When The Global Silver Shortage Arrives… It Will Be Too Late

When this occurs, individuals running to their local coin shop or calling a precious metal dealer on the phone requesting to “get sum silver”, will find out there are hundreds of poor slobs waiting in line before them. Now, when I say “poor slobs”, I am not being derogatory here. I am just using a term suitable for the masses by the banking elite.

Investors need to realize, this will be nothing like the 1979-1980 time-period when Americans stood in line to purchase silver as the price surged to $50. We must remember, this huge silver buying frenzy was mainly focused in the U.S. and a few western countries. Furthermore, most Americans had very little debt in 1980, and the total U.S. Retirement Market was only worth $1 trillion compared to $25 trillion today.

Orthodox Analysis Will Not Prepare You For What’s Coming

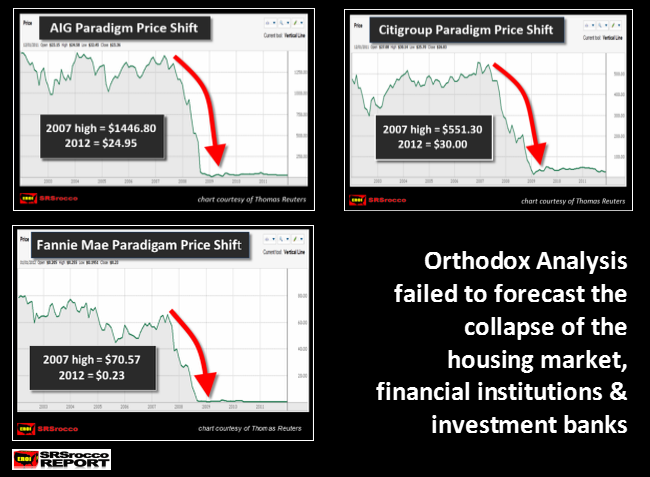

If we look at the chart below, we can see the failure of Wall Street and the Main Stream Media (MSM) to warn investors of the impending disaster in 2008. In less than a year’s time, the U.S. suffered a collapse of the housing market, financial institutions and investment banks:

The once proud AIG – American Insurance Group, saw its stock price fall from a high of $1,155 (chart figure above is incorrect) in 2007, to a low of $25 in 2008. Citigroup’s stock went from a high of $551 in 2007, to a low of $30 in 2008. Even though Citigroup’s stock has gone up a bit lately, its current price of $55 is still 10 times less than its high reached in 2007.