How to Buy Gold Bars: A Comprehensive Guide for Investors

You are reading this article because you have considered or decided to buy gold bars to be gifted or held as an investment, but you are unsure where to begin, and perhaps your initial research on bullion dealers' websites has been confusing. As you scroll through the diverse range of gold bullion bars available, you wonder how different gold bars compare. Which are the best gold bars to invest in? You have come to the right place, as this article gives you a comprehensive beginner's guide to buying physical gold bars.

Why Buy Physical Gold Instead of Paper Gold?

Let us start with the basic question of why buying physical gold is more advantageous than buying paper gold.

Physical Gold

Physical gold refers to gold bars, gold coins, gold jewelry, or any objects fashioned with gold. For the purpose of this article, we will focus mainly on investment-grade gold - bars and coins, also referred to as gold bullion.

Physical gold is tangible, highly portable, and can be stored in any secure storage of your choice. If kept securely outside of the financial system, tangible gold easily survives any economic collapse. Having physical gold bullion as part of your investment portfolio is one of the easiest and safest ways to protect wealth.

Paper Gold

Paper gold refers to any proxies of gold, such as gold certificates, gold ETFs, gold stocks, or any digital representation of gold. Paper gold products are diverse in nature because they can be very different. For example, a gold certificate is tangible and can be used to redeem a gold bar from the certificate issuer. In this context, the value denoted by the certificate is often the same as a physical bar of gold.

On the other hand, gold mining stocks will have a different value, since it represents the value of gold mining companies or other businesses in the gold industry. Additionally, gold mining companies are fraught with risks pertaining to the gold mining industry, such as geopolitics, regulatory changes, environmental regulations, natural disasters, miner strikes, and poor company management. You are absolved from these risks if you are purchasing physical gold.

Regardless, paper gold is not the real gold itself - it is a representation of the real thing. While paper or digital gold may cost less in terms of premiums or a lack of storage and insurance costs, they are very much at risk of financial crises and geopolitical turmoil.

Buy Gold for Its Original Purpose

So, should you buy physical gold or paper gold? The answer to this question is best found in the original purpose of having gold.

The yellow metal is often described throughout mankind's history as a 'safe-haven' asset. This means that when sh*t hits the fan, people have often sought refuge in gold's certainty to retain value in tumultuous times.

John Exter, a central banker who lived through the Great Depression in the 1930s, created the Exter's Pyramid with gold as the foundation of a financial system. The inverted pyramid illustrates that money consistently flows downwards toward gold in a recession or financial crisis when investors panic sell other financial assets and securities - a flight to quality assets in times of distress.

Gold, seen as the ultimate safety net, is also why many countries worldwide continue to hold gold bars as part of their reserves. They are not holding paper gold.

Gold's original purpose has always been to be a store of value and to protect wealth. If this aligns with what you have in mind for your gold purchase, then buying physical gold is the way to go.

Which Gold Bar Brand is the Best?

As a precious metal retailer for over a decade, we are often asked which gold bar brand is the best. In our opinion, no specific brand of gold bars is the absolute best. Furthermore, several criteria can be used to assess a brand's quality: price, bar design, packaging quality, and refiner's reputation. Oftentimes, some of these criteria are subjective to an individual's preferences.

Instead, a better way to assess is to determine whether the refiner is accredited by the London Bullion Market Association (LBMA). Most of the largest gold refiners worldwide, such as PAMP, Heraeus, Valcambi, and Metalor, are LBAM-accredited refineries. The LBMA's stringent accreditation of gold refineries ensures that the most reputable and well-managed precious metal companies are included in this select group.

Many countries exempt gold bullion bars produced by LBMA-accredited refineries from sales tax because they use the LBMA's Good Delivery Rules as a benchmark for precious metal tax exemption criteria. This increases the recognizability of LBMA-accredited refiners' gold bars in international markets, resulting in higher transaction volumes worldwide.

For example, the Goods and Services Tax (GST) is exempt when investment precious metals are purchased in Singapore. Therefore, it would be more cost-effective to buy a tax-exempted gold bar than a taxable gold bar.

Therefore, a gold bar produced by an LBMA-accredited refinery is likely to be more liquid internationally, an important criterion for gold investors when they need to sell their gold bullion. Moreover, the gold content and quality of most investment-grade gold bars are similar. They are refined to 99.99% purity and have the same precise weight of gold, often making choosing between brands a matter of aesthetic preference. Many bullion dealers also practice having the same pricing for the same gold bar weight regardless of brand.

Regardless, Argor-Heraeus, Metalor, Heraeus, and Credit Suisse gold bars are excellent gold bar brands produced by reputable gold companies. PAMP Suisse gold bars are highly recognizable worldwide, especially their Lady Fortuna minted gold bars, although they often retail at a higher premium.

Why Buy Gold Bars and Not Gold Coins?

If you have decided to buy physical gold bullion, the next common question that comes to mind is: Should I buy gold coins or bars? What are the differences?

Most reputable gold mints and refineries, which are accredited by the London Bullion Market Association (LBMA), will produce bars and coins with the same fineness (purity) and quality. The common gold purity for bullion is 99.99%.

Gold Coins

Gold bullion coins are an excellent option when investing in physical gold. They often have the same quality of gold as gold bars. For example, a 99.99% pure 1 oz Canadian Maple Leaf gold coin is similar in quality to a 99.99% pure Royal Canadian Mint 1 Oz gold bar. The first difference, in this case, is the shape - one is coin, while the other is a bar.

Another difference is the price premium - how much you are paying for the gold product above the gold spot price. In general, coins have a higher price premium compared to bars. This is often also true for precious metals like silver and platinum.

The higher premiums for gold coins are due to the higher costs of manufacturing. Gold coins have details seldom found in bars, such as reeded edges, monarch effigies, legal tender statuses, and more intricate motifs. You can see how the costs add up with these features incorporated into a gold coin.

Gold coins are often minted from as small as one-tenth of a troy ounce to a maximum weight of 1 troy ounce or 31.1 grams. While their small sizes make coins highly portable, which is excellent, lowering the price premium beyond 1 troy ounce of gold requires one to consider gold bars. In general, price premiums go lower then the weight of the product increases. So, a 1-kilogram gold bar will have a much lower price premium than a 1 troy ounce gold coin.

Gold Bars

Given that the quality of gold bars is essentially the same as coins, the biggest advantage of bars is the lower premiums available when you buy products that are more than 1 troy ounce.

For example, a 1 troy-ounce bullion gold coin can be bought at a price of about 3.8% over the spot price of gold. Compare that to a 100-gram gold bar that can be bought for as low as 2.5% over spot, or a 1-kilogram gold bar with a premium of only 0.6% over spot. This price difference between bars and coins can add up if you are planning to commit substantial funds to your gold investment journey.

If your investment strategy is to accumulate the most number of gold ounces with the money you have, then buying gold bars is the most efficient way to achieve your investment goal.

Understanding The Different Types Of Gold Bars

Before you start investing in gold bars, it is important to understand the different types available in the market. The two main types of gold bars are cast bars and minted bars.

Cast Bars: These bars are made by pouring molten gold into a mold. Once the gold cools and solidifies, it is removed from the mold. This process often leaves marks and imperfections, giving each cast bar a unique appearance. Gold cast bars often have a rough texture and no design on them. They are commonly retailed without original packaging from the gold mint or refinery.

100-gram Metalor gold cast bars

Minted Bars: Minted gold bars are produced through a complex, highly controlled process to ensure precision and quality. It starts with gold being rolled into long, flat sheets. The thickness is precisely controlled to match the desired end weight of the bar. These sheets are then cut into blanks, which are the basic shape of the gold bar. The blanks are then struck in a similar way to how coins are made. This involves using a minting press that stamps the bars with designs, logos, and necessary markings. Gold minted bars are often sold in plastic blister packaging from the gold refinery or mint.

Minted gold bars in plastic blister packaging

Difference in Price Premium Between Cast and Minted Gold Bars

While a gold cast bar and a minted bar have different manufacturing processes, they are produced to the same purity. If both bars are melted in a fire assay, the gold quality would be the same. One obvious difference between gold minted bars and cast bars is their appearance, with the former having more refined aesthetics and the latter looking rougher with blemishes such as uneven surfaces, scratches, and indentations.

The other difference between these two types of gold bars is the price premium. Due to the more complex and costlier manufacturing process, the price premium for minted gold bars is higher than cast gold bars, even though they have the same quality of gold.

Both gold minted bars and gold cast bars are equally liquid and can be easily sold back to reputable precious metals dealers. Gold investors would often then decide based on aesthetic preferences and prices. Once again, if your investment strategy is to accumulate the most number of gold ounces with the money you have, buying gold cast bars is the most efficient way to go.

Deciding On The Weight Of The Gold Bar

Gold bars are available in various weights, from 1 gram to 1 kilogram. The weight of the gold bar you choose will depend on your investment goals and budget. As mentioned earlier, larger gold bars will have a lower price premium (i.e., price per gram or price per troy ounce), while smaller gold bars will have a higher price premium.

What Are Some Popular Weights for Gold Investment?

Here are some popular gold products you can consider when investing in gold bars.

1-kilogram Gold Bars: A 1 kg gold bar costs between USD $50,000 to $70,000 (depending on gold price fluctuations). This weight of gold is often the choice for investors with large amounts of funds to put into gold. The price premium for the 1 kg gold bar is the lowest, allowing them to maximize the amount of gold bought. A 1 kg gold bar is still highly portable, being smaller than an iPhone. Given their rectangular shape, they can also fill up a safe efficiently, allowing you to maximize the space in a safe.

100-gram Gold Bars: A 100-gram gold bar costs between USD $5,000 and $7,000 (depending on the fluctuations of gold prices). It is very portable, often produced to a size smaller than a matchbox. 100-gram gold bars also allow you to liquidate in smaller amounts if you decide to sell them in the future. Based on retail sales at our bullion store in Singapore, 100-gram gold bars are one of the most popular weights, given their balance between price premium, size, and budget-friendliness.

1-troy ounce Gold Bars: A 1-troy ounce gold bar costs between USD $1,600 to $2,200 (depending on the fluctuations of gold prices). It is extremely portable, having a similar size as a 100-gram gold bar but thinner. These gold bars are popular with customers with a smaller budget given that they have a better balance of premium and size than the 20-gram, 10-gram, 2.5-gram, and 1-gram gold bars.

How Can I Calculate the Differences in Price Premiums?

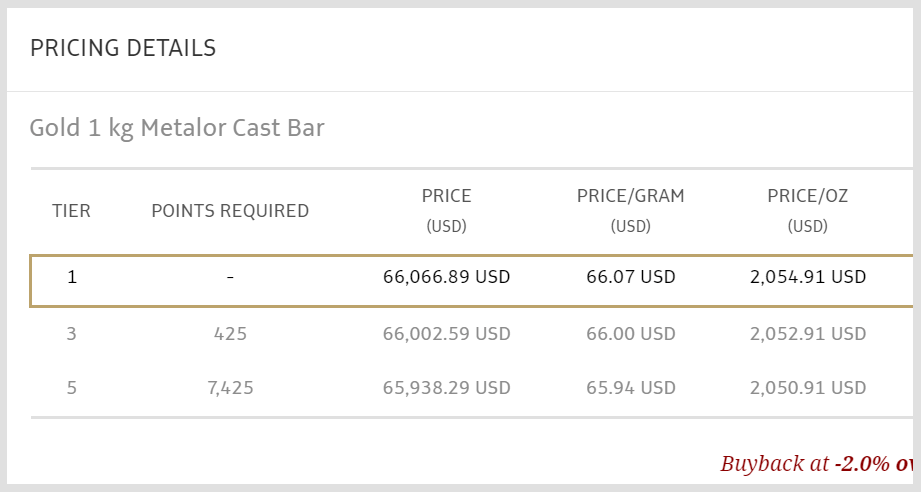

You can easily see the premiums for different gold products, without the need for calculation, from Silver Bullion's product pages (e.g. gold bars, gold coins).

The percentage next to the product's price shows you the premium over the gold spot price.

The percentage (0.6%) to the left of the Tier 1 price is the price premium

If you prefer to see the price premium differences in currency, you can click on the '% over spot, view details' link. A table with a wealth of information is displayed with the product's price per gram and per ounce.

How Can I Be Sure That the Gold Is Real?

Your best defense from buying fake gold products is to buy gold bullion from reputable precious metal dealers. By doing your own due diligence and researching a bullion dealer, you increase your chances of buying genuine gold products. Given their broad customer base, reputable gold dealers often have many third-party online reviews. Reading such reviews can give you a better idea of how reliable the precious metal company is.

Reputable bullion dealers have often been in the precious metal business for many years and have good customer support that can be reached either by phone or email. Due to their stature in the gold industry, they often have direct suppliers who are the gold mints, refineries, or precious metal wholesalers. These companies have their reputations and businesses at stake and are not incentivized to risk all that by selling counterfeit gold. Rather, avoid buying gold bullion from unknown individuals or entities in online marketplaces, especially if the products are offered at good prices.

At Silver Bullion's retail store, our staff often weigh and test purchased gold products with high-precision scales and the Precious Metal Verifier to show customers the authenticity of their purchased gold. However, this service may not be available to other bullion dealers or if you purchase online to have the products shipped.

How Can I Compare Gold Prices From Different Bullion Dealers?

As with the purchase of other goods in our daily lives, it is a logical step to want to compare gold product prices between bullion dealers. Thanks to the advent of the Internet, most bullion dealers are listing product prices online on their websites. This allows you to compare the prices of the same gold bar across different dealers from the comfort of your home!

Payment Options

Most dealers accept cash, credit cards, wire transfers, and checks as payment for gold bars. The gold industry is a low-margin business, so extra charges are common for credit card payments. For large-sum payments, wire transfers are often the way to go.

While cash payments are available, they could be subjected to anti-money laundering reporting to authorities when payment amounts exceed certain limits in some countries.

Check payments may be subjected to clearing in the dealer's bank account first before you can pickup or receive your purchased gold.

Selling The Gold Bars

While you are reading this article with the intention of buying gold bars, understanding how you can sell gold bars in the future is also important. Thankfully, the process of selling gold bars is often similar to buying gold bars.

Most reputable bullion dealers will buy gold bars back from you without questions. Unlike most products bought in our daily lives, like a television or a laptop, which have lower resale value, gold bullion bought back from customers is still valued based on the current gold price. If the price of gold had risen since the time you bought the gold bar, your bullion would have a higher value now!

Would the bullion dealer be unwilling to buy back your gold bar? This is unlikely if the dealer is a good businessperson operating a company with good cash flow. When bullion dealers buy directly from their suppliers, they will often buy precious metals above the spot price of gold. However, they can buy back gold from individual customers below the gold spot price if the current price dictates that, giving them a bigger profit when they resell the gold.

Investment-grade gold can be easily resold since government mints and private refineries are internationally recognized, making their products highly liquid. The same cannot be said of other assets, such as real estate, art, or other collectibles.

Once the gold is sold, you can receive the proceeds either in cash, check, or wire transfer, depending on the dealer's payment policy.

Conclusion

Investing in gold is one of the best investment decisions you can make to safeguard your wealth and purchasing power. Gold is one of history's oldest and most reliable forms of money. Buying gold bars and storing them safely in a safety deposit box or safe can protect your wealth from a financial system collapse. Remember that investing in gold bars is a long-term investment, and its value appreciates over time. With further research into buying gold bars, you will realize that gold investing is one of the easiest and safest ways to grow and protect your wealth!