All You Need To Know About Borrowing

Unlock liquidity when you need it and on the terms you and your lender agree in a free bid / ask market, while maintaining ownership of your metal. Loan amounts vary from as little as 3,000 USD to 2,000,000 USD or higher.

Lenders are other clients willing to lend funds while Silver Bullion acts as escrow agent, custodian and platform operator and will handle all the details between the borrower and the lender. Review the “Things to know about Secured Lending” if you are interested to lend yourself.

Any active S.T.A.R. storage customer owning parcels can:

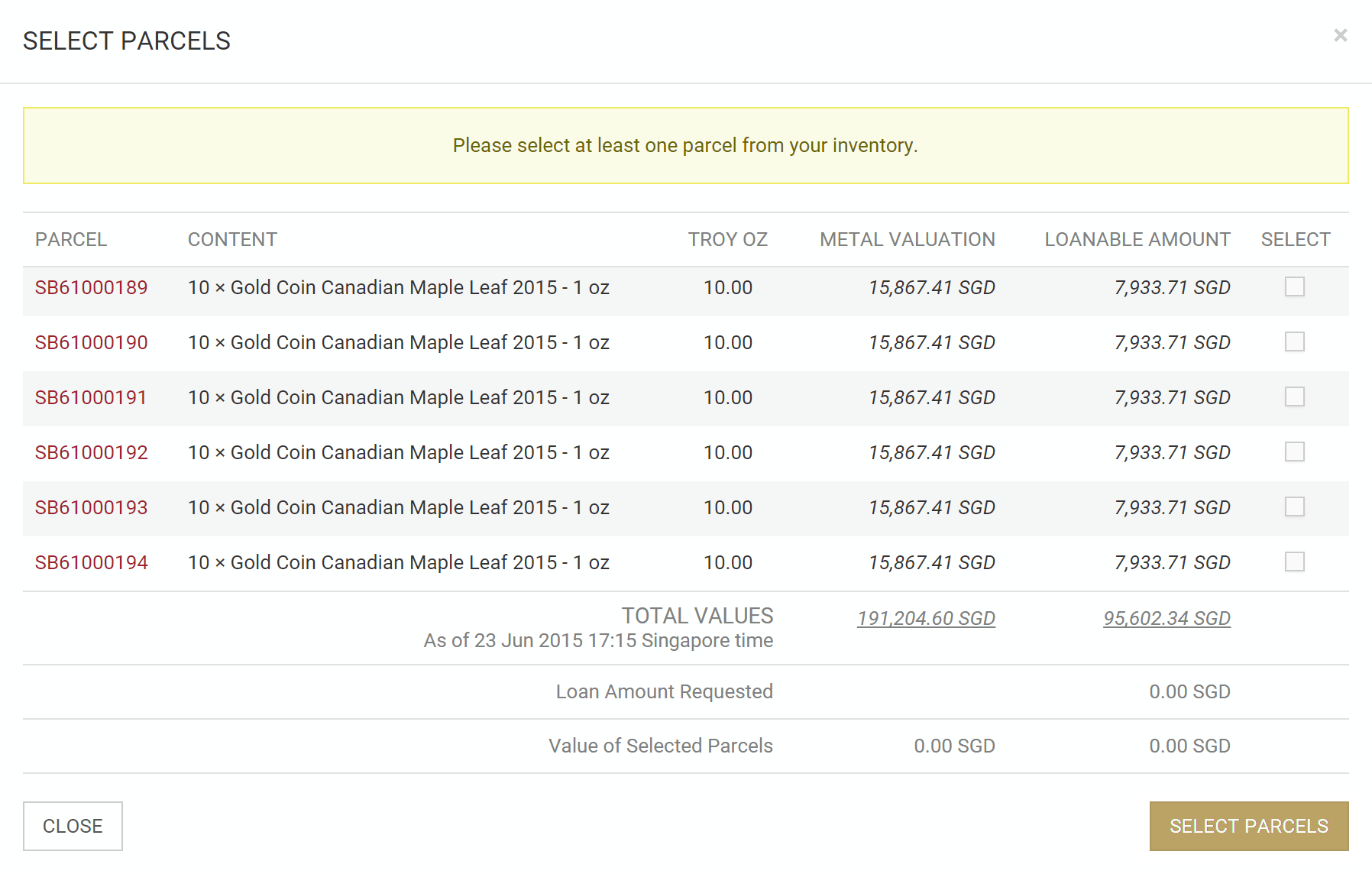

Use their parcel as collateral to get up to 62.5% of its value in USD, Euro or SGD.

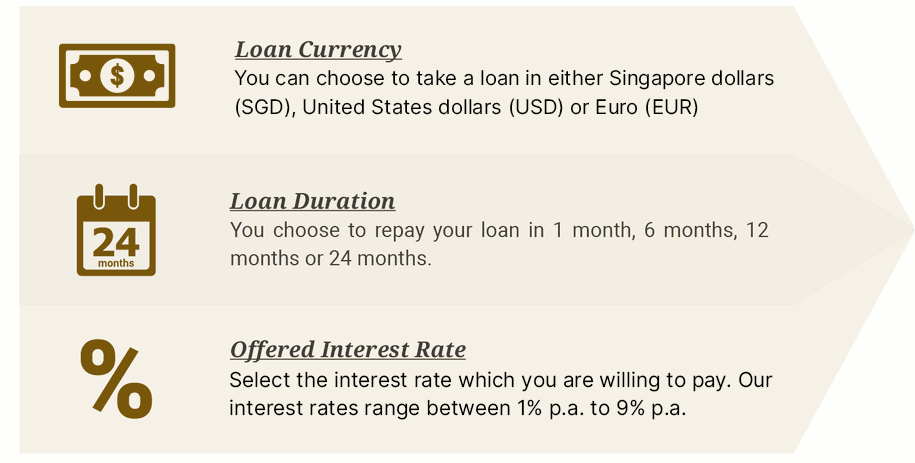

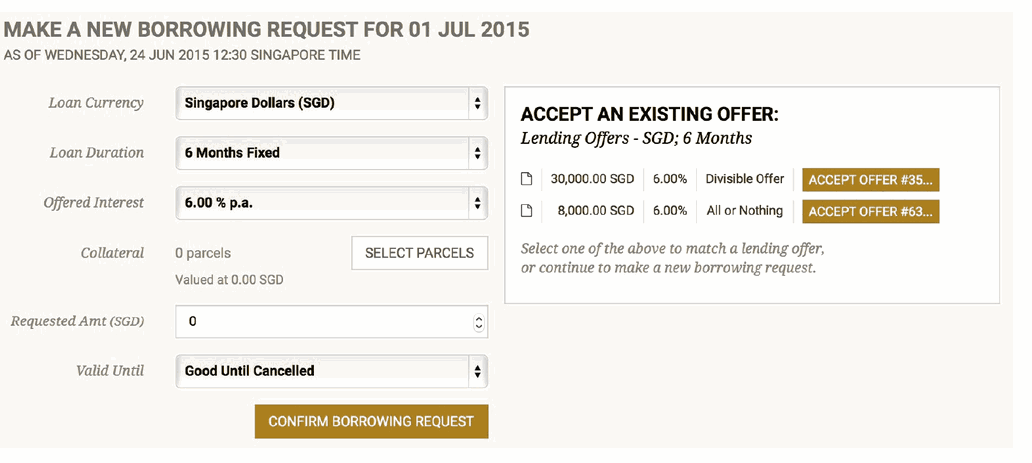

Request their own loan amount, interest rate, currency, and duration.

Enjoy simple procedures to get the liquidity quickly without usage restrictions.

When you agree on terms with a lender a loan contract is created and, on the Loan Start Date, a lien is placed on the metal parcels you choose to use as collateral. The lien ensures that the parcels cannot be sold or withdrawn while acting as collateral for secured loans. Loans always start and end on the 1st, 8th, 15th and 22nd of the month, allowing you to roll over funds from one loan to another without downtime. The next loan payout is on 01 Jan 2025.

Once the secured loan is fully repaid the lien is removed. Unless you are unable to repay the loan and the loan defaults, your ownership of the parcel never changes, nor is the parcel moved or physically changed in any way. For clarity purposes, borrowing on our secure P2P loan platform is different from “metal leasing” which involves the loss of the physical metal in exchange for an IOU in return for a fee.

| 1 Jan 2025 Contracts |

Lenders are offering |

|

|---|---|---|

| EUR 1 month | 5.25% p.a. | |

| SGD 1 month | 4.50% p.a. | |

| USD 1 month | 4.50% p.a. | |

| EUR 6 months | 5.50% p.a. | |

| SGD 6 months | 5.00% p.a. | |

| USD 6 months | 5.50% p.a. | |

| EUR 1 year | 5.25% p.a. | |

| SGD 1 year | 5.00% p.a. | |

| USD 1 year | 5.50% p.a. | |

| EUR 2 years | ||

| SGD 2 years | 5.25% p.a. | |

| USD 2 years | 5.75% p.a. | |

| 1 Jan contract bidding closes in 9 days 13 hours | ||

How much can you borrow with your precious metals?

The amount of money you can borrow depends on the metal type and loan duration. You can obtain a gold loan with a 62.5% loan-to-value ratio.

For example, if you have $10,000 worth of gold holdings, you can borrow up to $6,250 with them.

Like gold loans, 1-month loans can be obtained using silver, platinum, palladium, and nickel. However, the loan-to-value ratio is 50% for the 6 , 12, and 24-month loan durations, for these metals.

The table below gives an overview of the different loan-to-value ratios when you borrow money with different metals.

Loan Duration and LTV Ratio

| Metal | Loan Duration | LTV Ratio |

|---|---|---|

| 1 Month | 62.5% | |

| 6 Months | ||

| 12 Months | ||

| 24 Months | ||

| 1 Month | 62.5% | |

| 6 Months | 50% | |

| 12 Months | ||

| 24 Months |

How are interest rates set for precious metals loans?

Loan interest rates are determined by either the lenders or borrowers. As a borrower, you can decide on the interest rate you would like to borrow at when you submit your borrowing request. A loan is matched if a lender agrees to your loan terms.

It is also possible for lenders to set the interest rate when they submit their lending offers. Should a borrower accept the lenders' loan terms, a loan is matched at the lender's interest rate.

This ability for lenders and borrowers to set their own interest rates creates a price discovery mechanism in our secure loan market. Borrowing requests submitted with lower interest rates could take longer for a loan to be matched if other borrowing requests are listed with higher interest rates.

Transfer-in existing Gold, silver or platinum to obtain precious metal loans

S.T.A.R. Parcels do not necessarily have to be purchased from us to qualify as collateral for a precious metal loan. If you own a minimum amount of gold, silver or platinum, stored in a precious metal vault or at home, you can transfer it to us to obtain a loan.

We facilitate the transfers of bullion from other vault operators or bullion dealers having done so since 2013. In addition to organizing precious metal transfers, we will authenticate and seal the bullion into tamper evident bags (where applicable) upon arrival.

Once a parcel is accepted under S.T.A.R. Storage you will be able to sell it, collateralize it or withdraw it at short notice. The parcel will be part of third-party quarterly bullion audits and, having tested it on transfer-in, we guarantee the bullion metal purity.

Please review our transfer-in page for more details and to initiate a transfer please write us at [email protected] or schedule a call with our customer service.

How is the precious metal loan disbursed?

Our secure P2P loan platform has rolling weekly loan bidding cycles, with loans always beginning on the 1st, 8th, 15th, and 22nd of the month. These loan start dates are when the funds from matched precious metals loans are disbursed to borrowers.

For example, if you matched a loan between the 2nd and 7th of the month, the loan proceeds will be disbursed to your S.T.A.R. Storage account on the 8th.

Please note that loan proceeds will be transferred to the P2P Balances of your S.T.A.R. Storage account by default. You would need to request a bank wire should you need the funds to be transferred to your bank account. Such requests can be submitted online in the P2P Balances of your S.T.A.R. Storage account.

Loan repayment and roll-overs

To close a loan and remove liens on bullion parcels the full amounts need to be settled by the loan end date as specified in the loan contract. Settlements can be done in two manners:

Repayment: This requires that any outstanding balances be received by the due date. This can be accomplished by transferring funds to Silver Bullion, or by selling unencumbered S.T.A.R. parcels or grams instead ahead of the settlement date.

Roll-overs: About a week before the loan settlement date, your existing loan parcels can be used to enter into a new loan contract – subject to offers – to start on the settlement date of the maturing loan. The proceeds of this new loan can then be used to net out the amount due from the prior loan.

A typical roll-over example works as follows:

Assume a 10,500 USD repayment, backed by 2 parcels, is due by July 31st.

On July 22nd these two parcels can be used to make a new loan contract starting August 1st.

The new loan contract terms depend on bid/ask offers at the time of renewal and might or might not come from the prior loan lender.

For example, a borrower might choose to borrow 12,000 USD, thereby settling the prior loan and having an excess 1,500 USD (before interest and administrative charges).

You only pay a fee when a loan is matched

There are no charges when you list a borrowing request on our secured loan platform. You only need to pay a small processing charge when a personal loan is successfully matched with a lender.

Our fee is charged at 0.5% per annum of the loan amount (1% for 1-month loans), prorated by the loan duration. This fee is paid at the end of the loan together with interest payment. Assuming a 10,000 USD loan, the fees would be as follow:

| Duration | Loan principal | Processing Fee | Fee |

|---|---|---|---|

| 1 Month | 10,000 USD | 1% | 8.33 USD |

| 6 Months | 10,000 USD | 0.5% | 25.00 USD |

| 12 Months | 10,000 USD | 0.5% | 50.00 USD |

| 24 Months | 10,000 USD | 0.5% | 100.00 USD |

The processing fee is set per year; hence a 1-month loan is prorated to only 1/12th of 1%.

In case of missed settlements

While we send several automated email reminders ahead of loan settlements it remains the responsibility of the borrower to ensure the funds are available to settle the loan on its respective settlement dates. See the Loan Schedule for more details on dates.

Should the borrower have insufficient funds to settle a maturing loan, the ‘Sweeper Fund’ will provide interim financing to the borrower to ensure that the maturing loan is still settled on time and a default, due to delay, is avoided.

The Sweeper Fund will charge a 1% late fee for the bridging loan provided to the borrower. It is the responsibility of the borrower to ensure that this bridging loan and the sweeper late fee are settled by the next loan start date to avoid another use of the Sweeper Fund.

The Sweeper Fund can be used for maximum of 4 times (which is 1 month) for a given loan and is only a temporary solution. Should a borrower not settle the bridging loan, a collateral liquidation due to missed repayments will be necessary.

A typical Sweeper Fund late fee operates as follows:

Assume a 10,500 USD repayment is due by July 31st.

There is 6,000 USD balance, settlement is short 4,500 USD on July 31st.

The Sweeper Fund will cover the missing 4,500 USD to settle the loan contract due on July 31st and charge the borrower a 45 USD (1% of 4,500 USD) late fee, requiring 4,545 USD to be settled ahead of the next loan start date, being August 8th.

Borrowing Limitations

Secured Borrowing is available to single, joint and certain trust accounts only. Company accounts cannot borrow funds as it may be considered a public offering under Singapore law, requiring an approved prospectus and additional licensing.

Furthermore, Silver Bullion needs to ensure the collateral is fully owned (perfected interest) by the account holder taking the loan. If there is ambiguity in this respect, collateralization might not be allowed.

Popular Borrower Uses

General Purpose

You might not need funds now, but it is good to know that your metal enables you to have quick, low-cost, access to cash at your disposal that could be put towards buying more precious metals, repayment of a mortgage loan, or debt consolidation.

Replace High Interest Debts (arbitrage)

Use your loan to repay higher interest debts such as unsecured loans, credit cards, and mortgages in high interest countries.

Purchase Additional Metal

You can now pay for metal orders with your upcoming P2P funds, even if the loan payout is not until the next Loan Start and is more than two business days away. Just note in the Order Comments section that you wish to use your P2P funds for your metal payment.

Tax Planning

If you are subject to capital gains taxes on sale of precious metals, taking a low interest loan from the P2P Platform in order to obtain liquidity can form part of your tax planning strategy and may offer an alternative approach in managing tax liabilities.

How to Borrow

Borrowing is simple you only have to follow the 3 steps as described below.

Popular Borrower Uses

General Purpose

You might not need funds now, but it is good to know that your metal enables you to have quick, low-cost, access to cash at your disposal that could be put towards buying more precious metals, repayment of a mortgage loan, or debt consolidation.

Replace High Interest Debts (arbitrage)

Use your loan to repay higher interest debts such as unsecured loans, credit cards, and mortgages in high interest countries.

Purchase Additional Metal

You can now pay for metal orders with your upcoming P2P funds, even if the loan payout is not until the next Loan Start and is more than two business days away. Just note in the Order Comments section that you wish to use your P2P funds for your metal payment.

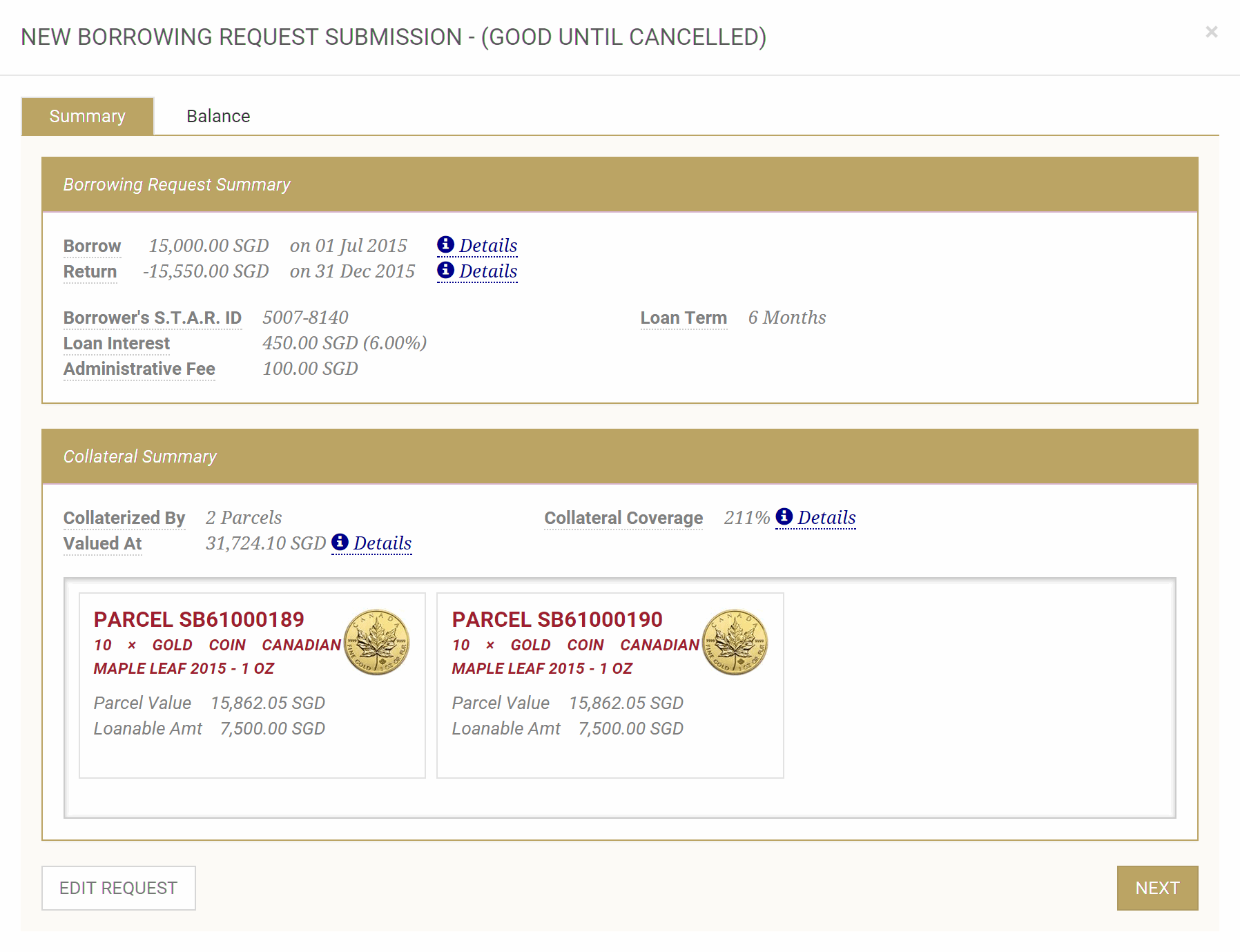

Loan Contracts

Once your loan request is filled and a legally binding contract between the borrower and lender is created, Silver Bullion will act as an escrow agent to enforce the contract by collecting and disbursing funds between the parties and locking collateral.

Your loaned amount will become available in your P2P account on the Loan Start date. You can then have the funds wired to your linked bank account, use them to purchase metal or use them for P2P loan purposes.

Should your P2P balance be insufficient to cover an interest, fee or principal repayment you will be charged a late fee of 1% of the outstanding amount. Please note that eventual bank wire fees from or to your linked bank account will debited to your P2P account.