How Much Silver Is In The World

Definition of Silver

Silver is a precious metal that has been prized for its beauty and value for thousands of years. It is a grey-white, lustrous metal that is rare in nature and has been mined and treasured throughout history. Silver is used in a wide variety of applications, from jewelry and silverware to electronics and solar panels. It is a ductile and malleable metal that is highly conductive and thermally stable. In this article, we will explore the impact of silver on the world and the corresponding availability of the precious metal.

Utilization of Silver

With unique properties that lend themselves to both industrial and artistic uses, Silver is a versatile and valuable element in our world that plays an important role across multiple industries.

One of the primary industrial uses for silver is its excellent electrical conductivity of both heat and electricity, making it a crucial component in many electronic devices varying from solar panels to cell phones. Silver is also used in electrical contacts, as it is less prone to wear and tear than other metals. With its unique antimicrobial and antibacterial properties, silver has also proven to be very useful in medical devices and appliances such as wound dressings, catheters, and surgical instruments. Lastly, silver's ability to reflect light and heat also makes it a component of mirrors and thermal insulation.

Beyond its practical uses, silver has historical significance as a monetary metal. Throughout history, silver has been used to mint coins and as a form of currency. Though it is no longer widely used as legal tender, silver is still considered a valuable store of wealth by many investors.

In addition to its industrial and monetary uses, silver has been fashioned into a wide variety of luxury goods throughout history. From jewelry to fine art to silverware, the use of silver in decorative objects is widespread. Of course, the demand for such luxury goods can fluctuate based on economic factors.

Availability & Reserves of Silver

With its wide range of uses across various industries; Silver plays an important role in our everyday lives. Knowing the supply of silver is important to understanding the demand for silver, which proposes the question of the availability and reserves of silver and how much silver we actually have left on this planet.

Availability of Silver

When examining the availability of silver, it is very hard to find an accurate number, due to the fact that large amounts of silver are discarded each year, as well as recycled, etc. In order to find the most accurate statistics, we are going to look into multiple reliable sources throughout the article.

According to the CPM group, the above-ground volume of Silver lies slightly above 1.75 million tonnes in 2018. This number seems reasonable when compared with the estimate from the United States Geological Survey (USGS), which after deducting the lost silver, came up with 1.62 million tonnes of above-ground silver in late 2018. This puts the total amount of silver throughout history in a range of 1.62 - 1.75 million tonnes.

However, not all of this silver is still available for commercial extraction, as a portion of it has been lost or used in industrial processes. As of 2021, the estimated amount of silver reserves available to be viably and commercially extracted from the world is approximately 530,000 tonnes. These reserves are a vital component of the silver market, as they play a significant role in determining the pricing of the precious metal.

Silver reserves refer to the amount of silver that is economically feasible to mine and extract at the prevailing market price. The level of reserves in a country is determined by factors such as geology, infrastructure, environmental regulations, and investment in mining technology. Understanding the level of reserves in different countries is crucial for predicting the future supply and demand of silver and its impact on pricing.

Recent developments such as the COVID-19 pandemic have affected the global silver market and its reserves. The pandemic has disrupted supply chains, leading to a decrease in the production of silver and other metals. Additionally, the increase in demand for silver in the production of solar panels and other renewable energy technologies has put pressure on silver reserves.

Production & Mining Of Silver

Silver has been a valuable precious metal for thousands of years due to its unique properties such as high ductility, malleability, and thermal and electrical conductivity. It is primarily obtained as a byproduct of metal mining activities such as lead-zinc, copper, and gold. The silver content in these ores is typically low, ranging from 0.1 to 20 grams per tonne.

The extraction of silver involves two primary methods: open-pit and underground mining

-

Open-pit mining is more commonly used for the extraction of silver due to its cost-effectiveness. In this method, large-scale equipment such as trucks, bulldozers, and loaders is used to remove the overlying rock and expose the silver ore below the surface. The silver mined is then transported to the processing plant, where it is crushed, ground, and chemically treated to separate the silver from other minerals.

-

Underground mining is used when the silver ore is too deep to be accessed through open-pit mining. The method involves the use of tunnels and shafts to access the ore body. Underground mining is more expensive than open-pit mining, and it requires specialized equipment and skilled labor.

Mexico is the largest silver-producing country in the world, closely followed by Peru, China, and Australia. Together, these countries account for the majority of the world's silver production. Mexico and Peru are particularly significant because they have been mining silver for centuries and have a long-established history of mining the metal. Other countries with significant silver reserves include Chile, Poland, Russia, and the United States.

Once the silver ore has been extracted, it undergoes a refining process to remove other impurities and metals. The extraction of silver mainly relies on flotation, cyanidation, or amalgamation.

-

Flotation is the most commonly used method to extract silver from its ore. In this process, the finely ground ore is mixed with water and various flotation reagents. Air bubbles are introduced into the mixture, and the hydrophobic silver minerals attach to the bubbles, rising to the surface as froth. The froth containing the silver-rich particles is collected and further processed to extract the silver resources.

-

In the process of Cyanidation, the ore is crushed and then mixed with a dilute solution of sodium cyanide. The cyanide solution reacts with the silver, forming a soluble complex called silver cyanide. The silver cyanide is then separated from the ore slurry and treated further to recover the silver.

-

Amalgamation is an older method of extracting silver from ore, primarily used for high-grade ores or those containing free silver particles. In this process, crushed ore is mixed with mercury, forming an amalgam of silver and mercury. The amalgam is then heated, causing the mercury to vaporize, leaving behind the silver.

Supply for Silver

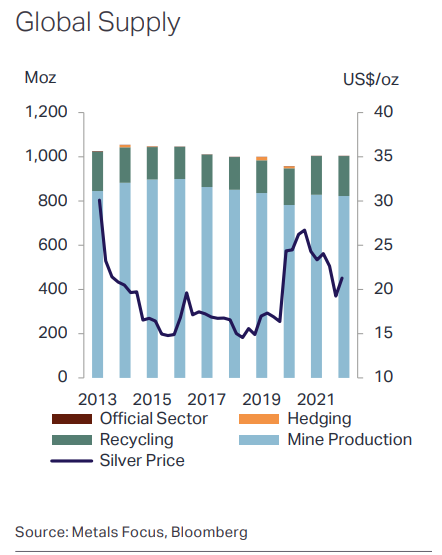

According to the Silver Institute, the global silver supply in 2022 was 822.5 million ounces and the total supply generated from recycling was 180.6, making a total of 1,004.7 million ounces of silver. Global mine production of silver in 2022 decreased by 0.6% compared to the previous year, primarily due to lower by-product output from lead/zinc mines in China and Peru.

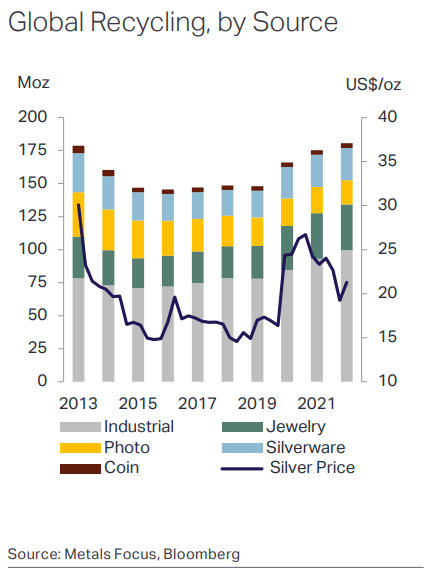

Peru experienced the largest decline in silver output due to mine suspensions, falling grades, and social unrest. Recycling activity, on the other hand, increased for the third consecutive year, reaching a 10-year high, driven by a rise in industrial scrap recycling, particularly from spent ethylene oxide catalysts.

Demand For Silver

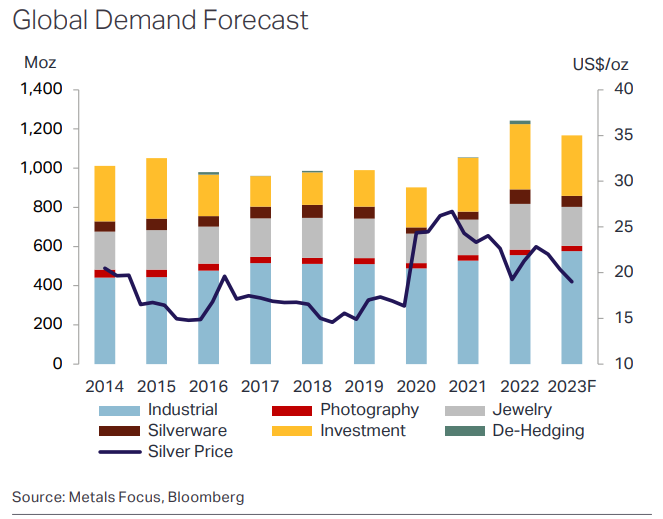

SThe demand for silver in the global market has been on the rise in recent years. Total silver demand in 2022 experienced a significant increase, rising by 18% to reach 1,242Moz (38,643t), the highest level since 2010.

Industrial demand for silver reached a new high of 556.5Moz (17,309t), driven by the growing use of silver in green economy applications, particularly in photovoltaics (PV) and electronics.

Other industrial sectors also saw growth, supported by electrification in the automotive segment, power generation and distribution investments, vehicle output, 5G network investments, and construction industry growth.

Photographic demand continued its long-term decline, reaching 27.5Moz (855t), although there were small increases in sales of consumer and professional film and paper.

Silver jewelry fabrication surged by 29% to a record high of 234.1Moz (7,280t), driven by strong demand in India, where post-pandemic pent-up demand, retailer restocking, and a shift towards higher purities led to a doubling of volumes compared to 2021. Silverware demand saw remarkable growth of 80% to 73.5Moz (2,286t), primarily driven by India, where demand more than doubled as employment and incomes returned to pre-pandemic levels.

Physical investment in silver reached a new high of 332.9Moz (10,356t), marking the fifth consecutive year of growth. India emerged as the top performer with a 188% year-on-year increase, benefiting from lower prices and anticipation of a duty hike on gold.

Silver Outlook for Supply & Demand

Extraordinary events in the economy are happening more frequently, systematic risk is increasing and therefore the market environment is forecasting a positive outlook for the silver industry. Safe haven assets like silver are expected to increase in attractiveness.

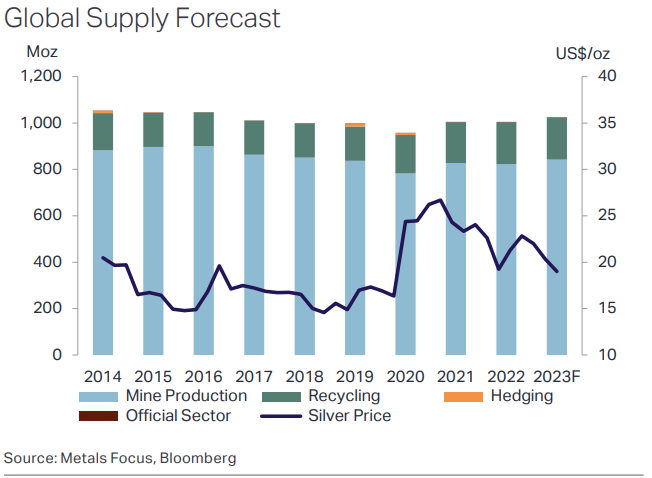

Regarding the Supply Outlook, Global silver mine production is expected to increase by 2.4% in 2023, driven by new projects coming online, particularly in Mexico and Chile. Mexico's Juanicipio project, as well as Kinross' La Coipa and Gold Fields' Salares Norte in Chile, will contribute to higher production.

Although Peru, Argentina, and China are expecting lower production due to mine closures and other factors, heading activity is expected to remain neutral. Silver recycling however is expected to continue increasing, providing the supply to cover the deficit from some of the countries.

Industrial demand for silver is expected to increase by 4% to a new record high, driven by the green economy, GDP growth, and investments in PV, power grids, and 5G networks. Photographic demand for silver is projected to continue declining, as well as jewelry fabrication with an anticipated 15% decrease, primarily due to India normalizing after the surge in 2022. Chinese demand is expected to recover, while the outlook for Western demand is mixed.

Net physical investment is expected to decrease by 7% as key markets, including the US and Europe, post a drop after a strong 2022. Demand for silver in exchange-traded products (ETPs) is forecasted to have a slight drop compared to a steeper decline in 2022.

The medium-term outlook for silver suggests rising mine production driven by higher output from established mines and new projects. However, in the longer term, around four to five years from now, a decline in mined output is expected due to grade decline and reserve depletion at existing operations. The re-start of Pan American Silver's Escobal mine in Guatemala could boost global output, but it depends on ongoing consultation with the local community.

Recycling of silver is expected to experience price-led swings for jewelry and silverware, leading to losses in the medium term and later gains. Industrial scrap recycling should see steady structural gains, while photographic recycling is expected to continue its structural decline.

Price Of Silver In The Market

The price of silver is subject to constant market fluctuations, with various factors playing a role in determining its value. Currently, there are several market trends affecting the price of silver. For instance, the ongoing pandemic has had a mixed impact on the silver market, with increased demand for safe haven investments such as precious metals like silver, alongside reduced industrial demand due to global lockdowns.

The value of silver in the market is influenced by a range of factors. One major driver is industrial demand, as silver is used in the production of a variety of electronic devices and medical equipment. Furthermore, the shift towards renewable energy sources has increased demand for silver in the solar panel industry.

Investment demand is another key factor that impacts the price of silver. During times of economic uncertainty, investors often seek out precious metals such as silver as stable asset. Additionally, production costs, supply and demand dynamics, and central bank reserves all play a role in determining the value of silver in the market.

There are numerous indicators used to track the price of silver, including spot price, futures contracts, and options contracts. Spot prices refer to the current market value of silver, while futures contracts allow investors to purchase silver at a set price for delivery at a future date. Options contracts, on the other hand, provide investors with the option but not the obligation to buy or sell silver at a predetermined price before the contract expires.

Impact Of Central Banks On Silver Reserve Levels

Central banks play a crucial role in managing the global supply of silver. These financial institutions hold significant amounts of silver reserves, which can impact the overall levels of the precious metal available on the market. By carefully managing their silver reserves, central banks can influence market prices and meet the demands of industrial and investment sectors.

One way central banks can impact silver reserve levels is through their policies and strategies toward the precious metal. Some central banks view silver as a monetary asset and hold it as a reserve alongside other precious metals like gold. These banks may actively manage their silver reserves, buying or selling the metal based on market conditions to maintain a certain level of supply.

Other central banks may hold silver reserves primarily as a means of supporting their domestic silver mining industries. In this case, the banks may have policies aimed at encouraging industrial use of silver, which can also impact overall market supply and prices.

Currently, the top 5 central banks with significant silver reserves include the United States, Germany, Italy, France, and China. The U.S. Federal Reserve, for example, holds more than 3,000 tonnes of silver as part of its monetary reserves. The bank does not actively trade silver, but rather uses it as a hedge against economic uncertainty.

Germany's central bank holds around 3,400 tonnes of silver, and has a policy of balancing its silver reserves with gold. Italy and France have similar policies, each holding around 2,500 tonnes of silver as part of their respective gold and silver reserves. China, on the other hand, has been actively acquiring silver reserves in recent years as it seeks to diversify its currency holdings and reduce reliance on the U.S. dollar.

Aside from the actions of central banks, several other factors can influence the silver market. Currency fluctuations, inflation, political instability, and changes in consumer and industrial demand can all impact the supply and demand of silver on a global scale. Understanding these factors is crucial for investors and market participants looking to gain insight into this important monetary metal.

Investment Opportunities in Precious Metals

Investing in precious metals has long been considered a safe haven for investors looking to diversify their portfolios and protect against economic uncertainty. With volatile global markets and geopolitical tensions, many are turning to precious metals like silver and gold as investment opportunities.

Gold Vs. Silver Investments

When it comes to investing in precious metals, gold and silver are two of the most popular options. Both metals have a long history of being used as currency and a store of value and are considered safe-haven assets that can protect investors during times of economic uncertainty. However, there are some key differences and similarities between the two metals that investors should be aware of.

One important metric used to compare the value of gold and silver is the gold-silver ratio. This ratio represents the number of ounces of silver it takes to buy one ounce of gold. Historically, this ratio has fluctuated between 15:1 to 100:1, with the current ratio hovering around 84:1. A higher ratio suggests that silver is relatively undervalued compared to gold, while a lower ratio suggests the opposite.

There are several factors that drive demand for gold and silver, including industrial usage, jewelry, and investment purposes. Gold is commonly used in electronics, medical devices, and aerospace technology, while silver is often used in solar panels, mirrors, and electrical contacts. Jewelry also accounts for a significant portion of demand for both metals, with gold being more popular for high-end luxury items, and silver being more affordable for everyday wear. Finally, both metals are widely held by investors as a hedge against inflation and other economic risks.

In terms of market size, gold is the larger of the two metals, with a total market value of around $12.8 trillion, compared to around $1.3 trillion for silver. However, silver is more volatile than gold, with larger price swings in both directions, which can make it more attractive to traders and speculators.

Investors have a variety of options for gaining exposure to gold and silver, including physical bullion, exchange-traded funds (ETFs), and mining stocks. Physical bullion can be purchased in the form of coins or bars and is typically stored in a secure location. ETFs offer a convenient way to invest in these metals without the hassle of physical storage, while mining stocks provide exposure to the companies that produce these metals.

Overall, both gold and silver offer unique advantages as investment options. While gold is often considered a more stable and reliable store of value, silver can offer greater potential for price appreciation due to its volatility. Understanding the differences and similarities between these two metals can help investors make informed decisions when incorporating them into their portfolios.

Types Of Precious Metal Investments Available

Investing in precious metals is a popular choice for investors looking for a safe haven and diversification in their portfolios. There are various options for investing in precious metals, from physical metals to exchange-traded funds (ETFs) and mining company stocks. Let's take a closer look at the types of precious metal investments available to investors.

One popular option is investing in physical precious metals. This includes purchasing silver and gold coins, bars, and rounds. Investors can choose to store these metals themselves or use the services of a reputable custodian. The benefit of investing in physical metals is that investors have direct ownership of their investment; however, the downside is that storage costs can add up.

Another option is investing in precious metals through exchange-traded funds (ETFs). These funds hold a basket of precious metals and trade on an exchange, allowing investors to buy and sell shares similar to stocks. ETFs can give investors access to the precious metals market without the hassle of purchasing and storing the physical metal. When you invest in precious metals ETFs, you don't physically own the underlying metals. Instead, you hold shares in the ETF, which represent an indirect ownership stake. If you prefer to have direct ownership of physical precious metals, such as gold or silver, ETFs may not fulfill that desire.

Mutual funds that specialize in precious metals are also available for those who prefer a more diversified investment approach. These funds invest in various precious metal securities, such as mining stocks and ETFs. Mutual funds can provide investors with exposure to a broad range of precious metal investments, making it a convenient option for those who want to invest in precious metals without focusing on individual companies. Similar to ETFs, the downside to mutual funds is a lack of physical ownership.

Investing in mining company stocks is another option for those looking to invest in precious metals. These stocks offer exposure to the companies that produce precious metals. The performance of these stocks is often tied to the price of the metals they mine, which can make them volatile. However, investing in mining companies can offer potentially higher returns compared to investing in physical metals or ETFs. Here the downside is a company-specific risk since these companies are not only driven by the success of precious metals but also by shareholder decisions and exposure to equity markets.

Lastly, investors can also invest in precious metals by purchasing shares in a precious metals royalty company. These companies provide funding to mining companies in exchange for a percentage of their revenue. This can provide investors with exposure to the precious metals market while also potentially offering stable income streams.

Monetary Metal Vs. Industrial Metal Utilization

Monetary metals, such as gold and silver, have been used as a store of value and a medium of exchange for centuries. In contrast, industrial metals, such as copper and aluminum, are primarily used for their physical properties in various industrial applications.

While both types of metals are important in their respective markets, their utilization and demand dynamics are very different. Monetary metals are often seen as a safe-haven investment in times of economic uncertainty or geopolitical tensions. This is because they are resistant to inflation and their value tends to hold up in times of market turbulence.

On the other hand, industrial metals are more closely tied to global economic growth and activity. As such, their demand can fluctuate greatly depending on economic conditions and industry demand. For example, copper is used in construction and electrical wiring, and therefore its demand is closely tied to the housing and electronics industries.

Another key difference between monetary and industrial metals is their pricing. Monetary metals are often priced based on global supply and demand dynamics, as well as geopolitical and economic factors. Industrial metals on the other hand, are more closely tied to their cost of production, as their primary use is in production processes rather than as a store of value.

In recent years, some metals, such as silver, have seen an increase in industrial demand due to their use in solar panel production. This has led to a shift in the supply and demand dynamics of these metals, affecting their pricing and market outlook.

Overall, while both monetary and industrial metals are important in their respective markets, investors should take note of the differences in their utilization and demand dynamics. This can help in making informed investment decisions and understanding the various factors that can affect their prices and overall market outlook.

Long-Term Investment Strategies With Precious Metals

Investing in precious metals, particularly silver, can be a smart addition to any long-term investment strategy. Not only do precious metals serve as a diversification tool, but they also act as a hedge against inflation. With its limited and finite supply, silver has maintained its value over time, making it a safe-haven investment in times of economic or political uncertainty.

One popular strategy for investing in precious metals is dollar-cost averaging. This involves investing a consistent amount of money into the market at regular intervals, whether the precious metals market is up or down. By doing this, an investor will purchase more precious metals when prices are low and fewer when prices are high. This can help mitigate the risks of volatility in the precious metals market.

There are a variety of forms in which you can invest in precious metals such as sovereign-minted bullion coins, rounds, and bars. These items are typically made of a high purity of silver, making them a valuable asset for investors. Furthermore, digital currencies such as exchange-traded funds (ETFs) can also be purchased. ETFs track the market performance of precious metals such as silver, making them an easy and cost-effective way to invest in silver.

Physical Attributes & Storage Methods for Precious Metals

When investing in precious metals, it is crucial to understand physical attributes and storage methods. These metals have high value, are easily transportable, and can be subject to theft or damage, so proper storage can help ensure their safety and longevity.

Different Forms & Sizes Of Precious Metals (Bars, Rounds, Coins)

The three most common forms of precious metals are bars, rounds, and coins. Bars are rectangular blocks of metal that come in a variety of sizes, ranging from small 1-ounce bars to larger 100-ounce bars. Rounds are similar to coins in that they are round in shape and often have designs on them, but they do not have a monetary denomination. Instead, their value is determined by the metal content. Coins, on the other hand, are legal tender issued by governments and are often used for their collectible value beyond the metal content.

One of the primary differences between these forms is the weight. Bars and rounds are typically sold based on weight, with the price increasing as the weight increases. Coins, however, can have varying weights and designs, which can affect their value beyond the metal content. Additionally, coins often have a higher premium compared to bars and rounds due to their collectible nature.

Another important difference is the purity of the metal. Most bars, rounds, and coins are made from gold, silver, or platinum, and their purity is measured in fineness. For example, a 1-ounce gold coin with a fineness of 99.99% means that 99.99% of the coin is pure gold. Generally, bars and rounds have a higher purity than coins due to the manufacturing process.

Collectible coins, while still valued based on their metal content, can also have additional value due to their rarity, historical significance, or unique design. These coins are often sought after by collectors and can be sold for a premium above their metal content. However, it's important to remember that collectible coins are not guaranteed to increase in value and should be researched and purchased carefully.