Nothing New With Gold and Silver Price Movements

In the gold and silver bull market between 2001 to 2011, the gold price soared from a low of $256 to a then-record high of $1,920 – a gain of about 650%. In the same period, the silver price climbed from a low of $4 to a high of $49 – a gain of about 1,100%, clearly outperforming gold.

If we examine the path of both precious metals to their 2011 peak, we will notice several spikes and consolidation patterns. First, momentum spikes prices to a new high, and then a period of consolidation ensues to flush out the exuberance of the price run-up. This is a common mechanism of markets to rebalance instances of assets' over-valuation and under-valuation.

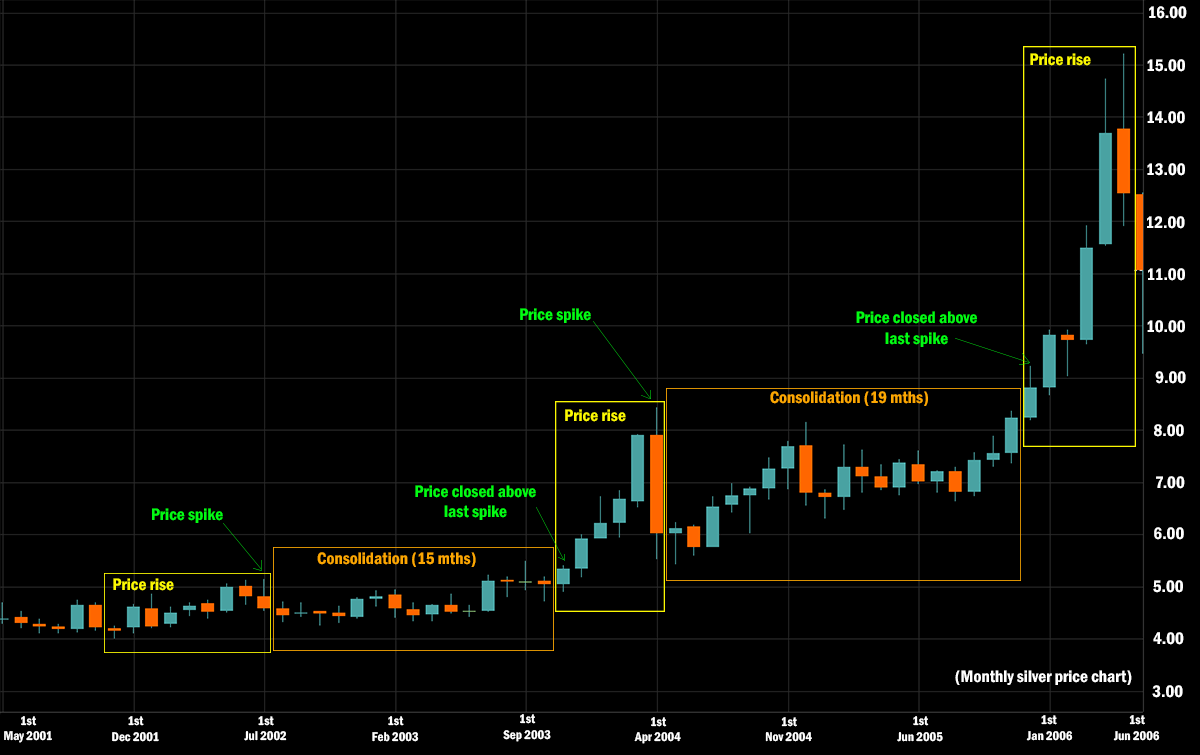

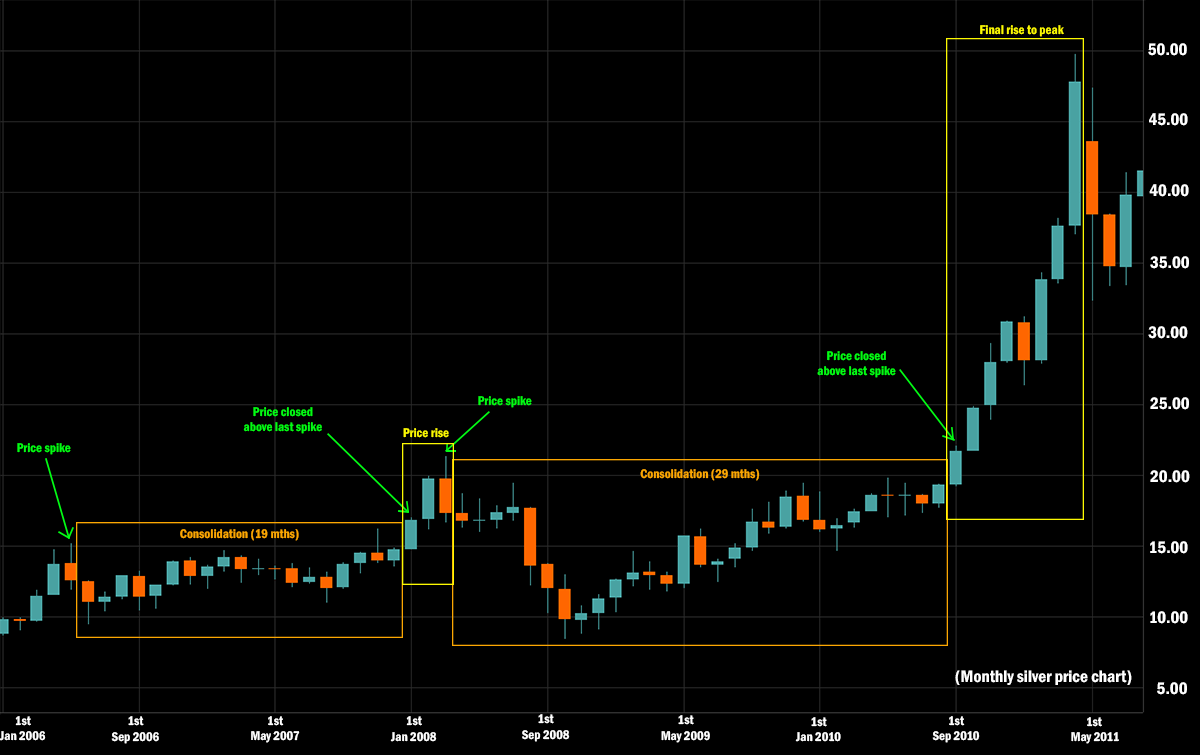

Let us take a look at this price behavior in the silver bull market between 2001 and 2011. For ease of analysis, the first chart below shows the period between 2001 and 2006 and the second chart shows the period between 2006 to 2011. Each candlestick represents one month. If the candlestick is blue, it means that silver prices closed higher by the end of the month than when they started. The red candlestick reflects the opposite.

The yellow boxes show months of price rises before the consolidation months follow (in orange boxes). Price rises end with the highest price reached (spike). Consolidation periods end when the following month closes higher than the last spike.

Silver price chart from 2001 to 2006 (Click for larger image)

Silver price chart from 2006 to 2011 (Click for larger image)

From these silver charts, we can observe the following:

- The consolidation periods are always longer than the price rise periods - the breadth of the orange boxes are wider than the yellow boxes.

- It is normal for prices to consolidate between 15 to 29 months after a price spike.

- Prices can correct dramatically during consolidation periods. The correction in 2008 as a result of the Great Financial Crisis was about 57% from peak to trough.

- The final rise to the bull market’s peak is swift with the largest gains.

Nothing New Under the Sun

With the above in mind, how do silver’s price movements in recent times compare?

We continue to see this pattern in silver prices today. From the depths of the 2020 Covid crash, silver skyrocketed from a low of $11.50 to nearly $30 in August 2020. This spectacular near tripling of the price rise happened in five months. Moreover, it was larger than any price spikes in the last bull market, save for the final spike to the peak in 2011.

Silver prices from the Covid crash till today (Click for larger image)

With such momentum in the 2020 price rise, the subsequent consolidation period is understandably drawn out – it is into its twenty-third month, well within the periods of consolidation seen in the last bull market. This is not something new. If anything, the length of the consolidation could hint that bearish sentiments in silver could be waning soon. We could be in the endgame of the current consolidation phase.

While some buyers rejoice in seeing the silver price dip under $20 again, most buyers cannot help but feel the fear of ever-lower prices. This is nothing new as well – it is the nature of markets.

Those looking at silver’s price chart in recent years will secretly wish they had bought silver at the lows during the Covid market panic in 2020. However, they forget that tremendous fear is also present when prices crash or spiral lower and lower.

This is why we have often heard of Warren Buffett’s quote, "Be fearful when others are greedy. Be greedy when others are fearful."

Buffett is not advocating always buying at the lowest price, which is unrealistic. He is saying that fear is an excellent indicator of when an asset becomes of good value. Fear is a natural derivative of over-selling in the markets when money leaves one asset class for another.

The “buy low, sell high” mantra is four simple words but this principle is often difficult to execute because of emotions. It is human nature to chase an exciting market of higher prices and disdain a quiet market. In reality, the majority do not ‘buy low’ because of the tremendous fear then. Similarly, they do not ‘sell high’ because of the callous risk-taking at the top of markets, believing that prices will only go higher.

Commodities Have Never Been More Undervalued

The chart below shows how incredibly undervalued commodities are relative to the Dow Jones Industrial Average (DJIA) in recent years. In fact, commodities, precious metals included, have never been cheaper relative to the DJIA in 120 years! This despite of the rising prices of certain commodities such as oil, industrial metals, and grains on the back of higher inflation in the past year.

Commodity prices relative to Dow Jones Industrial Average (Click for larger image)

It's the Seventies Again... With Major Differences

The last time the official US inflation rate rose to over 8 percent from the lower bound was in the seventies – a stagflationary period of high inflation and low economic growth, much like today. It ended with gold and silver reaching record highs of $850 and $49 respectively in 1980. While history may not repeat exactly, it frequently rhymes.

Although we compared the price action of the last silver bull market earlier, the market conditions today are very different from the early 2000s. For example, the US monetary base then was only about $800 billion, and today it is a staggering $5.6 trillion. The national debt then was about $7 trillion. Today it is $30 trillion. US unfunded liabilities are now at $169 trillion. Despite the noise and chatter from the Fed and government, no one has an answer for the ever-increasing debt problem.

The next financial crash is going to be bigger and a lot harder than the 2008 financial crisis. The precious metals bull market has begun albeit still in the early stages and the price consolidation now is nothing new – gold and silver are repeating what they have done in past bull markets. The case to hold physical gold and silver has never been stronger and a great wealth transfer awaits those who recognize how undervalued precious metals are today.