5 Key Takeaways From the 2024 Central Bank Gold Reserves Survey

The Central Bank Gold Reserves Survey, published annually by the World Gold Council (WGC) since 2018, compiles central bank responses to questions regarding gold reserves management. When compared to past surveys, it reveals changes in central bankers’ attitudes toward gold and hints at the monetary system trends that could develop in the next few years.

Since the 2024 Central Bank Gold Reserves Survey was released in June, we have poured over the survey results to understand gold’s standing in the minds of central bankers. We summarize the 5 key takeaways from this year’s survey to help you understand the developing gold trends.

#1 – Central Banks Are More Positive Toward Gold

In 2022, central bank annual gold purchases reached a historic high of 1,082 tons. In the following year, central banks in various countries added 1,037 tons of gold – the second-highest annual purchase in history.

The 2024 survey noted that central banks are showing a more favorable view of gold as a reserve asset. Some 81% of central banks surveyed expect global central bank gold holdings to increase in the next 12 months, while 29% of respondents said that they intend to increase their gold reserves in the same period. The World Gold Council said these responses show “the highest level of positivity towards gold” since 2019.

Some 71% of respondents also reported higher total reserve levels than five years ago, a slight increase from the 69% reported in 2023.

Credit: WGC

#2 – Recognizing Gold as a Strategic Safe-Haven Asset

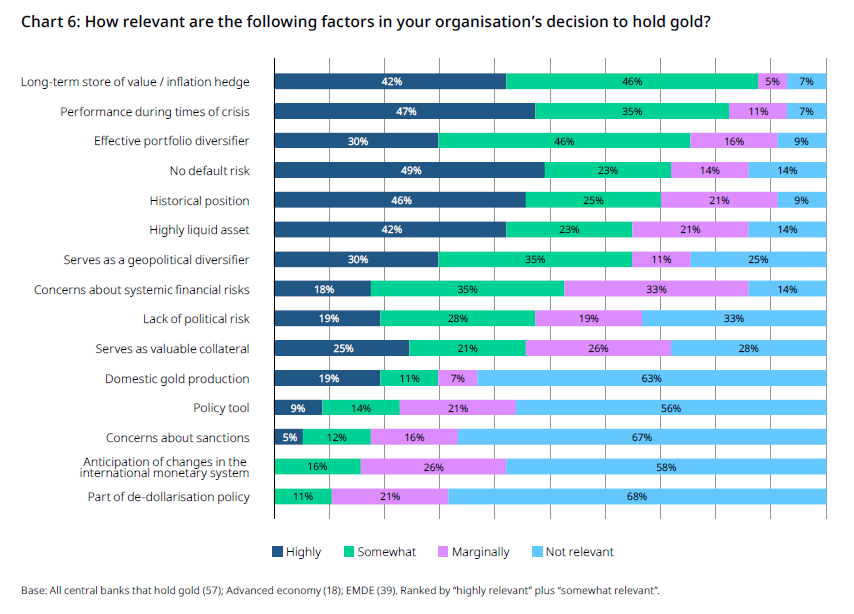

In this year’s survey, respondents cited the top four reasons for central banks to hold gold as a “long-term store of value/inflation hedge,” “performance during times of crisis,” “effective portfolio diversifier,” and “no default risk.”

Credit: WGC

According to the WGC, global central banks had more than 36,699 metric tons of gold in their reserves as of the end of 2023. While they were net sellers of gold between 2000 and 2009, central banks become net gold buyers since 2010.

Interestingly, central banks became net buyers of gold 2 years after the 2008 Global Financial Crisis (GFC) when the international financial system was brought almost to its knees.

Financial contagion from the GFC then spread to Europe, causing the 2009 to 2019 European debt crisis. Several months later, the COVID-19 crisis severely disrupted the global economy as countries began closing their borders, restricting travel, and imposing strict social-distancing measures that affected whatever economic activity was permitted.

As the world emerged from the COVID-19 crisis in 2021, goods and services demand rebounded as economies reopened. However, global supply chains were still constricted due to disruptions from countries imposing pandemic-related restrictions to contain new infection waves.

Due to the confluence of “pent-up” demand for goods that were in shortage or delayed, the prices of goods and services began rising quickly in the second half of 2021.

The outbreak of the Russia-Ukraine war in February 2022 added to these inflationary pressures. Both countries were major exporters of key commodities such as oil and gas, fertilizer, iron ore, wheat, and edible oils, and the conflict disrupted their supply. Before long, shortages of these commodities led to higher energy prices, driving up the cost of electricity and transport.

US inflation rates rose to 6.5% and 7% between 2021 and 2022, prompting the Federal Reserve to raise interest rates to between 5.25% and 5.5%—a 16-year high.

Western government sanctions on Russia due to the war also triggered mentions of the Cold War’s resurgence, increasing geopolitical uncertainty.

It is certainly uncanny that central banks became net gold buyers during the years when these crises happened. In this context, the top four reasons for central banks to hold gold make a lot of sense and are spot-on.

Furthermore, survey respondents also rated “interest rate levels,” “inflation concerns,” and “geopolitical instability” as the top 3 reasons relevant for their reserve management decisions, again matching the economic challenges brought about by the crises that have occurred since 2008.

Credit: WGC

Gold has always been a safe-haven asset and an inflation hedge, especially when we consider inflation to be the expansion of the money supply brought about by central bank money printing. Physical gold held in a secured vault has no counterparty or default risk.

Given the current geopolitical uncertainty, global central banks seem to be reducing counterparty reliance, preferring to shore up their financial strength with physical gold. The WCG survey noted that advanced economy central banks “appear to be valuing gold’s financial role to a higher degree compared to previous years.”

#3 - Increasing Pessimism About the US Dollar’s Future

The 2024 Central Bank Gold Reserves Survey also noted that more advanced economy respondents believe the US dollar’s share of global reserves will decline, increasing from 46% in 2023 to 56% in 2024.

Furthermore, 62% of respondents believe that the US dollar’s future proportion of total reserve assets will diminish in the next five years, compared to 55% in 2023 and 42% in 2022.

Credit: WGC

The survey also noted that Emerging Market and Developing Economy (EMDE) central banks had been the primary driver of gold buying since the 2008 Global Financial Crisis, and they “appear to be more pessimistic about the US dollar’s future share of global reserves and more optimistic about that of gold.”

Despite the potential sensitivity surrounding mentions of de-dollarization within central bank circles, given that it may displease the US, there was a noticeable uptick in the number of respondents indicating that the reason for their central bank to hold gold was part of their de-dollarization policy.

In the 2024 survey, 6% and 13% of advanced and EMDE central banks, respectively, selected ‘Part of de-dollarization policy’ as the reason for their central bank holding gold. No advanced economy central bank selected this option, and 11% of EMDE respondents selected it in the 2023 survey.

Interestingly, no advanced economy central bank cited “concerns about sanctions” as a reason to hold gold in both years' surveys. However, this year’s survey had 26% of EMDE respondents selecting this option—a 1% increase from the 2023 survey.

Pessimism about the future of the US dollar is growing, no doubt caused by Western government sanctions on Russia for its invasion of Ukraine. Unfortunately, freezing Russia’s dollar reserves and preventing it from using the dollar in international trade has not significantly dented Russia’s economy. This is probably due to Russia being a commodity-exporting giant.

Other EMDE nations are unlikely to match Russia’s export prowess and are rightly concerned about potential sanctions should they misstep globally. Should they reduce the dollar’s proportion of their reserve assets, what alternatives can they consider as replacement?

While the currencies of their other trade partners are a logical replacement, the counterparty risks associated with them cannot be ignored. Currencies are always dependent on the actions of the issuing countries.

A mismanaged country is likely to see its currency value plummet. Other nations could also pressure countries to reduce bilateral trade or cut ties with the sanctioned country.

Aristotle shared this view 2,500 years ago when he said, “In effect, there is nothing inherently wrong with fiat money, provided we get perfect authority and god-like intelligence for kings.”

EMDE central banks have indicated their intention to increase their gold holdings in the short term. They are likely favoring gold’s neutrality as an asset as the ultimate crisis insurance for their countries.

After all, former Fed chairman Alan Greenspan perhaps summed it up best when he said in 2014: “Gold is a currency. It is still, by all evidence, a premier currency. No fiat currency, including the dollar, can match it.”

#4 - EMDE Central Banks Getting Serious About Gold

While 29% of central bank respondents, the highest proportion since 2019, intend to increase their gold reserves over the next 12 months, the survey noted that substantially more EMDE central banks intend to increase their gold reserves than advanced economy central banks.

When asked about gold’s future share in global reserves, 75% of EMDE respondents believe gold’s share will rise, compared to 57% of advanced economy respondents.

Credit: WGC

Additionally, the survey showed that a “higher proportion” of EMDE central banks (23%) indicated that they have considered upgrading their gold holdings to meet LBMA Good Delivery standards compared to advanced economy central banks (11%).

When asked if central banks have considered establishing a domestic gold purchase program to add gold from mining supply produced within their countries, only EMDE central banks responded either by saying that they have considered establishing a domestic gold purchase program (7%) or they already have such a program in place (26%). No advanced economy central bank has indicated that it has a domestic gold purchasing program or is considering establishing one.

When these EMDE central bank responses are viewed together, it is hard to ignore that they are increasingly serious about gold as a reserve asset. Not only are they buying gold from the international market, but they are also planning to extract gold from their own countries to add to their reserves.

The World Gold Council’s Gold Demand Trends report also supports this view. Annual data on sovereign gold purchases show that EMDE central banks have been the primary drivers of gold buying since the 2008 Global Financial Crisis.

With discussions on de-dollarization becoming common and a changing world order on the horizon, EMDE central banks could be increasing their gold reserves in preparation for the day when they may need to choose a side—either with the US bloc or the China bloc. Substantial gold holdings could guarantee a seat at the big boys’ table when a new global superpower emerges and establishes a new world order.

#5 – The Bank of England is the Most Popular Central Bank Gold Storage Location

Some 55% of respondents said that they vault their gold reserves with The Bank of England (BoE), making it the most popular storage location for central bank gold again since 2019.

The Bank of England holds the second-most gold in its vaults after the Federal Reserve Bank of New York. According to the BoE, the Bank’s vaults only hold around 6% of gold on behalf of the UK Treasury. Most of the approximately 400,000 bars stored in BoE’s nine vaults in Threadneedle Street are held on behalf of other central banks and certain commercial firms.

The survey’s second most selected storage location was ‘domestic storage,’ which saw a moderate uptick from previous years. Some 41% of respondents said they are storing some gold reserves in their countries.

The Bank of International Settlements (BIS) and the Federal Reserve Bank of New York were the third and fourth most popular gold storage locations, respectively.

LBMA Good Delivery gold bars remain the most common way for central banks to hold gold. They are the choice for 100% of advanced economy respondents and 94% of EMDE respondents.

This article was originally published at: https://thereserve.sg/articles/5-key-takeaways-from-the-2024-central-bank-gold-reserves-survey