Is Your Gold Storage Program Making You an Owner of Bullion or Creditor?

The gold industry frequently misuses the word ‘ownership.’ There are many ‘gold ownership’ programs that claim to offer customers the opportunity to buy gold with the ‘lowest cost of ownership.’ The use of the word ‘ownership’ gives the impression that the buyer owns the gold bought but is this true? Let us delve deeper.

Legal ownership is possible only if you also hold the asset sold to you or if you can provide proof of ownership. The first criterion for proof of ownership is that the asset must be uniquely identified so that you can own the specific asset. For example, you can own an apartment because it has a unique address. You can own a vehicle because it has a unique number plate.

The second criterion is using a legal document to transfer ownership of that specific asset to the buyer. In the real estate world, there are land titles. For commercial transactions, the invoice serves as proof of ownership. If the company you are storing gold with gives you a certificate of ownership, that is not legal ownership as certificates have no legal bearing. You are still a creditor.

By the same measure, bank deposits are not ownership-based. You can be the de-facto owner of U.S. dollar banknotes while you hold them. However, once you deposit the banknotes into a bank, you cease to be a banknote owner and have become an unsecured creditor to the bank.

Programs that allow customers to buy gold fractionally online are notorious for misrepresenting gold ownership. Such programs often allow the purchase of gold in small increments at prices much lower than physical gold.

Customers think they own gold, but the abovementioned criteria for proof of ownership are not present. Within such programs’ online accounts, customers will not find invoices with serial numbers of specific gold bullion in them. Instead, their accounts only show that they purchased a certain number of generic gold grams (or troy ounces). They are creditors to the company offering the gold program, not owners of gold.

If such programs claim they are allocated, then who owns the actual gold in the program? In most cases, the company is the gold owner while customers are creditors having a claim on the gold. Often, ‘allocated’ just means there is gold present. It has no bearing on who owns that gold.

If all gold is present to back customers’ claims, such programs could be seen as fair trade as customers give up ownership for the convenience of having some exposure to the gold price. However, if the gold backing such programs are partially or not present at all, or even leased to another entity, the price for convenience will be high for customers. Oftentimes, such programs work only during peaceful times. They are prone to fail during a financial crisis or when there is gold shortage.

If you are looking to speculate on gold prices in the short term, such gold programs that allow buying of fractional gold can be convenient and cost-effective. However, if you intend to truly secure your wealth from the next financial crisis, such storage programs offer little protection because you will not own any gold until you convert the fractional gold grams into physical gold – the gold grams remain an I.O.U until you take physical delivery.

How Silver Bullion is different

At Silver Bullion, our mission is to protect wealth from the coming financial crisis. Our customers store physical bars and coins, and are legal owners of their bullion by design. We intentionally created a storage system that made us accountable, making any cheating easily detectable.

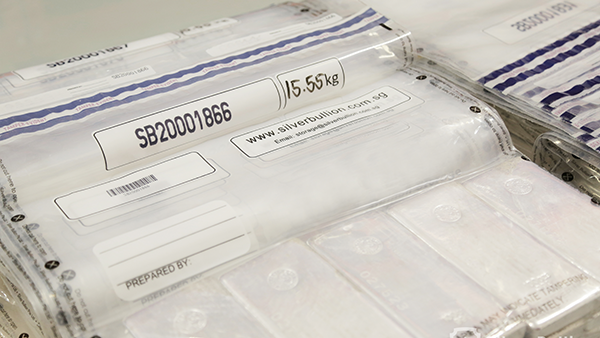

All purchased bullion for S.T.A.R. Storage has unique parcel I.Ds. Ownership of parcels is transferred to customers using commercial invoices that indicate specific parcel I.D.s. Commercial invoices, like receipts, are proof of purchase, and they can be held up in court as proof of ownership. Falsifying invoices in Singapore is a criminal offense.

All bullion stored in Silver Bullion's S.T.A.R. Storage program has unique parcel I.Ds

You can download the Parcel Ownership List which shows your account number against unique parcel I.D.s, quantity, and the type of metal stored. You can quickly check if your parcels are listed correctly within seconds. Our external auditors, Bureau Veritas and Ernst & Young, use the same list for verification during our quarterly vault audits. When you store with Silver Bullion, you are an owner of bullion and not a creditor.

Precious metals checked by our external auditors

It is your choice which gold storage program suits your needs. However, it is essential to look under each program’s hood and understand how they work. The greatest money printing experiment by central banks and governments will fail, and its fallout will destroy the purchasing power of fiat currencies. Your purchased gold must be your legal property. When the crisis happens, you want to ensure that you are an owner of gold and not a creditor forcibly compensated with worthless fiat currency.