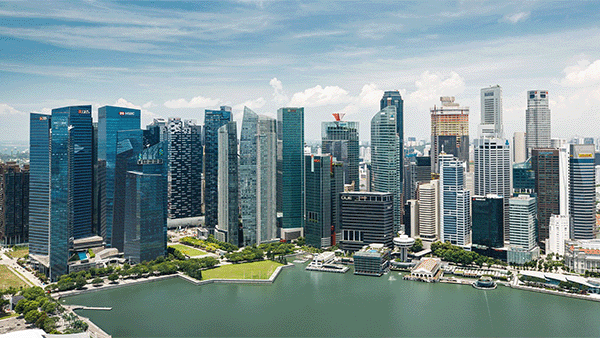

An Overview of the Singapore Precious Metals Market for International Investors

While Singapore is often referred to as a tax haven and a great precious metal storage location alongside the Cayman Islands and Panama, the city-state is vastly different in many ways. This article will help you understand Singapore’s deep-rootedness in the precious metals trade and its conscious effort to develop itself into today's precious metals hub.

Singapore’s History With Precious Metals

Since its independence in 1965, Singapore has long been a key player in the global precious metals market. In 1968, Singapore bought 100 tons of gold for its reserves, an astounding quantity of gold at the time. This gold purchase would prove to be astute as U.S. President Nixon closed the gold window in 1971, causing much market instability and sending the price of gold to a record high of $850 in 1980.

Singapore was also a gold distribution center for Southeast Asia since the 1960s. This decade also saw the country establish an over-the-counter (OTC) gold market, a mainly cash-based market for trading 25-kilogram 99.99% purity gold contracts.

While the London gold market was the largest and most liquid market in the world, the Singapore gold market became part of a group of matured and large organized markets, that included Hong Kong and Switzerland, responsible for the trading, storage and distribution of physical gold bullion bars globally.

From 1969, the Singapore gold market initially limited transactions to only non-residents and entities, such as banks and bullion dealers. However, in July 1973, the government took steps to liberalize the gold market by allowing Singapore residents to deal in gold bullion. Gold import licensing was also abolished in August 1973, allowing all residents to import and export gold freely.

In 1978, the Gold Exchange of Singapore (GES) was formed by a group of Singaporean bullion banks and brokers, namely the Overseas Chinese Banking Corporation (OCBC), the United Overseas Bank (UOB), and N. M. Rothschild & Sons Ltd. Through the GES, the 100 troy-ounce and 1-kilogram physically deliverable gold futures contracts were introduced. Subsequently, the GES also established the Singapore Gold Clearing House with OCBC, UOB, Overseas Union Bank (OUB), DBS Bank Ltd and the Bank of Nova Scotia as clearing members.

In late 1983, GES and the International Monetary Market (IMM), a Chicago Mercantile Exchange (CME) division, collaborated to establish the Singapore International Monetary Exchange (SIMEX). With the GES absorbed into SIMEX, the new exchange introduced a cash-settled 100 troy-ounce gold futures contract based on loco London prices in 1984. Unfortunately, this gold contract was discontinued in 1997 due to dismal demand. The SIMEX was then merged with the Stock Exchange of Singapore to form the Singapore Exchange (SGX) in 1999.

As a gold distribution center, Singapore's gold imports reached record levels in 1992, with 414 tons of gold imported, equivalent to almost half of Asia’s total gold consumption.

With the imposition of the Goods and Services Tax (GST), Singapore’s sales tax, in 1994, domestic gold jewelry and gold bar consumption fell to single-digit levels gradually as the GST was raised to 7% by 2007.

Singapore as a Global Precious Metals Hub

Singapore’s gold market languished in obscurity until 2010, when the government began taking steps to transform the country into a precious metals trading hub. In 2012, the government announced GST exemption on investment precious metals (IPM), a significant step to revitalize the Singapore precious metals industry. The impact of the tax exemption was quickly evident, with gold trading rising from $18 billion to $35 billion, a 94% year-on-year increase between 2012 and 2013.

Through its gold market reforms, Singapore attracted Metalor Technologies, a major London Bullion Market Association (LBMA) accredited Swiss precious metal refiner, to set up its refinery in the city-state in June 2013.

The tax exemption on investment-grade precious metals has since resulted in the establishment of many bullion dealers, precious metal storage and secure logistics companies in the country, completing the supply chain and the ecosystem of the bullion trade.

As Singapore’s gold market matures, the industry has seen increased dialogue and collaboration with the international gold market through the Singapore Bullion Market Association (SBMA) and the annual Asia Pacific Precious Metals Conference (APPMC).

Our company, Silver Bullion, became the first Southeast Asian member of the LBMA in 2023, a testament to the development of the Singapore gold market since its humble beginnings.

In 2024, the World Gold Council said that Singapore is set to become a leading gold hub as gold consumption in major emerging economies rises.

“The center of gravity of the gold market has shifted east, with Singapore, fortuitously placed as the potential fulcrum of this new balance,” said Fan Shaokai, head of Asia-Pacific and global head of central banks.

Structure and Key Players in the Singapore Gold Market

The maturity of the Singapore Gold Market is attested by the development of the gold and silver supply chain involving a precious metal refinery, vault storage providers, secure logistics companies, bullion dealers, and pawnbrokers.

Precious Metal Refinery

One of the major milestones in Singapore’s development as a precious metals hub is undoubtedly the establishment of its sole major gold refiner, Metalor Singapore, a 100% subsidiary of Metalor Technologies International SA, in the west of the country.

Today, gold bars produced by Metalor’s Singapore gold refinery are stamped with its unique ‘SG’ identification hallmark.

With a gold refinery in Singapore, Metalor is well-positioned for a quicker turnaround in distributing its gold bars within the Asia Pacific region without the need to import them from Switzerland.

Vault Storage Providers

One of the earliest contributions to the rebooting of Singapore’s gold market was the building of Singapore Freeport, a storage facility for fine art and highly prized collectibles.

Two key trends in Asia, reported by the World Wealth Report 2009, led to the establishment of Singapore Freeport. Firstly, wealth in Asia Pacific was expected to grow at an annual rate of 12.8 percent, significantly higher than the expected global average of 8.1 percent.

Secondly, high net-worth individuals in Asia were found to spend more on “investments of passion,” such as collectibles and fine art, consistent with a booming Asian contemporary art market.

While the Singapore Freeport (now renamed Le Freeport) was originally designed for fine art storage, precious metal dealers also began storing bullion on its premises.

In 2014, Silver Bullion founded its vault, The Safe House, to serve its global clientele interested in preserving wealth through silver and gold bullion in a safe jurisdiction like Singapore.

Silver Bullion increased The Safe House’s vaulting capacity when it moved its precious metals vault to The Reserve, the company’s current Singapore headquarters, in 2024. This new purpose-built precious metal vault has the capacity for an estimated 500 million troy ounces of precious metals.

The Safe House and The Reserve also provide secure safe deposit boxes that their global clientele can rent to store valuables and other assets.

With world-class storage and vaulting facilities established, Singapore is attracting wealth in physical assets, like gold and silver, intended to be stored within its borders to leverage the country’s safety and open economy.

Secure Logistics Providers

The establishment of international secure logistics companies such as Brinks, Malca Amit, Certis CISCO, G4S, and Ferrari Logistics has played a pivotal role in strengthening Singapore’s position as a leading precious metals hub. These companies specialize in high-security transportation and storage solutions, critical for handling valuable commodities like gold, silver, and other precious metals.

By offering seamless global logistics services, they facilitate the movement of precious metals into and out of Singapore, making the city-state an attractive location for traders, investors, and financial institutions that require secure and reliable transport for their assets.

These logistics providers further enhance the infrastructure of Singapore's precious metals ecosystem by providing short-term secure vaulting services. These specialized vaults within the country offer a trusted option for storing bullion in transit. This contributes to the growth of Singapore’s role as a regional and international storage hub, where precious metals can be stored safely and securely.

The availability of such services attracts more institutional investors and wealth management firms to choose Singapore for the safekeeping of their clients’ assets, further cementing its reputation as a global wealth hub.

Bullion Dealers

While the 2012 tax exemption on investment precious metals was pivotal in positioning Singapore as a leading global hub for precious metals trading, it also encouraged the purchase of gold in Singapore.

Moreover, after the 2008 financial crisis, global uncertainty prompted investors to seek safer assets, with gold, silver, and other precious metals becoming popular choices. Recognizing this shift in investor behavior, Singapore sought to create a tax-friendly environment to meet the demand for bullion trading and investment.

Silver Bullion, founded in 2009, was a forerunner of Singapore’s bullion market and was well-positioned to benefit from the sales tax removal on investment-grade precious metals. Since then, more precious metal dealerships have sprung up in the city-state, giving bullion buyers many ways to accumulate gold coins and bars as a form of wealth preservation.

Pawnbrokers

Despite Singapore’s Goods and Services Tax (GST) remaining on gold jewelry, pawnbrokers such as Maxi-Cash and ValueMax play an important role in enhancing Singapore’s reputation as a precious metals trading hub. These companies provide liquidity to individuals who own gold jewelry or other precious metals, effectively contributing to the recycling and circulation of gold within the local market.

By offering a secure and regulated platform for individuals to monetize their gold, pawnbrokers indirectly help drive the supply of precious metals, sustaining the broader bullion market in Singapore.

Pawnbrokers also act as intermediaries in the precious metals ecosystem by acquiring and reselling gold jewelry. Once pawned items are not reclaimed, they are often resold either as jewelry or melted down into bullion, contributing to the supply chain of gold in the market. This flow of second-hand gold helps maintain liquidity in the market, making it easier for traders and investors to access gold through various channels.

As a result, pawnbrokers serve as crucial facilitators within Singapore’s broader gold ecosystem, complementing the activities of bullion retailers and investment vaults.

Moreover, the regulated nature of pawnbroking in Singapore ensures a high level of trust and transparency in the market. Strict regulations governing pawnshops, including those for appraisals and customer protection, contribute to Singapore’s reputation as a safe and secure market for precious metals. This fosters investor confidence, both locally and internationally, further strengthening the country’s position as a leading center for precious metals trading and investment.

The Singapore Gold Market Regulatory Environment

As Singapore continues to position itself as a global hub for wealth management and precious metals storage, the city-state has introduced regulations to prevent money laundering and terror financing using cash, high-value precious stones, and precious metals within its borders.

Since 2014, dealers of precious stones and metals have had to submit cash transaction reports (CTRs) to the Commercial Affairs Department for cash transactions exceeding $20,000. If a transaction is deemed suspicious, a suspicious transaction report (STR) must also be submitted.

In early 2019, the Ministry of Law (MinLaw) introduced the Precious Stones and Precious Metals (Prevention of Money Laundering and Terrorism Financing) Act to combat money laundering and terrorism financing risks associated with high-value, cash-intensive trades in precious metals and gemstones.

The Act required formal registration by dealers in precious metals, gemstones, watches, and other luxury items where more than 50 percent of the finished product's value comes from the precious stones or metals. By imposing this requirement on dealers, the Ministry of Law seeks to create greater transparency and accountability in the industry.

Under the Act, a regulated dealer must perform customer due diligence before entering into a transaction or when reasons arise to suspect money laundering or terrorism financing activities.

Despite introducing the Act, MinLaw acknowledges that it is a delicate balancing act to keep Singapore’s regulatory regime relevant in preventing criminal misuse without stifling genuine business activities and practices. The Ministry believes that these regulations are necessary to safeguard the country’s security and international reputation.

Singapore’s Bullion Retail Market Characteristics

Today, it is easy to purchase and store precious metals in Singapore, whether you are a resident or a foreigner. The Singapore bullion market has developed unique traits that may differ from other international markets. We hope the following summary will help you understand the Singapore gold market, giving you greater confidence in investing in gold and silver in the country.

No Sales Tax or VAT

As mentioned above, the sales tax or value-added tax (VAT) has been exempted from investment precious metals (IPM) since 2012.

IPM bullion is defined by Singapore’s tax authority, the Inland Revenue Authority of Singapore (IRAS). Bullion produced by refiners accredited by the London Bullion Market Association (LBMA) at the required purity is highly likely to be considered IPM.

For example, nearly all the bullion Silver Bullion sells are IPM and, therefore, tax-exempt.

However, gold jewelry in Singapore continues to be taxable. Local jewelry stores often sell gold bars and coins produced by manufacturers that are not LBMA-accredited. These, too, will attract the sales tax.

Buy From Bullion Dealers, Not Gold Jewelers

It is no secret that Singapore bullion dealers offer the most competitive pricing for silver and gold bullion. Unlike the jewelry industry, the bullion industry operates with small margins in a competitive market where nearly every dealer sells similar bullion products imported from gold refineries and mints.

Gold jewelry can be fashioned with many designs, and more intricate workmanship can command higher price premiums than bullion. Due to the high profit margin, jewelry shops face a dilemma in offering gold bullion products next to gold jewelry in their retail shops due to the large difference in price compared to their staple jewelry products. Therefore, jewelers usually have a higher markup on bullion products to minimize the perception that gold jewelry is expensive.

Bullion dealers do not compete in the gold jewelry market, focusing on imported gold bars and coins. Since other bullion dealers can carry the same gold products, competitive bullion pricing is necessary for any dealer to thrive.

Online Bullion Prices

Today, it is common practice for bullion dealers to display prices on their websites. In addition to gold spot prices, the price of gold bullion coins and bars are also displayed transparently and updated every few minutes following the international gold price.

For example, the prices on Silver Bullion’s website, for precious metals and foreign exchange rates, are updated every 1 to 3 minutes to give customers the most accurate price at any moment.

These online prices are advantageous to consumers, as they can compare bullion prices without setting foot in a gold dealership and then choose the dealer for their gold purchase.

Varied Payment Options

As one of the world's top financial centers, Singapore has an open economy that allows the free movement of capital. Well-established Singapore bullion dealers accept different modes of payment, including cash, cheques, cryptocurrency, and domestic and international bank transfers.

In addition, Silver Bullion, a leading Singapore precious metals dealer, accepts payment in eight foreign currencies: the USD, Euro, GBP, AUD, CHR, CAD, HKD, and JPY. Foreign clients transacting directly in these currencies can avoid currency conversion, saving on foreign exchange.

Ease of Purchasing Bullion Online

Buying bullion from Singapore bullion dealers is simple today. Well-established and reputable precious metal dealers, like Silver Bullion, allow you to create an account online and submit orders through the dealers’ websites.

It is standard practice that the price of the bullion products is locked upon order submission, constituting a binding agreement between you and the dealer. You will need to make payment within two business days from the date of your order.

It is also a standard practice that submitted orders cannot be canceled. Otherwise, you will be liable for a cancellation fee and a market loss charge, calculated based on the price difference between order submission and cancellation.

This strictness with order submission is not new in the bullion industry. Bullion dealers purchasing stock from gold refiners, mints, and bullion wholesalers are subject to the same requirements. Therefore, you must be sure about your purchase before submitting any order.

You will be informed to collect your purchase once payment is received. Alternatively, if you buy bullion to store with the precious metals dealer, your purchased bullion will be transferred into vault storage upon payment.

With Silver Bullion, you will also receive your softcopy invoice, a photograph of your bullion, and details about your precious metals stored in their storage program, S.T.A.R. Storage.

Ease of Selling Bullion

As a customer, you can also easily sell bullion to reputable and well-established bullion dealers in Singapore. Like buying prices, the selling (or buyback) prices of different bullion bars and coins are usually transparently displayed on the dealers’ websites.

For example, you can create a Silver Bullion account before submitting a sell order, thus locking your sell price. You can choose how you receive the sale proceeds, either via cash in Singapore dollars, a bank transfer, a check, or cryptocurrency.

If you intend to use the sale proceeds toward lending a loan on Silver Bullion’s Secured Peer-to-Peer (P2P) Loan Program, you can choose to send your funds to your Cash or Peer-to-Peer Balance within your Silver Bullion account.

You must deliver the bullion to our bullion retail store no later than the next day. Like buy orders, sell orders are also binding legal agreements between you and the dealer, and a cancellation fee and market loss charge will apply if a sell order is canceled.

Learn More About Singapore’s Bullion Market

We hope that the information above helps you understand the Singapore bullion market. If you have more questions, please contact us or visit our bullion retail store. We receive inquiries daily and are accustomed to handling a wide range of customers’ questions.

Given our over-a-decade experience with the Singapore precious metals market, we are well-acquainted with the concerns of new customers. It will be our pleasure to provide you with the right information, regardless of whether you eventually choose to buy from us.

We are confident that Silver Bullion’s excellent track record in the Singapore bullion market, customer service, and superior wealth protection products will win you over as our client!