Best Silver Coins to Buy for Investment (Updated 2024)

It is probably safe to assume that you are reading this article because you are interested in investing in silver and may be wondering why you should consider buying silver coins or what the best silver coins to buy for your precious metal portfolio. Well, you have come to the right place, and this article will equip you with the basic knowledge of silver coins.

Before we dive into the best silver coins to buy, it is important to understand why investing in silver right now can be a wise choice.

Benefits of Investing in Silver Right Now

There are several benefits to having silver in your investment portfolio right now. They include:

Silver is a Monetary Metal

When you buy silver, you are buying a monetary metal: like gold, silver has been used as money for millennia throughout humankind's history. The use of silver as money was not due to any government decree, but it was naturally selected by free markets recognizing silver's intrinsic monetary qualities.

Silver and gold are the two precious metals that possess the qualities of money: divisibility, scarcity, portability, durability, fungibility, and a store of value. Unlike paper money, silver does not rust nor corrode.

Silver's monetary history continues to be evident in the names of modern currencies today. Currencies such as the dollar, pound sterling, peso, yuan, rupee, and ringgit have meanings related to their past silver history.

Despite being demonetized from the current monetary system, silver possesses the qualities of money and continues to be cherished as a valuable precious metal.

Silver Has a Limited Supply

Like gold, silver is classified as a precious metal. Unlike base metals which are abundant in the Earth's crust, precious metals are rare - found only in small quantities.

Silver is about 750,000 times rarer than iron and 800 times rarer than copper. In addition, silver is rarely found in significant concentrations in the ground. Rather, silver deposits are often dispersed within ore bodies of other metals, such as lead, zinc, copper, and gold. As a result, there are very few primary silver mines worldwide. Instead, silver is often mined as a byproduct in mines where the primary focus is extracting other more abundant and economically valuable metals.

In deflationary periods reducing base metal output, silver production is often affected, resulting in less silver coming on the market. With insufficient primary silver mines, it is also difficult for the industry to ramp up silver production to meet potential demand spikes.

Unlike fiat money, in which central banks can create unlimited quantities, silver supplies cannot be increased at will. If silver demand outpaces supply, market equilibrium is often reached with a corresponding rise in the silver price, benefiting silver investors.

Silver Has Myriad Uses

Besides being a precious monetary metal, silver is incredibly valuable and useful as an industrial metal. Silver is the most conductive metal on Earth. Although most electronic products and electrical fittings use copper as conductors, silver is used sparingly in areas where conductive efficiency cannot be compromised since it is a more expensive metal.

Silver usage is rising with the proliferation of mobile devices in our modern age. The increasing emphasis on the importance of the green economy is also leading to growing silver usage in the photovoltaic industry, which makes solar panels and electrical vehicle batteries.

As vehicles become more computerized, the number of vehicular silver-coated contacts and silver membrane switches is increasing. The Silver Institute estimates that over 60 million ounces of silver are used annually in motor vehicles. This figure is expected to rise to 90 million ounces used by the automobile industry by 2025.

In addition, silver is often used in medical applications, such as breathing tubes, catheters, surgical tools, and bandages, to take advantage of its antibacterial properties.

Excellent Portfolio Diversifier

Portfolio diversification is a common strategy to spread investments in different asset classes to limit risks to the overall investment portfolio.

Physical silver, like silver coins and bars, is an excellent portfolio diversifier. With most financial assets in digital form, like stocks, exchange-traded funds (ETFs), and bonds, physical silver stored securely does not have any counterparty risk. Should there be a repeat of the 2008 Global Financial Crisis, potentially collapsing the banking and financial system, physical silver coins and bars held in your possession are unaffected.

Even among tangible and hard assets, silver is unmatched in liquidity and portability. With a transparent international spot price, silver bullion owners can easily sell their coins through a bullion dealer and receive the proceeds within 1 to 3 days. The same cannot be said of other hard assets such as real estate, art, or precious gems.

High Gold Silver Ratio

The gold-silver ratio (GSR) is obtained by dividing the gold price by the silver price. When tracked over the long term, this ratio reveals periods of overvaluation and undervaluation of gold and silver.

At the time of writing, the prices of gold and silver are around $2,400 and $30, respectively. Therefore, the gold-silver ratio is 80.

On a long-term gold-silver ratio chart, a GSR of 80 shows silver is undervalued compared to gold. Since 1985, the ratio has declined to 50 or lower every time it hits 80 or higher. If gold rises to $3,000, a GSR of 50 means a silver price of $60, doubling from current prices.

Given that long-term trends are more stable trend indicators, we can reliably conclude that buying silver at high GSR levels (e.g., 80 or more) is investing in silver when it is undervalued.

How Our List of Best Silver Coins Was Selected

Before we reveal our best silver coins list, we want to also explain how the selected coins were selected from the many silver bullion coins available on the market. Given our experience retailing investment-grade silver for over a decade, we believe bullion silver coins are first purchased for wealth protection as a hedge against currency devaluation and collapse. Bullion coins are not collectibles. They were never intended as collectibles and, therefore, are not meant to be free from scratches. Instead, a silver coin gives you a full troy ounce of the solid precious metal at 99.9% fineness.

From this perspective, here are the criteria for determining the best silver coins for investment.

A. International Recognition

Our top assessment criteria for the best silver coins are the coins' worldwide recognition. Any consumer product that is internationally recognized fares better in terms of acceptance and resale in secondary markets than a lesser-known product.

Our selected coins are minted by the national mints (or sovereign mints) of their respective countries and have a long history of producing circulating currency and bullion products.

When you buy these sovereign mint silver coins, you are assured better liquidity should you sell them in secondary markets since they are commonly sold in many countries.

B. Quality

Sovereign silver coins represent the country's aspirations and are a source of national pride. Therefore, the mints have invested heavily in minting technologies to improve the production quality of their silver coins. For example, most of the coins in our selection are minted with anti-counterfeiting and security features using advanced lasers.

Many government mints, like the Perth Mint and the Royal Canadian Mint, guarantee the quality of their bullion coins in terms of their weight and purity.

The coins on our list are all produced by government mints, so each has a face value and is legal tender in the issuing country. Government mints are the only ones permitted to give coins a face value and legal tender status. Moreover, a "coin" is the official term for a government mint-produced product. Round-shaped bullion products produced by private mints are officially known as "rounds." They neither have a face value nor legal tender status.

When you buy the coins on our list, you can be assured that you are owning the best-produced silver coins.

C. Tax Benefits

The coins in our selection are often granted tax benefits in different countries because of their mints' reputations and production quality.

For example, UK residents have tax advantages when buying or selling UK Silver Britannia coins which are exempted from value-added tax (VAT) during purchase and capital gains tax (CGT) when sold.

Many countries worldwide also grant tax exemptions to bullion coins produced by government mints. For example, Singapore considers the coins on our list as Investment Precious Metal (IPM) and exempt from its Goods and Services Tax (GST).

However, the aforementioned silver rounds are often taxable in many countries.

D. Price Premium

When buying investment-grade bullion, the premium is the amount you pay above the spot price of gold or silver. In general, the premiums of bullion products decrease with larger coins or bars. This is due to lower production costs with larger silver products, usually bars, that can be produced to a maximum size of 1,000 troy ounces. Such silver bars often do not have a polished finish like coins and have a rough appearance.

The premium may also differ among bullion dealers, so be sure to compare prices before purchasing.

Bullion is primarily for investment purposes, so the premium you pay for silver coins should not be exorbitantly high. Therefore, our selection of coins has smaller premiums than silver jewelry, numismatics, and collectibles. A smaller premium allows quicker profit when silver prices rise.

We recommend buying the larger silver bars for investors focused on getting the lowest premiums for silver investments.

Best Silver Coins to Buy for Investment

Now that we've covered the benefits of investing in silver coins and our selection criteria, let's take a look at the best silver coins to buy when investing in silver:

1. Canadian Silver Maple Leaf

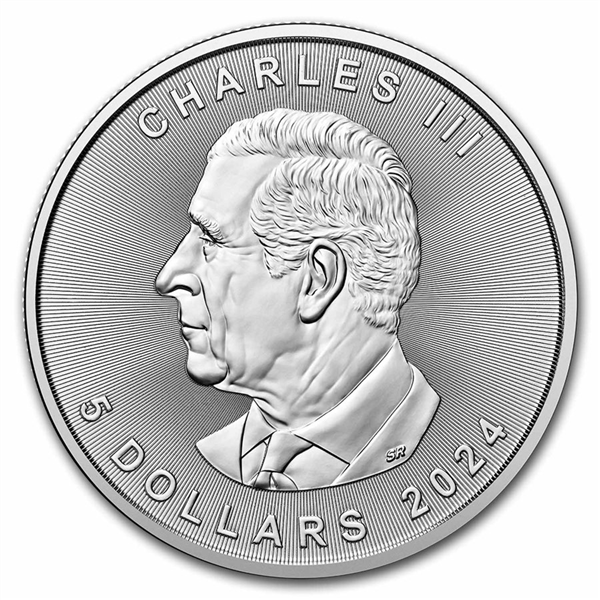

The 2024 Canadian Silver Maple Leaf coin

The Canadian Silver Maple Leaf is undoubtedly one of the world's most popular and recognizable bullion coins. The Royal Canadian Mint introduced it in 1988, and it was the first silver coin to achieve a purity of 99.99% fine silver. Each coin contains one troy ounce of .9999 fine silver and has a face value of five Canadian dollars.

The Canadian Maple Leaf silver coin's reverse features the maple leaf, Canada's national symbol, which has remained unchanged since 1988. In 2014, radial lines and a micro-engraved laser mark were introduced as security features. The radial lines are machined precisely to within microns to create a light-diffracting pattern that is difficult to counterfeit. The micro-engraved laser mark was a small maple leaf at the lower portion of the coin's reverse; within was a smaller maple leaf mark with the mintage year at the center. These fine details are only visible under magnification.

Between 1988 and 2023, the Canadian Silver Maple Leaf featured a portrait of Queen Elizabeth II on the obverse. The Queen's portrait was updated three times during her reign. Between 1988 and 1989, the coin displayed the Queen at 39 years of age; from 1990 to 2004, the Queen was shown as she was at age 64, and from 2005 to 2023, the portrait used was the Queen at 79 years old. From 2024, the silver coin's obverse bears the effigy of King Charles III.

Previously, milk spots were occasionally found on samples of Canadian Maple Leaf silver coins minted before 2018. The Royal Canadian Mint has since addressed the long-standing issue of milk spots by introducing "MINTSHIELD" surface protection.

You can purchase Canadian Silver Maple Leaf coins from Silver Bullion in a mint-sealed monster box containing 500 coins or multiples of 25 coins stored in mint-original plastic tubes.

Canadian Silver Maple Leaf monster box, each containing 20 tubes (500 coins)

2. UK Silver Britannia

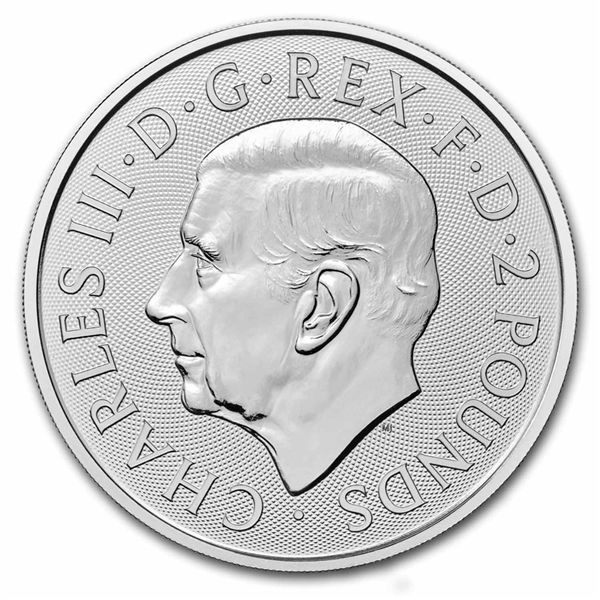

The 2024 UK Silver Britannia coin (King Charles III)

The UK Silver Britannia bullion coins have been produced by the renowned Royal Mint of the United Kingdom, the oldest mint in the world, since 1997. This popular silver coin was initially minted with 95.8% purity, only changing to a purity of 99.9% silver in 2013.

The reverse side of the UK Britannia silver coin features the iconic Britannia helmeted female warrior, a personification of Great Britain, holding a trident and a shield. While each year's release always features Britannia, there are differences in design details between coins of different mintage years.

Between 1997 and 2023, the obverse side of the coin bore the elegant effigy of Queen Elizabeth II. In September 2023, Queen Elizabeth II died, and a new batch of 2023 UK Silver Britannia coins was produced with the effigy of King Charles III. Each silver coin has a legal tender face value of 2 British pounds.

There are multiple security features in UK Britannia silver coins minted from 2021. The bullion coin's reverse has a hologram-like latent image that changes from a padlock to Britannia's trident, depending on the viewer's perspective. The waves behind Lady Britannia, finished using advanced picosecond lasers, create a surface animation of moving waves that is difficult to reproduce. The micro-text ‘Decus et Tutamen,’ which translates as ‘An ornament and a safeguard,’ created using specialist lasers, borders the design and provides both decoration and protection. Finally, tincture lines accent the Union flag on Britannia's shield, increasing the difficulty of counterfeiting the silver coin.

1-kilogram UK Silver Britannia coins were also struck by the Royal Mint in 2023, available in two versions - one with the effigy of Queen Elizabeth II, and another with the effigy of King Charles III.

You can purchase UK Silver Britannia coins from Silver Bullion in a mint-sealed monster box containing 500 coins or multiples of 25 coins stored in mint-original plastic tubes.

UK Silver Britannia monster box, each containing 20 tubes (500 coins)

3. Austrian Silver Philharmonic

The 2022 Austrian Silver Philharmonic coin

The Austrian Silver Philharmonic is Europe's best-selling silver bullion coin. The Austrian Mint, also known as Münze Österreich, introduced it in February 2008 as a silver version of the better-known Vienna Gold Philharmonic coins, which had been produced since 1989.

The Austrian Philharmonic silver coin is the sole European bullion coin denominated in euros. It is legal tender only in Austria and has a face value of €1.50.

While the Austrian Philharmonic gold coins are minted with a reeded edge, the silver version has a smooth edge, making it unique among the world's most popular bullion coins. The silver bullion coin was designed in honor of the Vienna Philharmonic Orchestra, one of the most renowned in the world.

The reverse side of the Austrian Silver Philharmonic coin features a selection of musical instruments, including a cello, bassoon, Vienna horn, harp, and four violins.

The coin's obverse features the pipe organ from the Musikverein Golden Hall, the home of the Vienna Philharmonic Orchestra. Like the American Silver Eagle coin, the silver purity is not shown as a percentage but as 'feinsilber,' which is German for fine silver, indicating 99.9% fineness.

The Austrian Silver Philharmonic is the only silver coin on our list with no security features at the time of writing. Regardless, they can be easily authenticated using non-destructive testing methods for precious metals.

You can purchase Austrian Silver Philharmonic coins from Silver Bullion in a mint-sealed monster box containing 500 coins or multiples of 20 coins stored in mint-original plastic tubes.

Austrian Silver Philharmonic monster box, each containing 20 tubes (500 coins)

4. Australian Silver Kangaroo

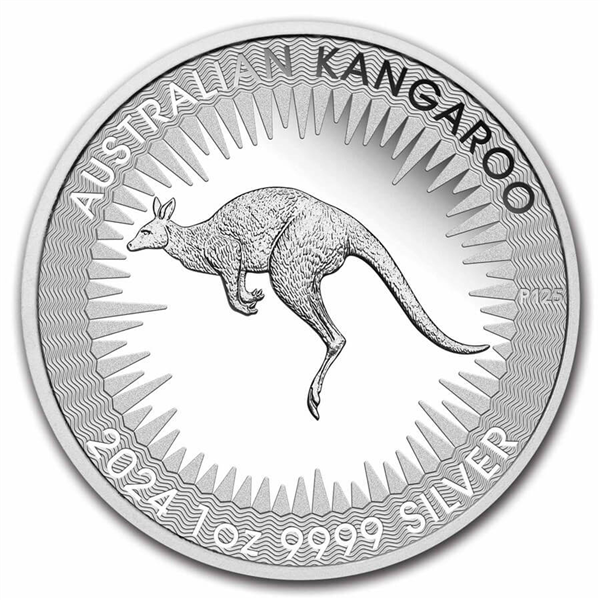

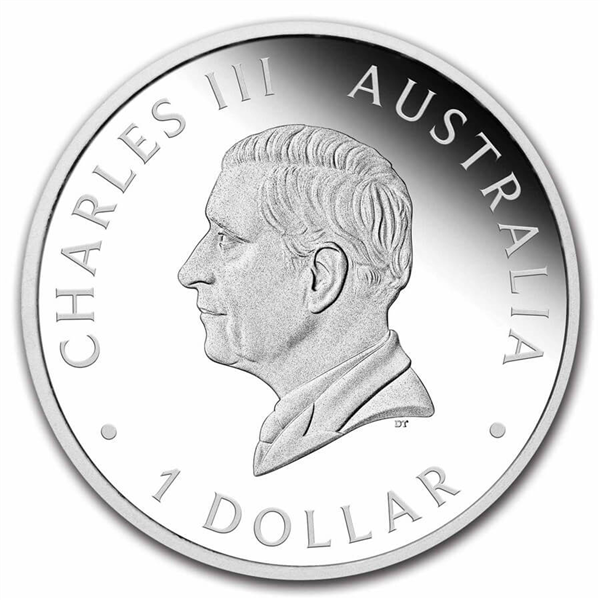

The 2024 Australian Silver Kangaroo coin

The Australian Silver Kangaroo silver coin, produced by The Perth Mint since 2015, is part of the mint's Australian Bullion Coin Program to showcase Australia's unique wildlife.

The silver coin's reverse features a bounding kangaroo in the middle of stylized sunlight rays, with the Perth Mint's 'P' mintmark near the kangaroo's tail. Australian Silver Kangaroos released between 2015 and 2023 feature the effigy of Queen Elizabeth II on the obverse. Since 2024, the coin's obverse portrays the effigy of His Majesty King Charles III. With each annual release of the Australian Silver Kangaroo coin, the reverse and obverse designs of the coins have remained unchanged.

The Australian Kangaroo silver coin is designed with anti-counterfeiting features to make counterfeiting difficult. The radial lines on both sides of the coin are difficult to reproduce with less sophisticated minting equipment. In addition, the Silver Kangaroo coin also features a micro-engraved "A" found within one of the letters in the coin's AUSTRALIAN KANGAROO heading as an authentication feature.

For example, the micro-engraved "A" was found in the first "A" of AUSTRALIAN of the 2016 Australian Silver Kangaroo coin. In 2017, the micro-engraved "A" was found in the third "A" of AUSTRALIAN.

You can purchase Australian Silver Kangaroo coins from Silver Bullion in a mint-sealed monster box containing 250 coins or multiples of 25 coins stored in mint-original plastic tubes.

Australian Silver Kangaroo mini monster box, each containing 10 tubes (250 coins)

5. American Silver Eagle

The 2024 American Silver Eagle coin

The American Silver Eagle is one of the most popular silver coins for investment and is the official national bullion silver coin of the United States. It was first introduced in 1986 through the American Eagle Coin Program, along with the American Gold Eagle bullion coin.

The American Eagle silver coin has since become highly recognizable worldwide and is considered one of the most beautifully designed silver coins. While it does not show its silver purity explicitly like many other bullion coins, the American Silver Eagle has the words '1 Oz Fine Silver' inscribed on it, indicating one troy ounce of silver and 'fine silver' meaning .999 fineness. The silver coin has a legal tender face value of one dollar.

The coin's obverse features the iconic Walking Liberty design, sculpted by Adolph A. Weinman. It shows an elegant Lady Liberty striding confidently towards the rising sun with the American flag draped on her shoulders. For American Silver Eagle coins produced before 2021, the reverse side depicts a symmetrical eagle clutching an olive branch in its right talon and arrows in its left talon. Silver bullion coins produced from 2021 feature a new reverse design of a striking heraldic eagle with both talons clutching an olive branch, symbolizing peace.

In addition to the reeded edge of the coin, American Eagle silver coins produced from 2021 onward also have missing reeds or notches as an anti-counterfeiting security feature.

Among the five silver coins we have recommended, the American Silver Eagle often has the highest premium.

You can purchase American Silver Eagle coins from Silver Bullion in a mint-sealed monster box containing 500 coins or multiples of 20 coins stored in mint-original plastic tubes.

American Silver Eagle monster box, each containing 25 tubes (500 coins)

Conclusion

Investing in silver coins can be a wise choice for those looking to diversify their investment portfolio and have a tangible asset they can hold in their hands. The five silver coins mentioned above are some of the best options to consider when investing in silver. They are all highly recognizable, easy to buy and sell, and have the potential to appreciate over time.