Surging Solar Panel Installations are Draining Global Silver Reserves

Why 2023 is a Watershed Year for Silver

In our June 2023 article "Silver's Undervaluation", I described the relentless and growing silver demand from the photovoltaic (PV) industry and how it accelerates silver deficits, leading to a fall in reserve stocks that must eventually lead to strong price appreciation.

As 2023 comes to an end, it has become clear that Photovoltaic growth has been much stronger than anticipated and is also set to grow much faster than expected. For the silver market, this seemingly unsatiable growth is a game changer that few people appreciate at this stage.

The Key Insights

These factors will create profound and certain—yet mostly unrecognized—demand pressure on physical silver markets in the coming years.

1. Photovoltaic panel demand growth is driven by economics now in a self-reinforcing process.

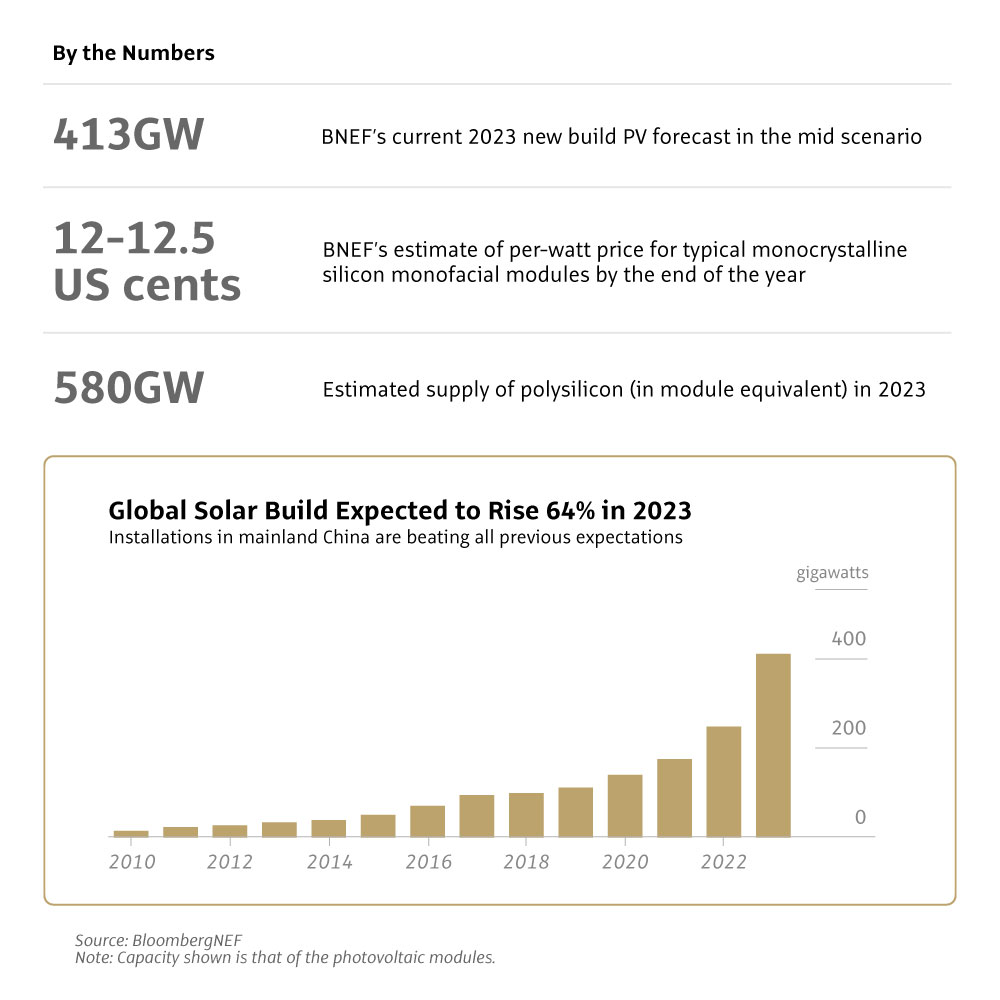

Consistent price falls per watt have made photovoltaics the lowest-cost source of electricity in most markets in 2023. In 1977 it took 105 USD for a watt of solar generation, by 2019 this had fallen to 0.25 USD and by late 2023 the price had halved again to just 12.5 cents. Intense competition, technology advances, and efficiencies of scale keep pushing costs lower, driving installation demand higher. Photovoltaics also remove geopolitical risk as they don’t depend on ongoing foreign energy imports and don’t produce CO2.

2. Photovoltaic panel production capacity is immense and growing.

And it's growing well beyond existing demand estimates, ensuring that panel prices are unlikely to rise. Bloomberg NEF estimates that 839 GW of yearly production capacities became available in late 2023, twice the 413 GW estimate of installations throughout 2023, and more investments are being made. Polysilicon – whose scarcity restricted panel growth in 2022 – is now also over-produced at 580 GW in 2023, representing a 40% overcapacity. Despite polysilicon overcapacity global production is set to increase by another 135% in coming years to keep up and sustain growth.

3. Each Gigawatt (GW) of solar panel capacity requires about 700,000 troy ounces of silver.

Bloomberg NEF estimates released November 30th, 2023 imply that panel installations have roughly tripled from 2020, when about 100 million ounces of silver were needed (according to The Silver Institute), to around 413 GW, now implying that around 300 million troy ounces of silver were consumed in 2023, likely representing ~30% of global silver supply. As photovoltaic production grows this demand is only going to increase.

Much of the above numbers come from the Global PV Market Outlook, 4Q 2023 by Bloomberg NEF.

Manufacturers Doubling Down

Most observers would expect that, given the oversupply, photovoltaic capacity investments would now be put on hold or slowed; yet the opposite is happening. Big manufacturers are doubling down on their investments, seemingly assured of further strong demand growth and in a quest to improve efficiencies and squeeze out competitors.

This is exemplified by Tongwei, the world’s largest manufacturer of polysilicon, who just announced on December 26th the construction of their new 3.9 billion USD mega-factory, capable of producing 400,000 tonnes of polysilicon, by-itself representing a 35% increase in global capacities (as of 2023).

Tongwei’s new factory is part of an even larger 1.5 million ton (136%) production capacity increase has been announced or under construction. These vast capacity investments mean solar panels are likely to become even cheaper, further improving the economics of deploying them. Innovative approaches, such as gravity batteries, are also addressing solar’s inability to work at night.

Source: BloombergNEF

Silver's Role in Photovoltaics

While Polysilicon capacities are set to more than double, despite overcapacities, the same does not hold true for silver.

The silver market was already experiencing a 23% deficit in 2022 and the silver supply cannot be increased in the short or medium term—as can be done with Polysilicon factory—because in most jurisdictions, it takes at least a decade to open a new mine and precious metal mining is not nearly as scalable as factories, regardless of demand.

Manufacturers have strived to minimize the use of silver in solar panels, and over the past decades, have managed to reduce silver usage per panel by about 80% while maintaining panel quality and lifespans of 25 to 30 years.

However, it is now increasingly difficult to drift away silver, and recent advancements in solar panel technology, such as TOPCon (Tunnel Oxide Passivated Contact) cells, are reversing this trend. These new technologies require substantially more silver per panel, creating even more silver demand as panels are becoming more advanced.

With the silver market already experiencing large deficits, the increased demand of physical silver by the photovoltaic industry must come from existing stocks, which will require prices to surge as stocks dwindle.

Eliminating Silver is Very Risky

Observers have been predicting the imminent substitution of silver for other metals for decades, however, production in the early 2010s has shown that eliminating silver often results in shorter panel lifespans, giving rise to expensive warranty claims by clients.

Because solar panels are expected to come with 25-to-30-year warranties, solar producers are exposed to huge liabilities if their panels fail halfway. In a scenario where premature copper oxidation degrades the panel a decade after manufacture the producer might be facing warranty claims spanning an entire decade worth of production. Few companies would be able to survive such a mistake, and very few are willing to take such a risk of eliminating silver.

In fact, I believe silver may become the primary bottleneck in panel production in the future as easily accessible silver stocks are used by the rapidly growing Photovoltaic industry.

A solar power plant in Dunhuang, China.

Silver's 2023 Supply Paradox

While physical silver photovoltaic demand is soaring, most investors, as evidenced by outflows from silver Exchange-Traded Funds (ETFs) and falling retail bullion premiums, have been net sellers of silver in 2023.

This creates a supply paradox as industrial silver, especially silver granules, are becoming harder to source while bullion dealers are typically well stocked. This offsetting effect might have been the reason that silver prices were relatively stable in 2023, having risen about 2% since the start of the year.

When industrial users are unable to source the quantities silver granules needed, they will typically resort to 1,000 troy oz good delivery bars as the next best, lowest premium volume silver source. Future and metal exchanges tend to be one of the sources for such industrial users.

Futures & Metals Exchanges Inventories are Falling

It is therefore interesting to look at 1,000 troy oz silver reserves held at major public exchanges over the past years, which reveals that COMEX Registered Stocks, Shanghai Gold Exchange (SGE), and LBMA Vaults have experienced big declines in their inventories since their 2020/2021 reserve peaks. In particular:

|

Vault |

Peak (2020-2021) |

Current (2023) |

Change |

| SGE | ~5,200 tons (167 m/oz) | 1,400 tons (45 m/oz) | -73% |

| COMEX | ~4,660 tons (150 m/oz) | 1,400 tons (45 m/oz) | -70% |

| LBMA London | ~3,800 tons (122 m/oz) | 2,600 tons (84 m/oz) | -32% |

How much of these stock reductions are related to photovoltaic producer demand is not clear, but it seems reasonable to assume that being the fastest growing and largest industrial consumer of silver, the photovoltaic industry demand is increasingly sourcing silver from exchanges.

Once surging silver demand exceeds their existing offtake contracts from mines and refineries, industrial users will increasingly try to secure future silver mining supplies and, where needed, take delivery of LBMA good delivery bars.

Silver Primed to Rise

The strong growth in silver demand due to PV applications is not yet fully appreciated by the broader investment community. However, as this reality becomes more widely recognized, investment demand for silver is likely to return, which will push prices up quickly.

I personally believe that photovoltaics have fundamentally and permanently changed the silver market in 2023 and a broader market awareness of these supply and demand imbalances will come in 2024.

Investors who recognize and act on these dynamics are will be well-positioned to benefit from the upcoming changes in the silver market, especially if they're long-term, fundamental investors like many in our community.

Gregor Gregersen, founder & CEO of Silver Bullion, Singapore.

Why LBMA 1000 oz Silver Bars

LBMA 1000 oz silver bars, which have some of the lowest premiums in the industry and are currently well-stocked, is what most of my personal silver holdings consist of.

Our 14 years of dedication to Systemic Wealth Protection has allowed us to cultivate relationships and infrastructure that open doors globally. As the first-ever London Bullion Market Association (LBMA) affiliate member in Southeast Asia, Silver Bullion has carved out a unique position to provide our clients access to LBMA bars at low premiums.

We currently offer our LBMA 1000 oz silver bars for just USD 0.60/oz over spot. Click here to view them.

Sincerely,

Gregor J. Gregersen

Founder, Silver Bullion Pte Ltd