Global silver output running low — report

“We’re just not seeing the investment in new mine capacity that would be needed to sustain continued record peak production,” Andrew Leyland, an analyst with GFMS who worked on the report, told The Street.

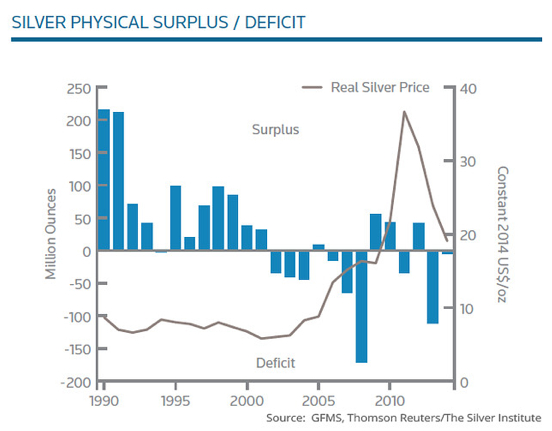

Weak silver prices are to blame, the report says. The precious metal lost 20% of its value last year, closing at $15.70, and dropped 36% in 2013, exceeding the losses in gold and other precious metals. In the year through Tuesday silver prices have recovered by 6.2%, but they are still close to the five-year low of $15.365 an ounce set in March. About 70% of the global silver supply is produced while mining other metals, especially gold, copper, lead and zinc. Weak prices for these commodities are also likely to weigh on silver supply going forward, the report adds.