The Coming Market Crash Will Wipe Out Global Silver Supply

Precious Metals by SRSrocco

Global Financial turmoil and low silver prices motivated experienced precious metals investors to purchase record amounts of silver. However, the market is starting to see a huge inflow of new and first-time gold and silver buyers. According to Money Metal Exchange, they experienced a 365% increase in first-time buyers over the past 45 day period (June 16th-July 31st).

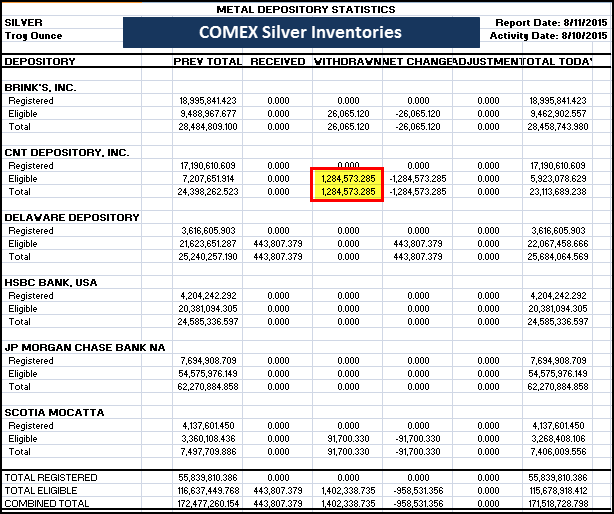

This recent surge in buying has put a huge dent in the retail physical silver market and is now impacting the wholesale market. The COMEX suffered another large 1 million oz (Moz) withdrawal from its warehouse inventories today:

The CNT Depository had 1.28 Moz of silver taken out of its Eligible category. When we add up the other small withdrawals and the 443,807 oz deposit, the net amount of silver removed from the COMEX was 958,531 oz. Almost another cool million ounces of silver removed in just one day.

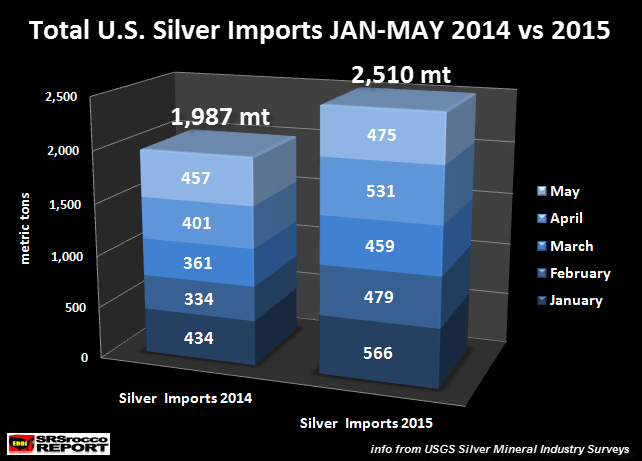

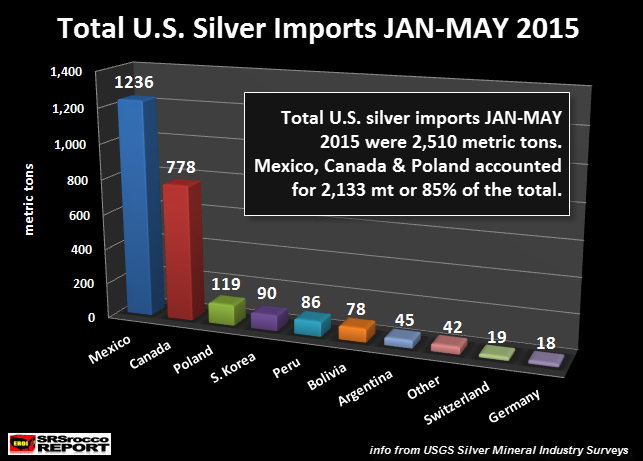

Then we had a new update on U.S. silver imports from the folks at the USGS. According to the data for May, the U.S. imported another 475 metric tons (mt) of silver. If we add up all U.S. silver imports JAN-MAY, it turns out to be a whopping 2,510 mt (81 million oz).

As we can see, total U.S. silver imports year to date (2,510 mt) are 523 mt greater than the same period last year (1,987 mt). Thus, silver imports are 26% higher than they were during the first five months of 2014 and are on track to reach 6,000 mt in 2015. This continues to be a surprise because the U.S. market demand for silver is probably less than it was last year.

However, the Silver Institute recently published a news release stating that U.S. silver jewelry imports increased 11% in the first five months of 2015. Now, silver jewelry imports are not stated as either “silver bullion” or “silver Dore Bars” in the USGS import data.