105 Trillion Reasons To Own Silver

You see, investors no longer understand what a “Store of Value” is anymore. Back in the day, if a person wanted to save something for retirement, they would put away gold and silver coins. So when they retired, they would cash in these gold or silver coins for goods and services.

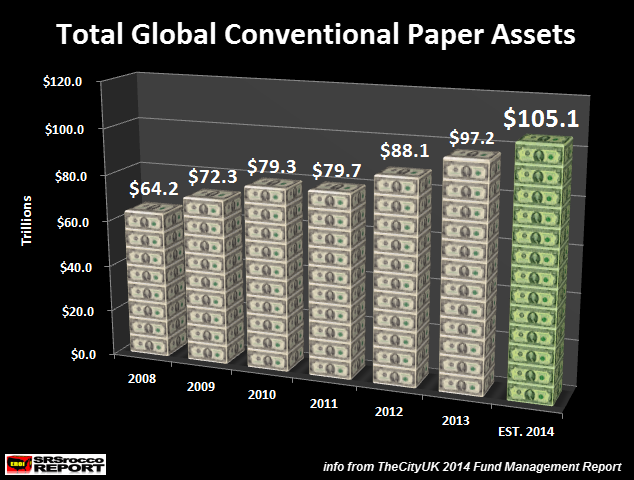

Today, the overwhelming majority of individuals have their funds invested in DIGITS or PAPER ASSETS in one form or another. Just how large is the total Global Conventional Paper Assets under management?? Look at the chart below:

According to the CityUK 2014 Fund Management Report, total global conventional assets under management increased from $97.2 trillion in 2013 to an estimated $105.1 trillion in 2014. That’s a lot of paper and digits.

Investors have switched their faith from owning physical stores of value such as gold and silver to a more sophisticated highly leveraged system based on paper a digits. The institutions that create, package and sell these supposed financial products (garbage) label them as ASSETS. Unfortunately for the naive masses, these are not assets, but rather future IOU’s.

On the other hand, a real asset is a silver coin. Here’s why.